Government bond yields recently held above an important level, but the next test may prove dangerous for the stock market.

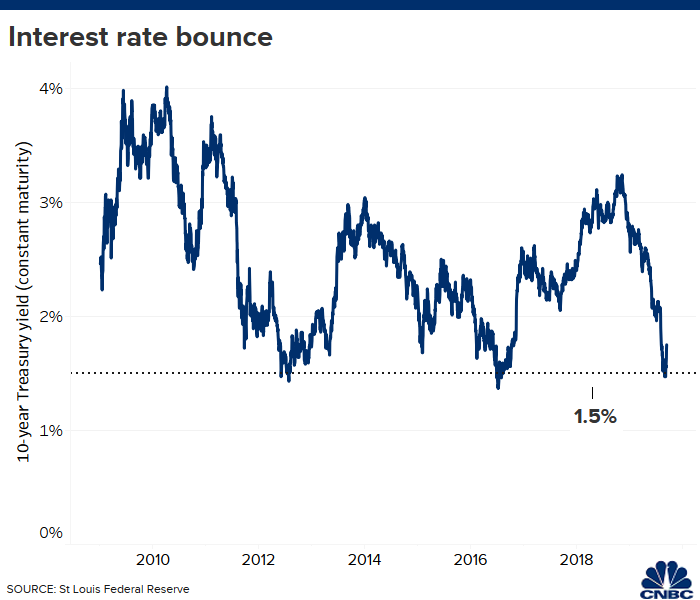

The benchmark 10-year Treasury note yield tested 1.5% in late August and early September, bouncing off that level and most recently trading around 1.8%.

That’s the third time the barrier has been broken since the economic recovery began in mid-2009, with the yield bouncing up strong each time. This signaled the renewal of the longest bull market run in Wall Street history that has coincided with the most durable expansion in U.S. history.

However, another challenge could mean tough times on the horizon, according to an analysis by Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch. In his weekly analysis of market flows, Hartnett called the 10-year’s movements over the past decade, and specifically its ability to stay above the 1.5% yield level, “the most important chart in the world.”

Hartnett explained that the stock market has maintained a close relationship with bond yields that could become ominous if fixed income stages another big rally, which he expects to happen in 2020 and be a drag on stocks and other risk assets.

“For the past 10 years, the correct market mantra has been lower yields mean lower credit spreads and higher stocks, so long as lower yields prevent recession. But given 1.5% on the 10-year Treasury was not breached in 2012 & 2016 when recession fears were high, a break below in 2019 would incite fears of a recession ‘tipping point’ causing higher spreads and lower stocks,” he said in an email.

Indeed, recession fears had been elevated during much the summer, cresting when the two-year yield briefly passed above the 10-year, a phenomenon known as an inverted yield curve. Inversions have been reliable recession indicators for the past 50 years.

However, a swell of mostly positive economic data, renewed hopes for a trade deal between the U.S. and China and the long-awaited announcement of more monetary stimulus from the European Central Bank helped turn the tide for bond yields, ending the 2-year/10-year inversion and indicating that things may not be as bad as feared.

Investors have been fleeing bond funds since yields bottomed earlier this month, with $6.1 billion in outflows over the past week, the second-biggest run of redemptions on record, according to BofAML data. The move came as the 1.5% level held, which coincided with a boost in sentiment.

“Emotionally and psychologically it probably was big because of the fact that global yields are negative. If we did break to a new low in that 10-year that we haven’t seen, that could have set off talk about breaking 1%,” said Jim Paulsen, chief investment strategist at the Leuthold Group. “That could have been very risky given the fragile state of where mindsets are now with recession, and that might be just enough to freeze up the financial markets.”

However, while the BofAML strategy team is positive for risk assets in 2019, it is bearish beyond that as it expects yields to head back lower. Hartnett said in his note to clients that he sees a 2020 with a “bond bubble pop” that “induces [a] Big Top in credit (spreads trough) & equities (multiples peak), causing Wall St deleveraging & Main St recession.”

“There’s a good chance that U.S. rates are going to sell off, said Robert Tipp, chief investment strategist at PGIM Fixed Income. “Our rates are simply unsustainably high vs. the rest of the world.”