Getty

As a new decade and year are about to begin, professional forecasters are, of course, going through the exercise of guesstimating the future course of the markets and U.S. economy. From what I’ve seen, they’re generally expecting the record-breaking U.S. expansion to continue at a middling 2% pace in 2020. Among the factors routinely listed as preventing faster growth is the demographics of aging: The rising ranks of retirement-age Americans, many experts say, is bad for the economy.

They’re wrong. This timeworn economic dictum is not only outdated, it ignores changes in American society that are turning an aging population into more of an economic and social asset than ever. For evidence, take a look at the new report, The Longevity Economic Outlook by the Economist Intelligence Unit for AARP, an update of a 2013 AARP study.

Fighting Negative Stereotypes of Older Americans

“We’re still fighting some of the negative stereotypes about older Americans,” says Debra Whitman, executive vice president and chief public policy officer at AARP. “The Longevity Economy Outlook demonstrates the sheer magnitude of older Americans’ contributions to all of society.”

Also on Forbes:

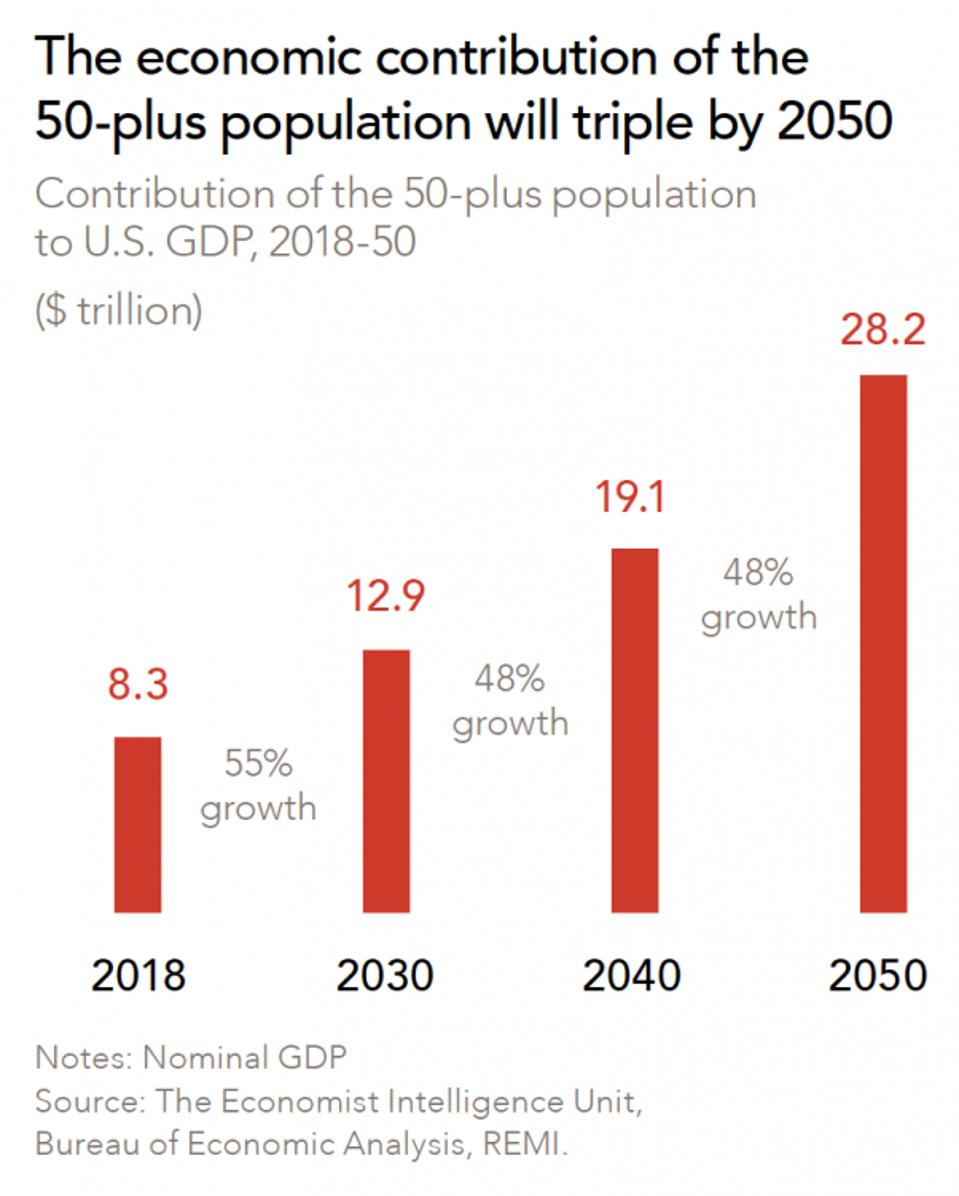

The new AARP report calculates the contribution to the U.S. economy of the 117.4 million Americans who are 50+ (35% of the population) at $8.3 trillion, or 40% of gross domestic product (GDP). That’s up from $7.1 trillion when AARP last looked in 2013. Put another way, if America’s 50+ population were its own country, it’s GDP would now be the world’s third largest, following the U.S. and China.

The study’s projections to 2050 are equally illuminating, and I’ll touch on a few striking figures in a moment. But broadly speaking, the report is a timely reminder that too much of the conversation about aging dwells on costs and burdens of older Americans, while voicing despair at the financing challenges of Social Security and Medicare. The popular image of growing old is too often pictured as years of chronic illness and mental decline — as Shakespeare wrote, “sans teeth, sans eyes, sans taste, sans everything.”

Reframing the Discussion About Aging

The Longevity Economic Outlook is just the latest analysis reframing the discussion about aging toward the economic and social possibilities created by greater longevity. The key questions such studies raise are: How can the nation best maximize the economic and social returns from longer, healthier lives? What private and public initiatives would improve the quality of work well into the retirement years, promote lifetime learning and training, boost the odds for successful late-life entrepreneurship and encourage business to imagine products and services geared toward engaged older adults?

While these questions have been floated around for years by reformers, it’s time to get urgent about embracing change.

“Older adults are an increasingly powerful force as workers, consumers, entrepreneurs and active participants in their communities,” says Paul Irving, chairman of the Milken Institute Center for the Future of Aging. “But an aging population should not be feared. The rapid growth of the longevity economy offers new opportunities for innovation, employment and economic growth for people of all ages.”

The recent Washington Innovation in Longevity Summit that my colleague Richard Eisenberg attended was filled with evidence of burgeoning interest by tech entrepreneurs and investors here and abroad to serve the 50+ market. “Almost every week, I hear from people from another country saying: ‘I want you to meet an entrepreneur or I have an investment fund for you to look at,’” said Mary Furlong, host of the summit.

The Longevity Economy of 2050

Now, let me turn to the future of 50+ Americans, as the AARP report sees things:

- Their numbers will soar to 157.3 million in 2050, comprising 41% of the population

- Their impact on GDP will triple to $28.2 trillion by 2050

- Their wages and salaries will reach $19.2 trillion, up from $5.7 trillion today

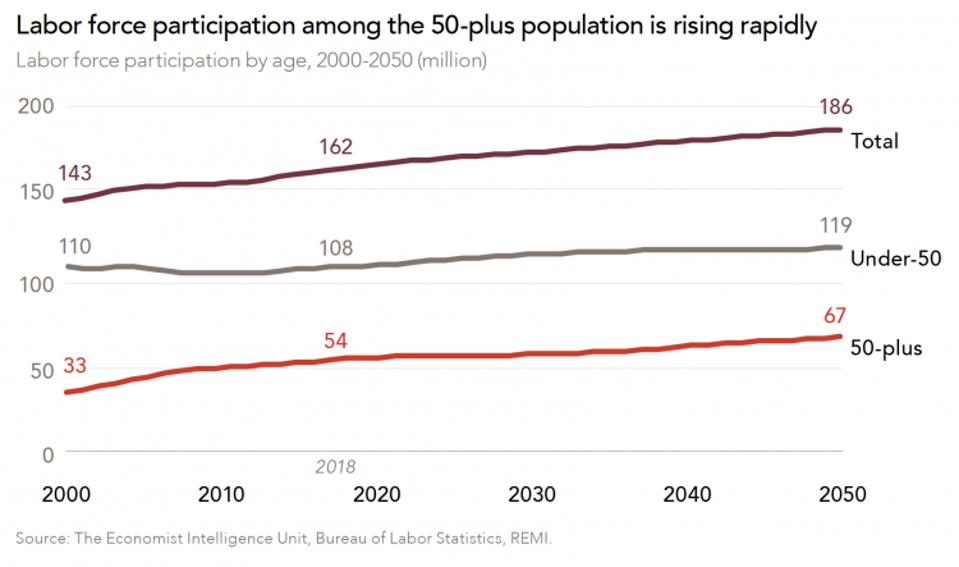

- They’ll account for 88.6 million jobs, a growth of 5.7% from 2015

While these gains are expected to be driven by businesses across the board, several fields in particular will do well, according to AARP, including financial services, insurance and health care.

The Economic Intelligence Unit, Bureau of Economic Analysis, REMI

Refuting Conventional Wisdom

Two other sets of numbers in the report are worth emphasizing and refute conventional wisdom that older Americans are a financial burden on the nation.

The Economist Intelligence Unit, Bureau of Labor Statistics, REMI

First, the tax contribution of the 50+ group is substantial. For example, the study says, the share of federal income taxes paid by the 50+ population amounted to 59% of the total income taxes paid in 2018, far above their share of the population Their portion of the federal tax total in 2050 is projected to rise to 65%. A similar dynamic holds on state and local levels.

The second figure of note is the estimated economic value of unpaid contributions. Those are things like caring for an aging parent, grandparents supporting grandchildren and volunteering. The AARP report puts the total value of this unpaid work at $745 billion in 2018. To put that in context, $745 billion is slightly more than total amount of Medicare benefits paid in 2018.

Perhaps most importantly, especially in an era when memes like OK Boomer manage to get an audience, is the theme of intergenerational benefits in the workplace and in society that runs throughout The Longevity Economic Outlook. Simply put, ideas for improving economic opportunities for older adults also boost prospects for younger generations (who, after all, will age, too).

How to Grow the U.S. Economy

Want the economy to grow faster than 2%? Then let’s start encouraging older Americans to work longer if they can; welcome them into the workplace; treat them with respect and give them the opportunity to use their skills and experience for employers and to start their own businesses.

That will make them become an even more powerful force for rejuvenating the economy.