In-and-out investors do worse than long-term holders. There are numbers to prove that.

Timing is everything

Getty

Are mutual fund investors impulsive? Do they jump into a fund after a winning streak and then sell out, in despair, after a bad stretch?

I tested this hypothesis by going to Morningstar

MORN

The answer to the question: Yes, fund clients are impulsive. Bad timing causes them to earn considerably less than they would have earned by buying and holding. On funds of domestic stocks, they’re throwing away something like $54 billion a year.

The key to this analysis is a number that Morningstar calls “investor return.” It measures the average results taken home, as opposed to the performance of the fund.

The usual performance number reported for a fund assumes a hypothetical buyer putting a single sum of money in at the beginning and leaving it untouched until the end of some measurement period, like a decade. Example: The Schwab 1000 Index fund delivered a 233% cumulative performance over the ten years to May 31. That amounts to a compound annual 12.8%.

The investor return on this index fund is a bit less, at 12.6%. This figure takes into account the monthly flows of money into and out of the fund. More precisely: If fund shareholders had been earning a constant 12.6% on every dollar they kept in play, they would have wound up with the fund’s ending assets. In short, the 12.6% measures average investor experience.

Where does the 0.2% shortfall come from? It means that buyers of this fund had a slight tendency to add money, or to take it off the table, at the wrong times. We’re human. After a bullish run we’re in love with stocks and buy more—maybe near a top. A correction in stocks makes bonds more appealing and we hold back, just when stocks are a bargain.

The mistakes among Schwab’s clientele pale in comparison to those of fund buyers generally. Morningstar has 827 domestic-stock funds with both ten years of history and sufficient detail on asset balances to permit a calculation of investor return. At 527 of those funds, not quite two-thirds of them, timing decisions lowered the annualized gains experienced.

Among all 827 funds the average impact, with both positive and negative impacts included, was a loss of 0.64% a year. Keep that up for 30 years and you shortchange a $1 million retirement portfolio by $175,000.

It is important to understand what Morningstar is measuring. A shortfall does not occur when a customer is invested for only a portion of the ten-year period, since both the reported performance figure and the investor return are compound annual percentages. (Morningstar’s investor number is an internal rate of return. For an explanation of how that arithmetic works, see this article on how to compare your results to a yardstick.)

A shortfall will show up, though, if people jump into a style or sector after an upswing, only to be disappointed and then move into another kind of fund that seems to be the new ticket to wealth. Such performance chasing depresses investor returns at both funds.

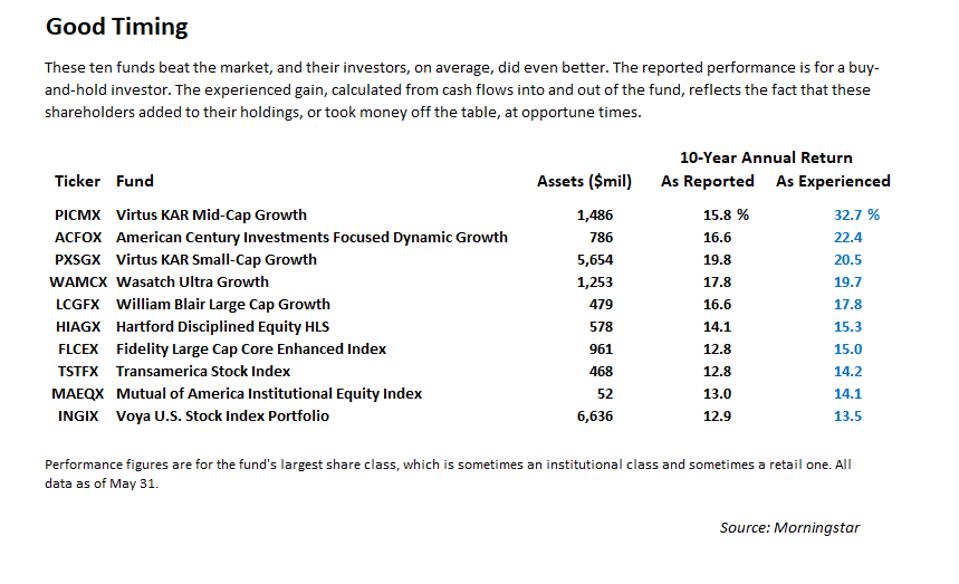

Some funds have customers who are either lucky or smart. Their timing is good. They do better than the performance figures indicate.

These ten funds all beat the market, as measured by the Schwab index fund, and had customers who improved on those good results by being invested at the right times:

Winners

Forbes

Noteworthy on this list are two funds from the Kayne Anderson Rudnick subsidiary of Virtus Investment Partners

VRTS

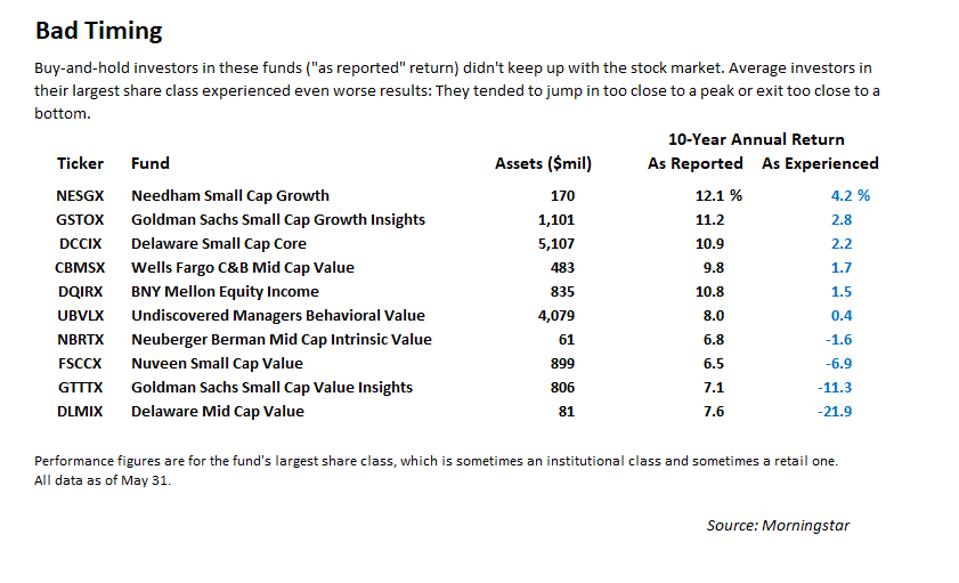

Winning funds with well-timed investor moves are the exception. More common: funds where investor flailing depresses gains. These ten underperformed the market and had customers who magnified the damage with their stumbling:

Losers

Forbes

I asked the operators of the second group of funds for comments and got one, from Needham:

“Our mission is to create wealth for long-term investors. Those who trade mutual funds or try to time the market may see returns that are less than those who stay invested and have been rewarded with excellent long-term returns.”

Moral of this story on investor returns: Follow Needham’s advice. Invest with enough conviction that you can stay put.

And if your attention is fleeting? Maybe you should discontinue the search for market beaters and just own an index fund.

Here’s one more statistic from that Morningstar data set. The average investor experience in the 827 funds was a compound annual 10.5%. That’s 2.3 points less than the return on the Schwab 1000 fund. This shortfall comes from both bad timing by customers and a parallel flailing by the funds. In their struggle to beat the market the fund managers ran up trading costs as well as their own management expenses.

Yes, 2.3% is a gigantic loss. Keep it up for 30 years and you cut your $1 million retirement in half.