In this new, post-pandemic, economic environment, I believe tax-efficient investing will be more important than ever. We’ve seen common loss-harvesting tactics, perhaps even the advanced idea of tax alpha, but frequently overlooked is the concept of tax location: where to put the assets to maximize after-tax return. With the upheaval in quicker-term investing (think meme stocks or crypto), as well as the possibility of all capital gains being taxed at ordinary rates for some individuals, or worse, the notion of carryover basis; tax location becomes paramount.

Location matters. The age-old adage in real estate is location, location, location. Anyone who has considered purchasing a house in Hawaii or Southern California can see that the valuations of similar sized house can vary by multiples of six times or more. Similarly, tax location can provide a significant ‘tax-alpha.’

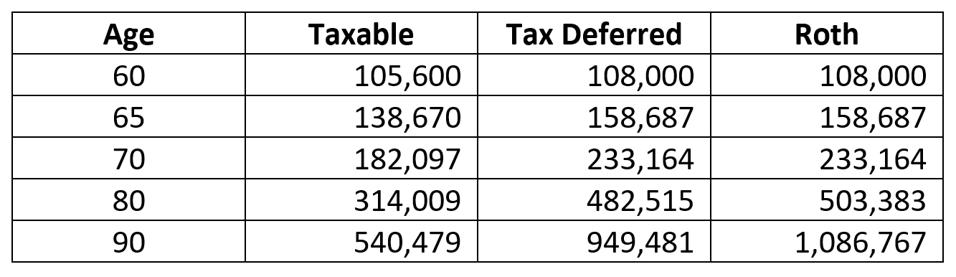

Short-term gains scenario. In this scenario the investor makes multiple trades a year, typically in a period of less than a year (short-term). The investor is in the 30% combined federal and state tax bracket. This investor has three general tax locations (there are more, as we’ll see later in the article): taxable account, tax-deferred (IRA or 401(k)) and Roth IRA. This investor is a trader, so their performance is 8%. Assume they’re age 60, start with $100,000, take RMDs starting at 72 and reinvest it in its entirety. The pure performance delta is easy to see:

The difference in IRA balances based upon location.

Leon LaBrecque

Over 30 years, the location in a non-taxable account almost doubles the overall value, compounding at the difference in after tax-return (about 2.27% a year, compounded). However, this doesn’t take into consideration the post-death taxes. The current law allows a step-up in basis, which eliminates capital gains taxes. Tax deferred assets like 401(k) and IRA are subject to taxable friction in the form of Required Minimum Distributions (RMD) and someone, either the investor or the heirs, pay taxes someday. In a Roth, all gains are tax-free for the lifetime of the taxpayer and spouse (spousal rollover) and then for 10 year thereafter to the heirs. Accordingly, Roth gives a step-up and tax-free growth.

Working its way into potential legislation is carryover basis, which would apply the basis of the original owner to the heirs.

Location can have a serious impact on balances.

Leon LaBrecque

For this illustration, the assumptions are:

· In the Step -up scenarios, that the heirs continue to pay taxes much like the original owner.

· In the carryover scenario, the basis is $100K at the outset, and the gain is imposed at death.

· In the tax-deferred scenario, the heirs pay taxes at the same rate as the owner.

· Assets maintain the return the owner achieved.

Larger assets. In situations where the asset values are higher, the location becomes more critical because of estate taxes and low basis/high growth. Add estate taxes and potential tax increases into account and the tax effect of location becomes much more prominent.

Location basics: There are generally for types of tax locations: You pay the tax now, you pay the tax later, you never pay the tax, or someone(thing) else pays the tax. In general, these include:

· Ownership in taxable account (you own it). The assets are owned in a taxable account, either individually, jointly or in trust.

o Income tax paid by owner.

o Current step-up basis (partial in joint accounts) Possible carryover basis in new legislation.

o Current preferential qualified dividend and long-term gain taxation.

o Subject to possible estate taxes at fair market value (larger estates).

· Tax-deferred assets (you own it). The assets are owned in a tax deferred vehicle like an IRA, qualified plan, or annuity in pre-tax assets.

o Income taxes paid on distribution, to owner or beneficiary (except charitable beneficiaries).

o Effectively steps up basis since assets are taxed at fair market value.

o Subject to possible estate taxes with a deduction for Income with respect to a decedent (IRD).

· Tax-free assets (you own it). The assets have tax-free growth and can pass to heirs tax-free. This includes Roth strategies and life insurance.

o No income taxes on the growth of the asset.

o Asset passes to heirs income tax free.

o In the case of Roth, heirs can continue tax-free growth for 10-years beyond death of owner (which could be last spouse to die).

o Subject to possible estate taxes. Life insurance can be excluded from the estate.

· Tax-shifted assets (somebody else owns it). The assets are transferred, through a variety of vehicles, to another party who assumes the tax liability. This could include a charitable vehicle, where the taxes would be eliminated.

o Income tax liability is on the owner. If given to a charity (outright, or in trust), the income taxes may be eliminated.

o May have possible gift taxes, estate taxes generally eliminated.

o Some vehicles allow the owner to retain control.

Exotic locations. There are exotic locations, like Intentionally Defective Grantor Trusts (IDT), where the income tax stays with the owner, but the growth and estate taxes are shifted. Irrevocable Life Insurance Trusts (ILITs) allow life insurance to be distributed income and estate tax free. Grantor Reserved Annuity Trusts (GRATs) pay an annuity to the owner and then allow the owner to transfer assets to the heirs tax-free (also sometimes called ‘Walton trusts’, after the Wal Mart founder). Charitable Trusts, like Charitable Remainder Trusts (CRTs) and Charitable Lead Trusts (CLTs) can give income tax deductions and allow the owner to receive income or pass assets to heirs.

Bottom line: As in real estate, location is everything in investing. A key part of an effective financial plan is getting the right stuff in the right place to the right people. Location, Location, Location. As always, I’ll try to answer questions. My e-mail is llabrecque@sequoia-financial.com. Check out our free e-book on IRAs at