A recent Maryland court case (Strashny v. Commissioner of Internal Revenue) filed on June 11, 2020 shows how your cryptocurrency holdings could work against you in applying for an installment plan with the IRS and how — contrary to popular belief — regulators have oversight over your cryptocurrency portfolio.

Facts Of The Case

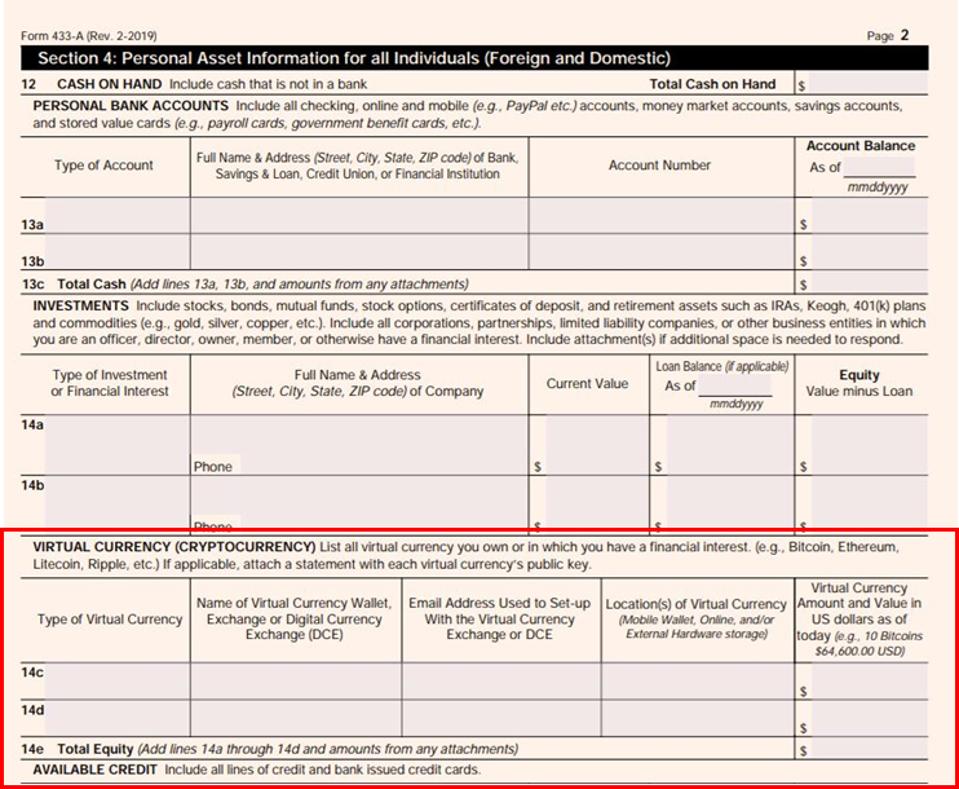

The taxpayers in the case, the Strashnys, filed a 2017 tax return on time, but did not pay the tax bill (~$1.1M including penalties). In July 2018, Strashnys sent an Installment Agreement Request to the IRS, requesting to pay off their huge tax bill over a six-year period. They also sent the IRS a Collection Information Statement (Form 433-A). This is the form where you report your income streams, personal assets (including virtual currency) and monthly income and expenses so the IRS can determine if you are eligible for an installment plan.

Form 433-A, Section On Virtual Currency

Shehan Chandrasekera

Meanwhile, the IRS sent out a CP90 Notice to the Strashnys warning it would take over their properties and seize wages if the tax bill was not paid on time. The Strashnys argued that the IRS could not send such a notice while the request for an installment plan was being addressed, and requested a Collection Due Process (CDP) hearing.

The Ruling

In the CDP hearing, it was ruled that Strashnys were not eligible for an installment plan. This is because they had more than $200,000 in annual wages and were drawing $19,000 a month from their $7M cryptocurrency holdings per the form 433-A field. The tax court determined that the Strashnys were in a good financial position to pay off the $1.1M tax debt by liquidating the cryptocurrency holdings or borrowing USD against them.

Takeaways

First, it’s uncommon for the tax court to ask people to liquidate or borrow against virtual currencies to pay off tax debt. The way this case was handled shows the tax court’s improved familiarity with virtual currencies.

The outcome of this court case shows how cryptocurrency is not immune from regulatory oversight. One might question why the cryptocurrency holdings were reported on Form 433-A in the first place. This IRS form is signed by the taxpayer under penalty and perjury. If the large holding of cryptocurrency were omitted from the form, this would have been a fraudulent filing and the consequences could have been much harsher.

Moreover, it is highly likely that the Strashnys would have to sell a portion of their $7M cryptocurrency holdings to pay off the $1.1M tax debt. Unfortunately, this could also result in more taxes because a taxable gain would occur when they sell cryptocurrencies.

Disclaimer: this post is informational only and is not intended as tax or investment advice. For tax or investment advice, please consult a professional.