A series of strategies for tax-wise investors. Table of Contents.

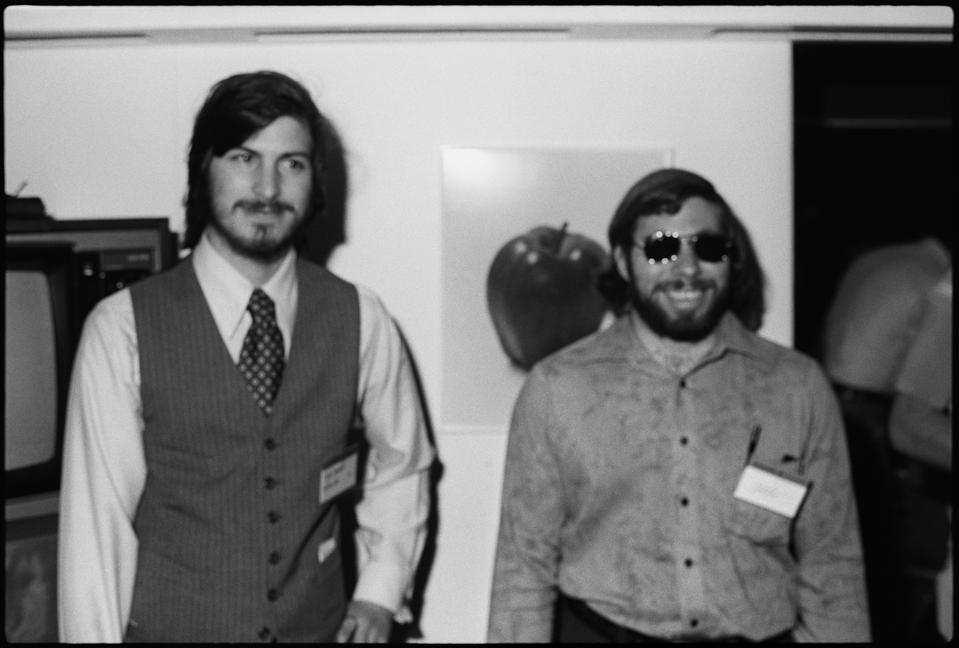

Entrepreneurs (Photo by Tom Munnecke)

Getty Images

To help entrepreneurs, Congress has granted a tax exemption on capital gains from small companies. Small here is defined as having no more than $50 million in assets when an investor buys in.

The deal is codified in the tax code’s Section 1202. To qualify for this exemption you must get your shares from the company, by purchase or labor, rather than in the secondary market; you must hold on for five years, and you must have bought after 2010. (The Apple founders came 33 years too early.) The cap gain freebie is good for an exemption on the greater of $10 million or ten times your purchase price.

Three cheers for small, struggling enterprises. If there were 500 investors each chipping in $100,000 to start the next Apple, they could collectively exclude $5 billion of capital gain when they cash out.

Fodder for reform? Maybe. But note that startup lottery winners tend to work in technology, a sector that donates to progressive causes. Section 1202 will probably be around for a while.