Technology companies, which face some of the biggest tariff impacts, have been slashing expectations for third-quarter earnings at a record pace.

With the kickoff to the heart of earnings season still about two weeks away, some 29 information technology sector companies have lowered their guidance, which is the biggest number since FactSet starting tracking the data in 2006.

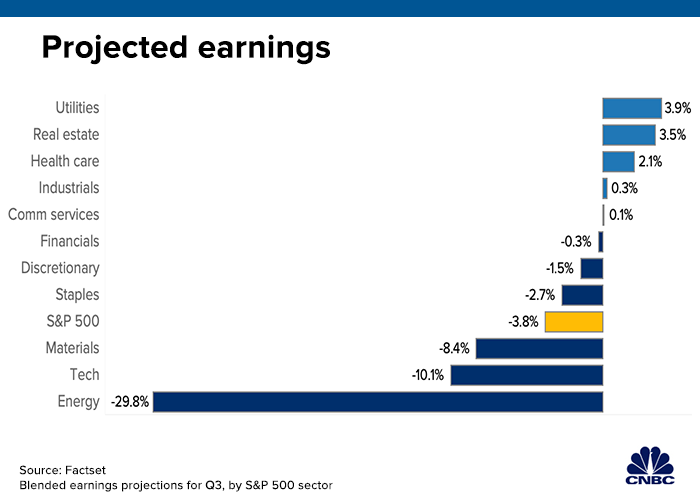

That comes as overall S&P 500 earnings, with 16 companies reporting so far, are tracking at a blended 3.8% decline from the same period a year ago and as markets are looking to gauge what impact the U.S.-China tariff war has had more than a year after it began.

“The number of companies being cautious going forward with guidance is a reflection of the tariffs. That has always been in my view what the critical factor is going to be,” said Michael Yoshikami, founder of Destination Wealth Management. “The rubber hasn’t met the road quite yet, but i think it is getting close. That is something to be concerned about.”

As a sector, technology is projected to show a 10.1% decline from the third quarter in 2018.

At the industry level, expectations have fallen most for semiconductors and equipment, an area especially hit by tariffs. Earnings for that group are now forecast to show a 30.3% decline, down sharply from the 22.1% previous estimate.

Companies that have seen sharp reductions in the semis space include Western Digital, Analog Devices and Advanced Micro Devices. Micron is one of the few companies to have reported Q3 earnings so far and posted an 84.9% decline

Electronic equipment instruments and components also has come down to an estimated 8.9% decline from 4.4% previously, according to FactSet.

Yoshikami said the prospects are likely to only get worse unless the Trump administration reaches a deal soon with China.

“You could actually have a negative impact that won’t show up for three or four months. That’s why I think a deal is better sooner rather than later,” he said. “I think you’ll see the cloud lift” once a trade deal gets done.

To be sure, markets have held up remarkably well despite the trade concerns. Major indexes continue to hover around record territory despite all the geopolitical turmoil.

However, a report Tuesday from the Institute for Supply Manufacturing Survey shows the sector at its weakest rate since June 2009, and comments from participants show a clear link to tariff concerns. Should corporate CEOs echo those concerns with poor guidance, that would provide a stern test for the market to advance from here.

“US stocks have rallied sharply this year because investors expect that an eventual US-China trade deal combined with a more dovish Fed will lead to a noticeable bump in future earnings,” Michael Arone, chief investment strategist at State Street Global Advisors, said in a recent report. “So, it follows that evolving changes in 2021 earnings expectations will likely determine what investors should expect from stock prices in 2020.”