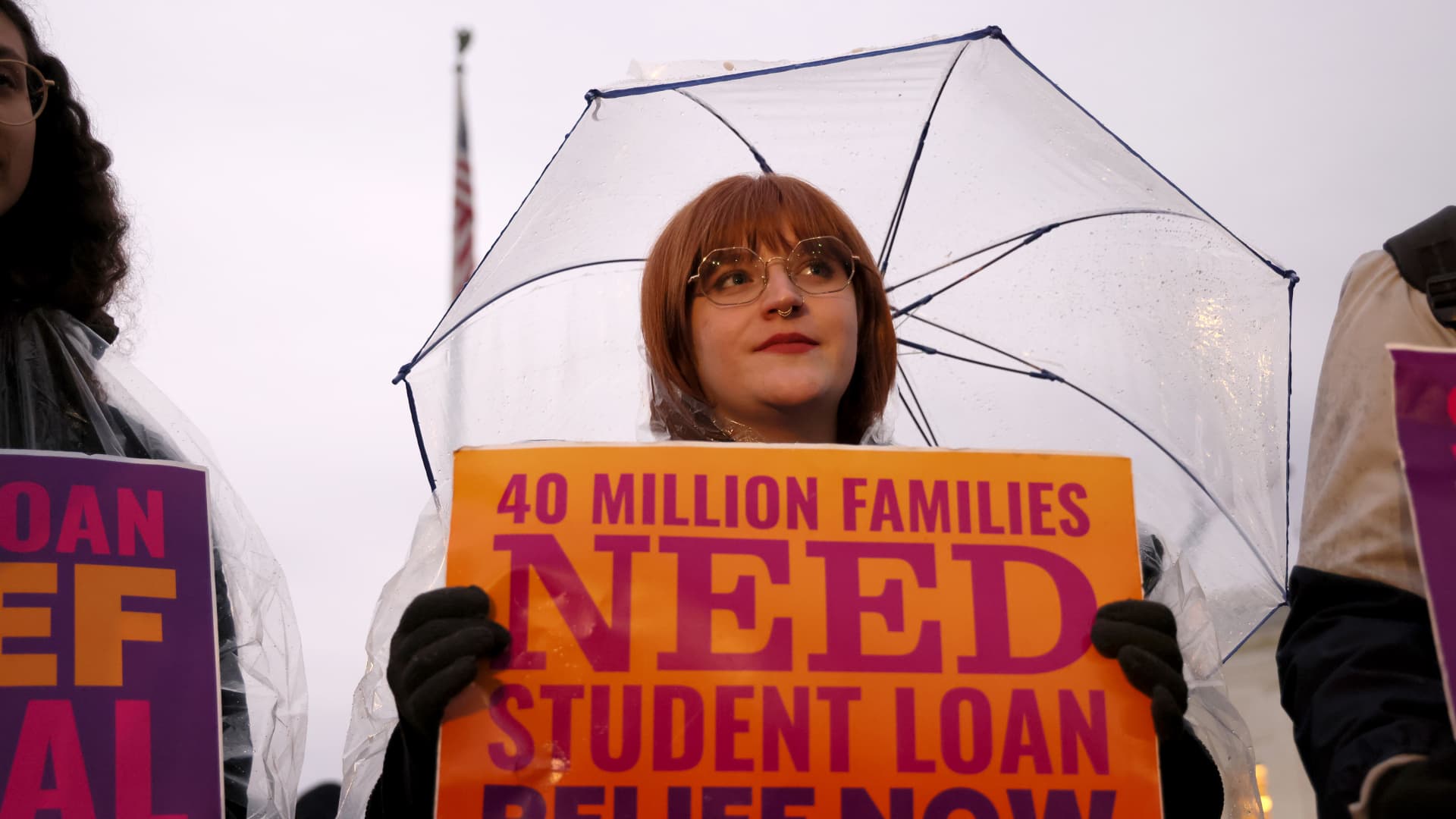

The Supreme Court decision on whether or not it allows the Biden administration to move forward with the plan to cancel $400 billion in student debt will have life-changing financial consequences for tens of millions of Americans.

Unfortunately for borrowers, legal experts remain skeptical that the justices will greenlight the relief.

“I expect the court will rule against the Biden administration,” said Paul Collins, Jr., professor of legal studies and political science at the University of Massachusetts Amherst.

Collins predicts the six conservative justices will vote down President Joe Biden’s program, and that the three liberal justices will be in favor of it. “The Supreme Court is an incredibly ideological and partisan institution in 2023 — perhaps more so than at any other point in American history,” he said.

More from Personal Finance:

3 ways to cut ‘off the charts’ travel costs, experts say

This free tax tool may find ‘overlooked’ credits or refunds, IRS says

Here’s Apple’s new 4.15% rate on savings account ranks

University of Illinois Chicago law professor Steven Schwinn agreed. “I predict the court will rule 6-3 against it, along conventional ideological lines,” he said.

Schwinn anticipates the six conservative justices to argue that the Biden administration is exceeding its authority by trying to cancel as much as $20,000 in student debt for tens of millions of people.

The White House has insisted that it’s acting within the law, noting that the Heroes Act of 2003 grants the U.S. education secretary the authority to make changes to the federal student loan system during national emergencies. The nation has been operating under an emergency declaration since March 2020 because of the Covid pandemic.

That act followed the 9/11 terrorist attacks, providing relief to federal student loan borrowers who’d been affected by those events.

If the Biden administration is forced to resume student loan payments, which have been paused for over three years, without delivering debt forgiveness, it warns that delinquency and default rates will skyrocket after the economic damage wrought by the public health crisis.

The plaintiffs challenging student loan forgiveness, including six GOP-led states, argue that the Heroes Act permits much narrower forms of relief, not the sweeping kind of cancellation the president hoped to deliver.

In other words, the states are basically asserting that Biden is using Covid as an excuse to pass his plan, said higher education expert Mark Kantrowitz.

“For example, if it was an emergency, why wait three years to provide the forgiveness?” Kantrowitz said. “Why present it in a political framework, as fulfilling a campaign promise?”

Dan Urman, a law professor at Northeastern University, said the conservative justices also seemed skeptical during oral arguments that the plan was allowed under the Heroes Act.

“I expect the court to strike down the program,” Urman said.

He will be launching his 2024 reelection campaign as American’s debt collector.Astra Taylorco-founder of the Debt Collective

Given the partisan nature of the highest court, Collins, the professor at the University of Massachusetts Amherst, said the six conservative justices may view blocking the plan as “dealing a blow to Biden’s historical legacy and likely reelection campaign.” Biden is expected to announce his intention of running for the presidency again next week.

Indeed, millions of Americans will likely be disappointed with the president for failing to deliver on his promise. Before the White House was forced to shut its application for debt relief amid the legal challenges to its plan, 26 million people had requested or qualified for the aid.

“He will be launching his 2024 reelection campaign as American’s debt collector,” said Astra Taylor, co-founder of the Debt Collective, a union for debtors, said of the president.

However, should it block the aid, the Supreme Court will likely also take a hit, Schwinn said.

“The court’s ruling in this case would only contribute further to the belief that this court is just an instrument of the modern Republican Party,” he said.