The nine justices of the U.S. Supreme Court have scheduled high-profile arguments over President Joe Biden’s student loan forgiveness plan for Feb. 28, meaning borrowers suspended in uncertainty about the fate of their debts will at least know more soon.

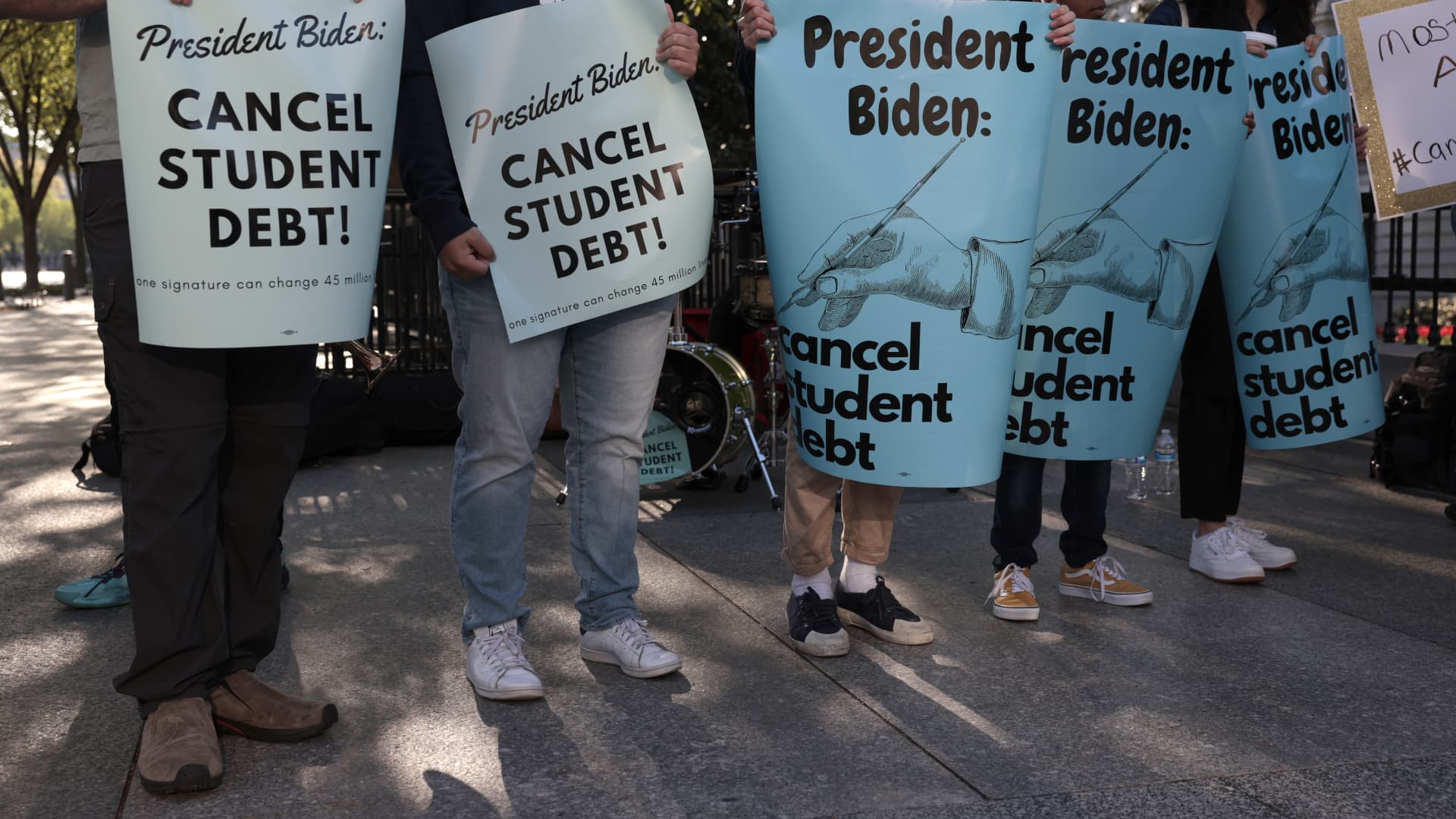

Since Biden unveiled his plan to cancel up to $20,000 in student debt for tens of millions of Americans, Republicans and conservative groups have filed at least six lawsuits to try to halt the policy, arguing that it’s an overreach of executive authority and unfair in a number of ways.

Two of those legal challenges have been successful in at least temporarily stopping the president’s plan from going forward. The Biden administration has appealed those decisions, and the country’s highest court has announced it will have the final say on the policy, which will remain on hold until then.

More from Personal Finance:

63% of Americans are living paycheck to paycheck

Used car prices are down 3.3% from a year ago

The 10 best metro areas for first-time home buyers

The justices will consider the lawsuits brought by six GOP-led states, which argue that forgiveness will disrupt state entities that profit from federal student loans, as well as a lawsuit backed by the Job Creators Network Foundation, a conservative advocacy organization, featuring two borrowers in Texas who are partially or fully left out of the president’s relief.

The fact that the justices have agreed so quickly to take both cases suggests that they’re eager to deliver a decisive ruling on the policy involving more than 30 million Americans, said Laurence Tribe, a Harvard law professor.

Like other legal experts, Tribe doesn’t have much hope that the plan will survive the Supreme Court.

“It’s basically put the program in deep freeze until it proceeds to most likely dismantle it,” Tribe said.

Higher education expert Mark Kantrowitz agreed that an eagerness to make a ruling doesn’t bode well for proponents of the president’s plan, “because ruling against forgiveness is less complicated.”

Dan Urman, a law professor at Northeastern University, also predicted the Supreme Court will rule against Biden. He said the conservative justices believe government agencies exert too much authority and “violate the separation of powers.”

Yet Tribe said the plaintiffs are dressing up their frustration with seeing students get relief in legal arguments about the separation of power.

“They think of this as elite, selfish kids getting at the head of the line when others have had to repay their loans,” Tribe said, adding that Republicans have not challenged when other groups get relief.

A report last month found that one of the plaintiffs in the Texas lawsuit was the beneficiary of more than $45,000 in debt cancellation under the Paycheck Protection Program, which provided loans to small businesses hurting from the Covid pandemic.

The Biden administration insists that it’s acting within the law with its student loan forgiveness plan, pointing out that the Heroes Act of 2003 grants the education secretary the authority to waive regulations related to student loans during national emergencies.

The U.S. has been operating under an emergency declaration since March 2020.

By Jan. 4, the Biden administration will have to submit to the court its opening brief in the cases. Responses from the plaintiffs are due around a month later.