Democratic presidential hopefuls in partnership with Univision at Texas Southern University in Houston, Texas on September 12, 2019.

Frederic J. Brown | AFP | Getty Images

Student loan borrowers have reason to pay close attention to the 2020 presidential campaign.

Many of the Democratic presidential candidates have detailed plans to address what increasingly is called a student loan crisis.

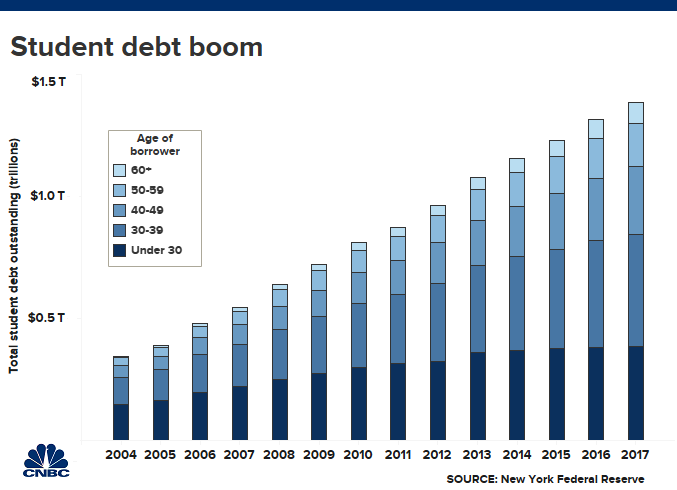

Education debt in the U.S. has eclipsed credit card and auto debt. Today the average college graduate leaves school $30,000 in the red, up from $10,000 in the 1990s, and nearly 1 in 3 student loan borrowers are in delinquency or default. Research has shown that the debt makes it harder for people to buy houses and cars, start businesses and families, save or invest.

More than half of Americans say student debt is “a major problem” for the country, according to a new Politico/Morning Consult poll. Candidates are taking note.

“It’s striking how student debt has become a top tier issue in this presidential campaign,” said James Kvaal, president of The Institute for College Access & Success.

Below are the candidates who have proposed big changes for student loan borrowers (or at least some of them).

Bernie Sanders

Democratic presidential hopeful US senator from Vermont Bernie Sanders gestures as he speaks during the first round of the second Democratic primary debate of the 2020 presidential campaign season hosted by CNN at the Fox Theatre in Detroit, Michigan on July 30, 2019.

Brendan Smialowski | AFP | Getty Images

Sen. Bernie Sanders, I-Vt., plans to erase the country’s $1.6 trillion outstanding student loan tab, releasing 45 million Americans from their debt.

“This is truly a revolutionary proposal,” Sanders told The Washington Post. “In a generation hard hit by the Wall Street crash of 2008, it forgives all student debt and ends the absurdity of sentencing an entire generation to a lifetime of debt for the ‘crime’ of getting a college education.”

The $2.2 trillion plan would be paid for by a new tax on financial transactions, including a 0.5 percent tax on stock transactions and a 0.1 percent tax on bond sales. That levy would raise up to $2.4 trillion over the next decade, according to the senator’s office.

Elizabeth Warren

Senator Elizabeth Warren

Heidi Gutman/Walt Disney Television via Getty Images

Under Warren’s proposal, borrowers with household incomes less than $100,000 would get $50,000 of their student debt forgiven.

People who earn between $100,000 and $250,000 would be eligible for forgiveness on a sliding scale – the cancellation amount reduces by $1 for every $3 a person earns over $100,000. And those who earn more than $250,000 would not get any debt relief.

The plan would likely be funded with a 2% annual tax Warren proposes to levy on accumulations of wealth exceeding $50 million, with an additional 1% levy on wealth exceeding $1 billion.

“The first step in addressing this crisis is to deal head-on with the outstanding debt that is weighing down millions of families and should never have been required in the first place,” Warren wrote in her Medium post announcing the plan.

In a Politico/Morning Consult poll, 56% of registered voters said they support the Massachusetts senator’s proposal to cancel outstanding education loans by raising taxes on the wealthiest Americans.

Just 27% of voters said they opposed it.

Joe Biden

Former Vice President Joe Biden

Heidi Gutman/Walt Disney Television via Getty Images

Biden laid out some of his plans for student loan borrowers at a recent campaign stop at Keene State College in New Hampshire.

Those who earn less than $30,000 a year will be off the hook from making their monthly loan payments, Biden said.

Other borrowers on so-called income driven repayment plans would pay 5% of their discretionary income toward their student loans, the former vice president said, whereas now they pay between 12% and 20%.

Higher education expert Mark Kantrowitz said Biden’s plans don’t make any big waves.

“He does not propose to forgive student loans, even in a targeted manner,” Kantrowitz said. “They won’t attract much attention from millennials.”

Some advocates point out that in 2005 Biden supported a bill that has made it harder for people to get rid of their private student loans in bankruptcy.

Cory Booker

Senator Cory Booker

Heidi Gutman/Walt Disney Television via Getty Images

Sen. Cory Booker, D-N.J., has said that he would forgive the student loan debt of public school teachers.

He has worked also with other politicians to make it easier for borrowers to refinance their student loans at lower interest rates and to expand the scope of the public service loan forgiveness program. That program allows not-for-profit and government employees to have their federal student loans canceled after 10 years of payments.

Julian Castro

Former US Secretary of Housing and Urban Development Julian Castro

Heidi Gutman/Walt Disney Television via Getty Images

Under Castro’s plan, student loan borrowers wouldn’t pay more than 10% of their discretionary income each month. After 20 years — or 240 monthly payments — borrowers will have any remaining debt forgiven tax-free.

A Castro administration would cancel a portion of the student loans of people who qualify for more than three years for means-tested federal assistance, such as Medicaid.

It would also expand the public service loan forgiveness program and make it easier for borrowers to discharge their debt in bankruptcy.

Kamala Harris

Senator Kamala Harris

Heidi Gutman/Walt Disney Television via Getty Images

Sen. Kamala Harris, D-Calif, said she would forgive the student debt of Pell Grant recipients who start a business in a disadvantaged community and manage to keep that business afloat for at least three years.

Pell Grants typically go to students from families with an income below $20,000. Last year, 7 million people received them.

Andrew Yang

Democratic presidential hopeful Tech entrepreneur Andrew Yang gestures during the third Democratic primary debate of the 2020 presidential campaign season hosted by ABC News in partnership with Univision at Texas Southern University in Houston, Texas on September 12, 2019.

Robyn Beck | AFP | Getty Images

Yang is calling for a “Bailout for the people,” and said he will explore a partial reduction in student loans for recent graduates with the largest balances.

Borrowers would be able to enter a 10-year repayment plan that caps their monthly bills at 10% of their salary. When the decade is over, any remaining debt would be erased.

He would also make it easier for student loan borrowers to declare bankruptcy.

Beto O’Rourke

Democratic presidential candidate former Texas congressman Beto O’Rourke

Win McNamee | Getty Images