Workers asked to repay unemployment benefits issued during the Covid pandemic may be getting a refund.

However, it may take states up to a year to issue the money, according to a memo issued Wednesday by the U.S. Labor Department.

States tried clawing back benefits from hundreds of thousands of Americans since spring 2020.

More from Personal Finance:

More than 1 million new $1,400 stimulus checks have been sent

Montana opts to end $300 unemployment boost. Other states may, too

Paycheck Protection Program has run out of money for most borrowers

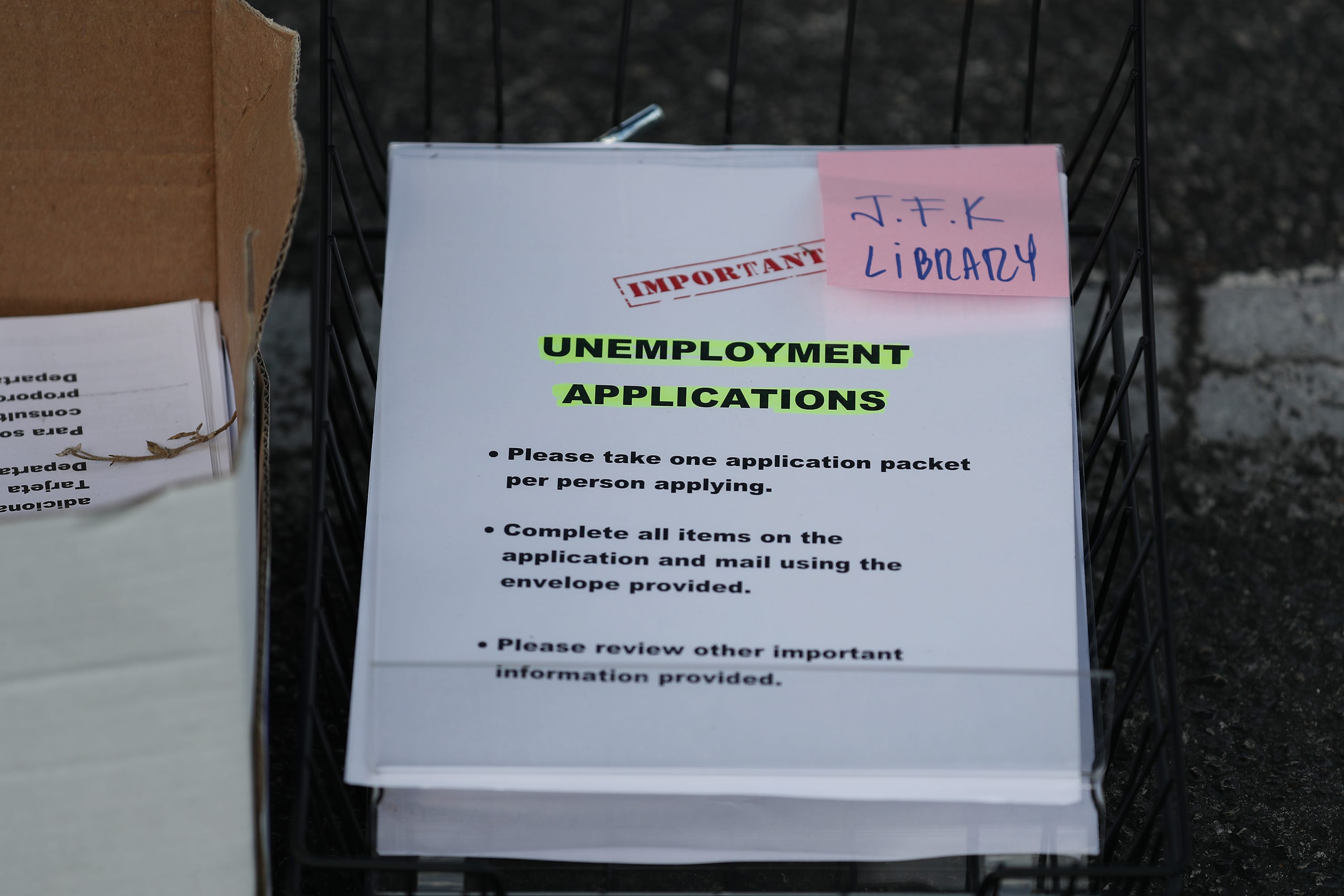

Many had received money through a new federal program, Pandemic Unemployment Assistance, created by the CARES Act to expand aid to a large pool of people typically ineligible for state benefits.

States rushed to issue benefits amid a flood of claims, only later realizing some had been paid in error — due to mistakes from both applicants and state labor bureaus.

However, the CARES Act didn’t offer a safety valve for states to forgive overpayments. That essentially meant states had to try to collect the funds.

Texas, for example, sent notices to about 260,000 PUA recipients between March 1 and Oct. 1 and tried to claw back $214 million.

Refunds and waivers

A $900 billion relief law passed in December let states opt to waive overpayments of benefits.

Now, states who opt into that forgiveness must issue refunds to workers who’d repaid all or some of their benefits prior to getting a waiver, according to the U.S. Labor Department.

“It may take some time (e.g., up to a year) for states to process such refunds and states are encouraged to contact the Department for technical assistance,” the agency said in guidance issued Wednesday.

States may forgive overpayments if a worker wasn’t at fault and recovering funds would cause financial hardship, for example.

States have many avenues to collect benefits deemed to be overpaid. They can reduce current benefits, garnish tax refunds, intercept lottery winnings and sue individuals to recoup aid, for example. Some charge interest on outstanding balances.

“In many cases, individuals received payments for which they may not have been eligible through no fault of their own,” according to Principal Deputy Assistant Secretary for Employment and Training Suzi LeVine.

“The guidance issued today by the U.S. Department of Labor will help states address this important issue, providing them with greater flexibility to forgo recovery of improper payments from honest workers who continue to struggle and direction in handling cases where real fraud exists,” she added.