Payments company Square is launching a business dedicated to “decentralized financial services” using bitcoin.

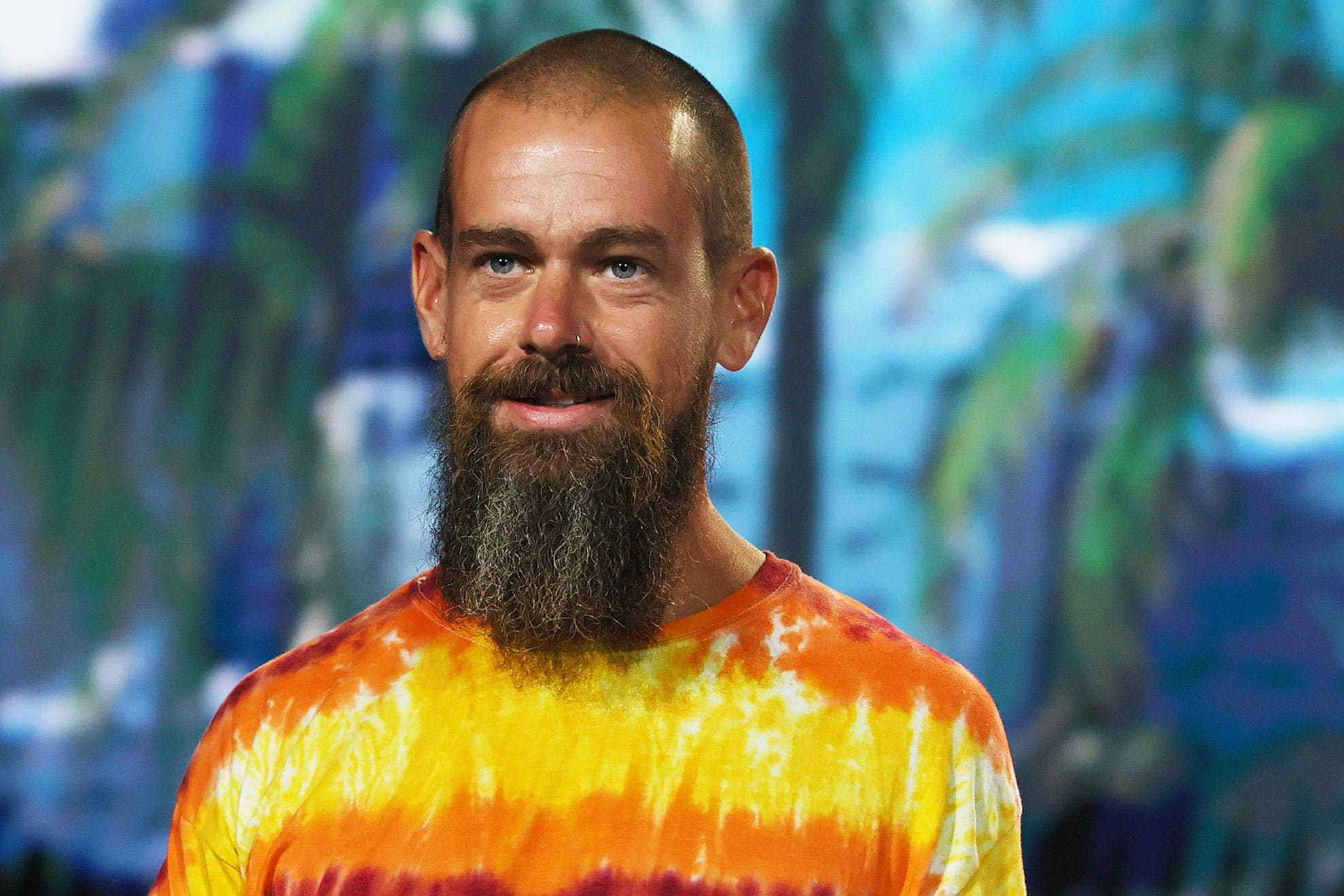

Square CEO and bitcoin bull Jack Dorsey said on Twitter late Thursday that the company is “focused on building an open developer platform with the sole goal of making it easy to create non-custodial, permissionless, and decentralized financial services.”

The new unit will include the Seller, Cash App and recently acquired Tidal businesses.

Decentralized finance, or DeFi, applications are those that don’t rely on centralized authorities like banks, but instead use blockchain-based smart contracts to execute transactions. Most are being built on the Ethereum blockchain.

DeFi applications allow for financial transactions that are more easily accessible, efficient, and relatively low cost. They’ve also been highly attractive to yield seekers who can generate returns between about 15% and 30% by participating in the DeFi ecosystem – by “locking” capital in smart contracts.

“DeFi platforms function similarly to traditional banks and financial services companies and could pose a disruption risk in the coming years,” Needham’s John Todaro said in a recent report focused on the DeFi opportunity. “In the current yield starved environment, there has been an increased demand for DeFi platforms which offer significantly higher yields than traditional financial products.”

But like cryptocurrency activity broadly, DeFi comes with many different kinds of risks, including regulation, asset volatility and the technology itself. Because there aren’t banks or other third-party companies facilitating transactions, there’s no insurance on funds that could potentially get lost. Cryptocurrencies are volatile, which means assets put up as collateral could quickly decline in value if there’s a downturn, which could lead to positions being liquidated. And there could be errors in the original smart contract code.

The current estimated value of funds currently locked into DeFi-related contracts is $55.21 billion, according to DeFi Pulse.

Dorsey said the team is committed to building in a transparent way that includes an “open roadmap, open development, and open source.”

Mike Brock, who leads strategic initiatives within Square’s consumer product Cash App, will lead the new business.

“Technology has always been a story of decentralization,” he said in a follow-up tweet. “From the printing press, to the internet to bitcoin – technology has the power to distribute power to the masses and unleash human potential for good, and I’m convinced this is the next step.”