The stock market scorecard can help you invest for retirement with confidence.

Getty Images, contributor gopixa

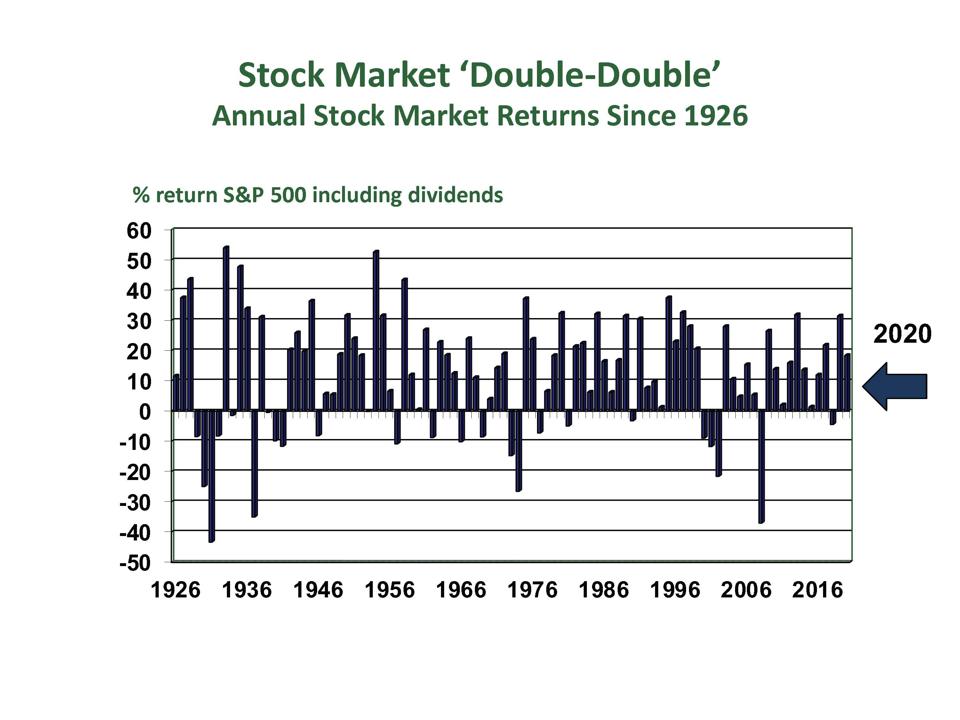

If a baseball or basketball team had a win/loss record of 70-25, you’d say it dominated the field. Well, 70-25 has been the win/loss record for the annual rate of return on the S&P 500 since 1926.

Impressive scores

When considering the return from both appreciation and dividends, in the past 95 years, the S&P 500 has had a positive return for 70 calendar years and a negative return for just 25 years—a 74% winning percentage The chart below shows the year-by-year record.

Steve Vernon

The win/loss ratio isn’t the only impressive score. For the years in which the S&P 500 had a positive return, the arithmetic average of the annual rates of return has been a little over 21 percent. However, for the years in which the S&P 500 lost money, the arithmetic average of the annual rate of loss has been a little more than 13 percent.

To sum up:

- The stock market has had positive returns for many more years than for negative returns.

- However, negative returns still happen often.

- The average gains during the winning years have been about 8 percent higher than the average losses during the down years.

- Generally, then, the average returns during the winning years will more than compensate for the losses during the down years, for those investors who remain invested over many years.

- Most of the time, but not always, you’ll earn more money by investing in stocks compared to other investments.

MORE FOR YOU

It’s the “not always” aspect to these conclusions that causes a dilemma for stock market investors.

Strategies for retirement investors

If you’re investing for retirement and you’re more than 10 years away from retiring, you can use the stock market’s 70-25 winning percentage to justify a significant investment in stocks. Given past performance, you should have enough time to ride out any potential stock market downturns, which are inevitable.

Investing becomes more complex, however, as you near and then enter retirement. If you’re in your 50s, 60s, or 70s, the chart above shows that most likely, you’ll experience a few more stock market crashes during your retirement years. The trouble is, nobody has reliably predicted when the stock market will crash. As a result, you’ll want to devise investment strategies to help you withstand future stock market crashes, whenever they might occur.

Start by maximizing your Social Security income, which is the “almost perfect” retirement income generator. For many middle-income workers, optimized Social Security benefits might be the only guaranteed, lifetime retirement income they’ll need.

To max out your Social Security benefits, you’ll want to delay starting benefits for as long as possible but no later than age 70. If you retire before you start your Social Security benefits, you can build a “Social Security bridge fund” that will substitute for the Social Security income you’re delaying. You’ll want to invest this portion of your retirement savings in investments that won’t drop when the stock market crashes, such as short-term bond funds, money market funds, or stable value funds in 401(k) plans.

Pre-retirees and retirees who want more guaranteed retirement income can consider bond ladders, guaranteed annuities, or tenure monthly payments from reverse mortgages.

After you build a sufficient floor of guaranteed retirement income, you can invest your remaining savings significantly in stocks to give you the potential for growth. These savings can be invested in low-cost target date funds, balanced funds, or stock index funds. Use these investments to generate a regular retirement paycheck that covers any discretionary living expenses you could cut back on if need be. Examples include hobbies, travel, gifts, and money you use to treat your grandchildren.

The above chart should encourage you to remain invested when the market drops and wait for the market to bounce back. If you have your basic living expenses covered, as described above, hopefully you’ll have the patience to ride out any stock market crashes.

This strategy balances guaranteed sources of retirement income with some investments in the stock market. With this strategy, you won’t need to worry about which stock market forecast is correct. By spending the time necessary to design a thoughtful retirement investing strategy, you can go enjoy your life worry free.