As enrollment deadlines approach, fewer students have figured out how they will afford college next year.

Ongoing problems with the new Free Application for Federal Student Aid have delayed financial aid award letters and even prevented many high school seniors and their families from applying for aid at all.

As of the latest update, roughly 7.3 million 2024-25 FAFSA applications have been submitted and sent to schools, according to the U.S. Department of Education, less than half of the more than 17 million students who use the FAFSA in ordinary years.

At the current rate, the number of FAFSAs submitted by the end of August will be about 2.6 million fewer than the same time last year, a decrease of 18%, according to higher education expert Mark Kantrowitz.

“This is a complete disaster,” he said.

More from Personal Finance:

Decision deadlines pushed to May 15 or later

Harvard is back on top as the ultimate ‘dream’ school

More of the nation’s top colleges roll out no-loan policies

Still, it’s too soon to say whether those remaining students will ultimately apply for aid and how that could impact their decisions about college in the fall, according to Sandy Baum, senior fellow at Urban Institute’s Center on Education Data and Policy.

“The question is really, ‘What is the long-term impact?’ We just don’t know yet,” she said.

Many institutions are now issuing aid with the information they have on hand, according to the Department of Education.

“Students should know that they are not going through this alone, we will remain in regular communication with schools and students and encourage students to stay in touch with us and with their colleges,” an Education Department spokesperson said.

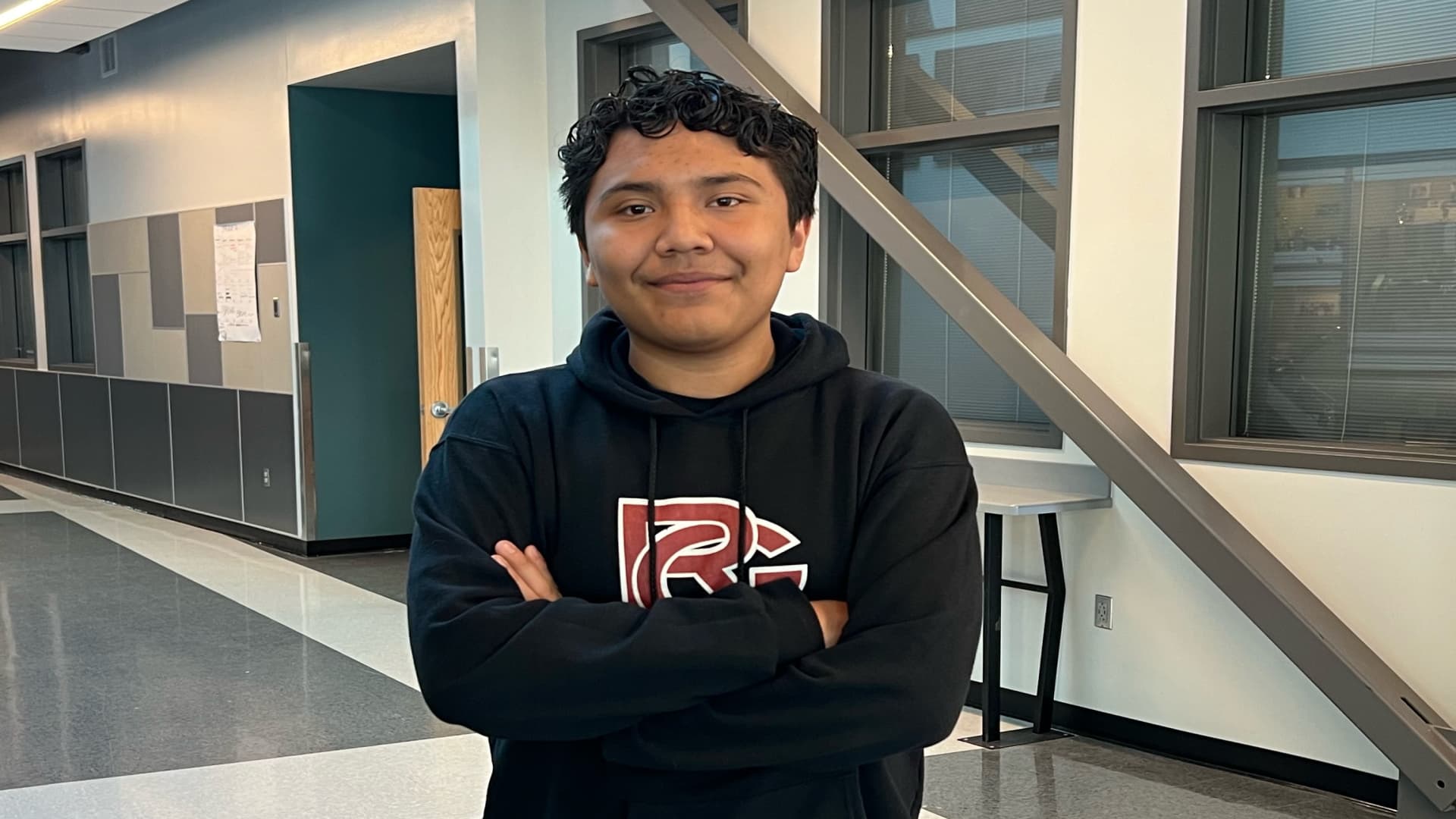

Ramon Montejo García, a 17-year-old senior at the KIPP Northeast Denver Leadership Academy in Colorado, has been accepted to his first-choice school, Wheaton College in Massachusetts.

But with a sticker price of nearly $80,000 per year, including tuition, fees, and room and board, Montejo García, like many college hopefuls, will need financial aid to bring the cost down. However, he hasn’t submitted a FASFA yet, which serves as the gateway to all federal aid money, including loans, work-study opportunities and grants.

One issue with the new form specifically concerned parents without a Social Security number. Although Montejo García’s parents have lived in the U.S. since 2001, they are both undocumented. (The U.S. Department of Education said this issue has been resolved.)

Without aid, Montejo Garcia said he will likely attend an in-state school but added that “it’s been really emotional.”

“How will this work out? I don’t have a lot of time,” he said.

Other students may default to their local public college as well, according to Charles Welch, president and CEO of the American Association of State Colleges and Universities.

“So many of our students are more likely to attend an institution that is close by,” he said. “For many of our students it’s less about comparing offers and more about, ‘Can I go at all?'”

Fewer grants going out

As of April 5, only 28% of the high school class of 2024 has completed the FAFSA, according to the National College Attainment Network, a 38% decline compared with a year ago.

Of all the financial aid opportunities the FAFSA opens up, grants are the most desirable kind of assistance because they typically do not need to be repaid.

Under the new aid formula, an additional 2.1 million students should be eligible for the maximum Pell Grant, according to the Department of Education.

However, given the slower pace of FAFSA applications being submitted, “the number of Pell Grant recipients will be about the same as last year, despite the new Pell Grant formula making it easier for students to qualify,” Kantrowitz said.

FAFSA completion paves the way for college

Submitting a FAFSA is one of the best predictors of whether a high school senior will go to college, the National College Attainment Network found. Seniors who complete the FAFSA are 84% more likely to immediately enroll in college.

However, in the past, many families mistakenly assumed they wouldn’t qualify for financial aid and didn’t even bother to apply. Others said a lengthy and overly complicated application was a major hurdle. Some said they just didn’t have enough information about it.

In ordinary years, high school graduates were already missing out on billions of dollars’ worth of federal grants because they didn’t fill out the FAFSA, experts say.

“We really want to think about the students considering forgoing the process altogether,” said Ellie Bruecker, interim director of research at The Institute for College Access and Success.

The goal of FAFSA simplification was to improve college access, she added. “The number of students left out of the college pipeline is huge.”