Free gondola rides to and from Salesforce Park

Source: Saleforce Transit Center

In a year plagued by U.S.-China trade tensions where investors piled into “tariff-proof” software stocks like Microsoft and Salesforce, a stunning reversal is occurring.

As trade tensions cool-off and a slowing economy forces companies to spend less on software services, these high-flying technology stocks that rely heavily on corporate dollars are being pressured.

“A lot of people had crowded into software as one of the few areas in the equities market where you could see some real growth and you could see that growth without a lot of trade risk,” said Keith Weiss, software analyst at Morgan Stanley. “What broke this momentum was you started to get some increasing concerns about the durability of growth.”

Historically, software stocks are a safe haven during times of macro uncertainty as software-oriented projects are seen as more defensible. After some software names, like Coupa, rallied more than 100% in the first half of 2019 due to trade war fears, the last three months have brought a reversal to the heavily owned sector. The exception being Microsoft, which reports earnings on Wednesday.

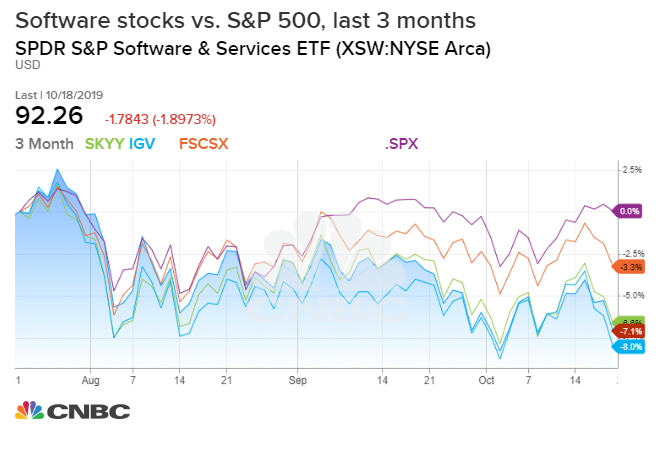

The S&P 500 software and services ETF, which holds Citrix and Zynga, is down more than 7% in the last three months. The Cloud Computing ETF and iShares Tech-Software ETF reflected a similar path and the Fidelity Select Software & IT Services ETF followed suit. Companies including Oracle, Adobe, Intuit, and ServiceNow, which reports earnings after the bell Wednesday, are held in these funds.

The biggest pullback is in high growth, high enterprise multiple names like CrowdStrike and Zscaler, which are both down about 50% in the past three months. Microsoft, which represent’s 50% of the market cap of the overall sector, is down less than 0.5% in the last three months.

“The bellwether in terms of whether people are buying the software sector has to be Microsoft” said Weiss. “Microsoft has hung in remarkably well. It is these high growth names…where you see the broadest pullback.”

Sector shift as trade war cools

Some of the pullback in software stocks can be attributed to positive trade war developments inflating other parts of the market that otherwise were threats, said Weiss.

If investors “feel that software is very crowded, its topped out in terms of multiples and valuations, and now with the potential of a trade deal, there’s other areas of the economy that could re-inflate on the back of that, and there’s potentially other growth elsewhere,” said Weiss.

Back in March, the S&P 500 software index touched an all-time high, roaring back more than 23% since its 2018 Christmas Eve low. The stand-out performance was driven by the group’s immunity to the China trade war, which hurt other technology companies, especially chipmakers. Ari Wald, head of technical analysis at Oppenheimer, called the software group a “must-own industry” and Joel Fishbein, software and cloud technology analyst at BTIG said “we are at a secular boom right now for software which we think will continue for several years.”

Fast-forward to today, trade tensions have started to cool after President Donald Trump said the U.S and China reached a “very substantial phase one deal.” But software stocks are known for their high multiples and valuations, and if the China threat is gone, the investors might be leaving with it.

“It’s more about flight from the high multiple names,” Weiss said.

Ultimately, Weiss attributes most of the decline in software stocks to concerns about the durability of growth for the group.

Corporate spending slump

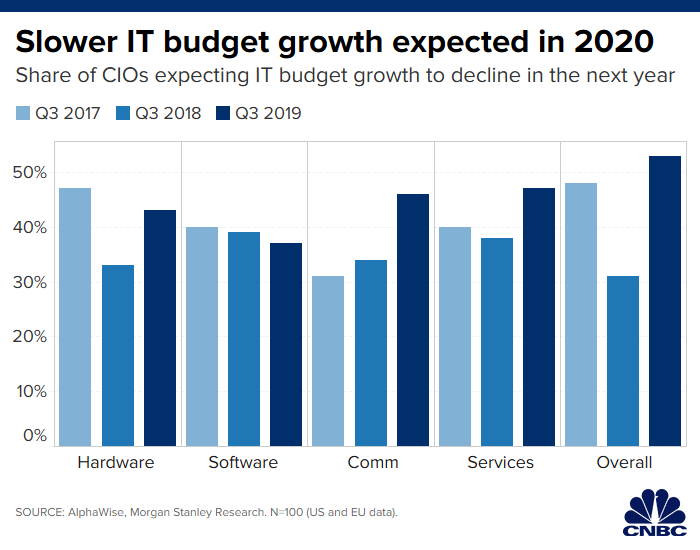

Analysts are expecting businesses to tighten their information technology (IT) budgets as soon as next year, as worries about the slowing global economy hinders companies from investing too far in the uncertain future. About 53% of chief investment officers said they will spend less on information technology in 2020, according to a Morgan Stanley survey.

“Despite being high quality businesses with recurring cash flows, high margins and secular tailwinds, Software companies are not immune to a slowing in corporate spend,” said Morgan Stanley’s chief U.S. equity strategist Mike Wilson in a note to clients. “Software and Hardware budgets were expected to see the steepest deceleration in 2020.”

CIOs are expecting software spending growth to decelerate to 3.7% in 2020 from 4.7% in 2019, the lowest level in ten quarters.

But how much do these software companies rely on corporate dollars? Morgan Stanley, which covers Yext, Twilio, Splunk and Zendesk among many others in the software space, expects the names in its coverage group to generate about $320 billion in revenues in 2019, with more than 85% of that from corporate environments, the firm’s Keith Weiss told CNBC. Zendesk reports earnings next week.

“At some point, the slowing business spend was likely to impact even the fast growing companies with the best secular growth stories, especially if they are more dependent on corporate rather than consumer spend. Nowhere is this more evident than in Software,” added Wilson.

As companies start to report earnings, chief executives are warning about this very trend. Shares of WorkDay tanked 16% following its earnings.

“I think people are still moving forward with their transformation projects,” said Aneel Bhusri, chief executive officer of software company WorkDay on its analyst day last week. “The one thing we don’t know yet is will the uncertainty cause some delays in opportunities. We definitely seen some delays.”

Time to buy?

Despite the correction in software stocks, Wall Street does not recommend leaving the sector.

“The more recent consolidation is a healthy pause in what is a longer-term uptrend,” said Wald of Oppenheimer. “I’d still expect these software stocks to hang in there.”

Wald said the pullback wasn’t that damaging for the group and “the previous leader is just pausing after a tremendous run and some of the laggards are playing a bit of near-term catch up.”

Wedbush analyst Steve Koenig echoed this sentiment in a note to clients. The correction in growth software has “felt horrific” but year-to-date performance is still strong and valuations are still above their depressed levels, he said.

“The most important technology trends usually play out over decades not quarters,” said Ali Khan, portfolio manager of Fidelity’s Select Software and IT Services portfolio. The FSCSX, with $7.2 billion assets under management, is up 13% this year, but has suffered in the past 3 months.

— with reporting from CNBC’s Michael Bloom.