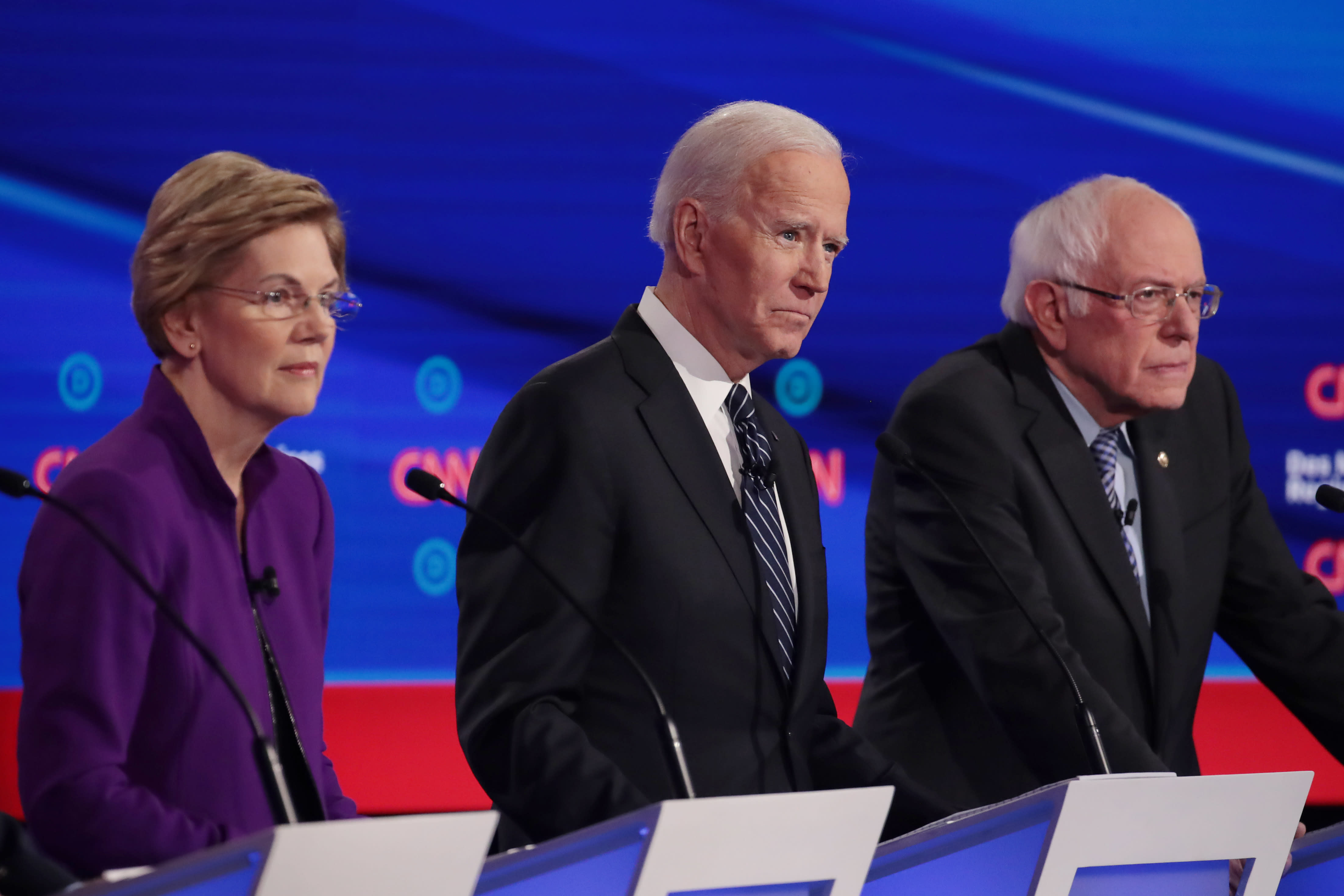

Sen. Elizabeth Warren (D-MA), former Vice President Joe Biden and Sen. Bernie Sanders (I-VT) (R) participate in the Democratic presidential primary debate at Drake University on January 14, 2020 in Des Moines, Iowa.

Scott Olson | Getty Images

Social Security policy has already prompted some presidential contenders to resort to fighting words.

But for many of the candidates, it’s also a personal matter.

That’s because a good number are age 62 or older. And that means they’re personally eligible to collect Social Security retirement benefits, provided they have contributed to the system for a sufficient number of years.

President Donald Trump, who is running for re-election, is 73 years old.

Meanwhile, Democratic candidates have a wide age range, from Bernie Sanders, the eldest candidate at 78, to Pete Buttigieg, one of the youngest at 38.

The candidates represent just a handful of the millions of American workers who pay FICA taxes, named for the Federal Insurance Contributions Act. That includes a 6.2% tax for Social Security and 1.45% for Medicare. Both employees and employers pay that same rate, for a total of 15.3% per paycheck.

To be eligible for retirement benefits, you need to have accumulated at least 40 credits, or about 10 years of work. The Social Security Administration calculates the benefit by using your average indexed monthly earnings for the 35 years with the highest earnings.

“Each person, no matter if they are in the political arena or if they are in the workforce, have to look at that unique fact set to determine which strategy would work best for them,” said David Freitag, a financial planning consultant and Social Security expert at MassMutual.

Here’s what the political candidates — and you — need to know to before you make a claiming decision.

62 to 70: The crucial ages

Multiple presidential candidates are 70 or over. That includes President Trump, 73. It also includes Democratic nomination contenders Sanders, 78; Joe Biden, 77; Michael Bloomberg, 77, and Elizabeth Warren, 70.

“The train has probably left the station for those over 70,” Freitag said. “There’s not much they can change.”

That’s because once you reach 70, you can no longer get delayed retirement credits if you put off collecting Social Security.

But the longer you delay from age 62, when you are first eligible to start collecting monthly checks, to age 70, the bigger your benefits get.

That applies to candidates such as Deval Patrick, who is 63 years old, and Tom Steyer, 62. It also applies to Amy Klobuchar, who at age 59 is approaching eligibility.

If you claim retirement benefits at age 62, you will receive a reduced benefit.

If you wait until your full retirement age — generally 66 or 67 for most, depending on the year in which you were born — you will receive 100% of the benefits you earned based on your record.

But delay even past then, up until age 70, and your benefits will increase even more. For those who were born in 1943 or later, that amounts to 8% for each year you delay.

Important factors to consider

There are certain situations when it just doesn’t make sense to delay benefits.

Freitag said he typically refers to this strategy as “one size fits one” because it is based on your particular circumstances only.

Factors to consider include your health; your spouse, if you’re married; dependent children, if you have them; as well as your longevity, Freitag said.

Delaying benefits does not make sense if you need the income and your health does not permit you to work, for example. It also doesn’t make sense to delay if you have had a serious health diagnosis and do not have that much time to live.

More from Personal Finance:

Biden and Sanders want to boost Social Security. Why are they fighting?

Social Security benefits narrow wealth gap but many retire poor

How your Social Security cost-of-living adjustment is calculated

If your spouse needs to collect spousal benefits based on your working record, you need to be receiving benefits in order for them to use that strategy. Spouses also need to be at least 62 to receive those benefits.

If you receive retirement benefits, your children could also be eligible to receive monthly checks if they are unmarried; under age 18; age 18 to 19 and a full-time student; or 18 and older and disabled.

For example, Donald Trump’s youngest son Baron, 13, is also able to claim Social Security benefits.

And then there’s the big question: How long will you live?

“No one really knows the answer to that,” Freitag said.

But you can get a sense of whether genetics is on your side based on how long your parents and other relatives lived, he said.

47 and younger: What to expect

Admittedly, strategies are less concrete for those who are younger.

That includes candidates like Andrew Yang, who is 45, and Pete Buttigieg and Tulsi Gabbard, who are both 38.

That is because the Social Security trust funds are currently projected to run out in 2035, at which point 80% of benefits will be payable.

That has led the presidential candidates and Congress to begin working on proposals to change the system.

Generally, that will require either tax hikes, benefit cuts or a combination of both. Democrats’ plans generally call for preserving current benefits.

Any changes to the system would be gradually phased in.

Don’t underestimate that Social Security is probably going to be around and is going to be an important component to most people’s retirement. It’s not going to be zero.

William Meyer

founder of Social Security Solutions

If you’re between 47 and 55, you can probably use today’s Social Security rules to plan your retirement strategy, said William Meyer, founder of Social Security Solutions, a provider of benefits claiming software.

But those younger than 47 are likely to be impacted by changing rules, Meyer said. But that doesn’t mean benefits will disappear.

“Don’t underestimate that Social Security is probably going to be around and is going to be an important component to most people’s retirement,” Meyer said. “It’s not going to be zero.”

Among the possible changes lawmakers could consider, one of the more likely scenarios is raising the full retirement age, which last happened in 1983, Meyer said. That’s as life expectancies for today’s younger generations creep up.

Another possible change is changing the way the cost-of-living adjustment is calculated, he said.

In any case, you shouldn’t underestimate the importance of your claiming decision. Using the current Social Security rules is a good place to start, Meyer said.

“This is the largest decision a person makes about their financial future,” Meyer said.

Also don’t hesitate to seek professional advice, he said.

“It’s like the tax code: It’s super complicated,” Meyer said. “If you put the pieces together, you can find more money.”