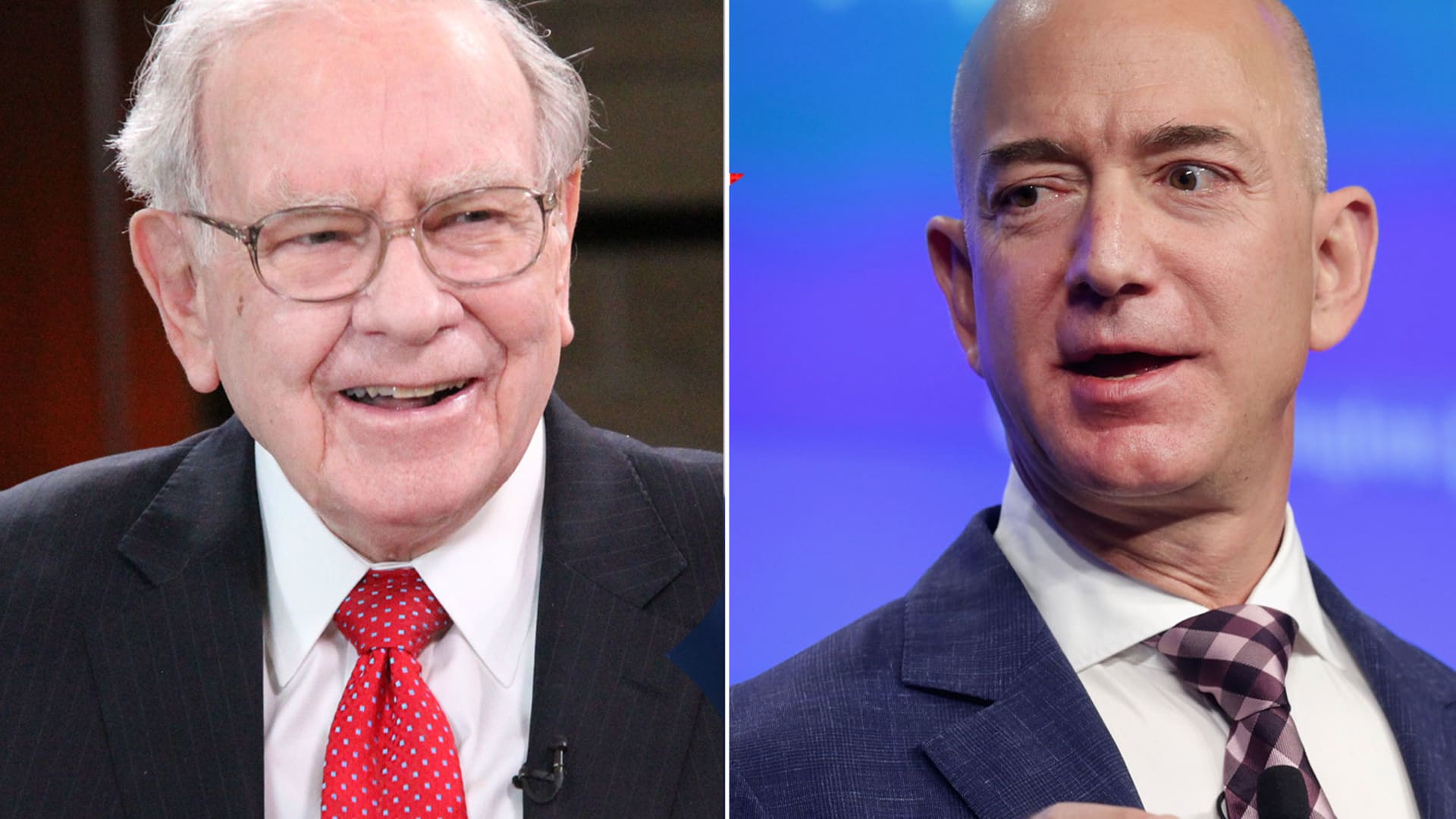

The wealth of America’s wealthiest people, such as Warren Buffett and Jeff Bezos, increased by a total of $6.5 trillion last year, mainly driven by soaring stock prices and financial markets, according to the Federal Reserve.

The total wealth of the 1% reached a record $45.9 trillion at the end of the fourth quarter of 2021, said the Federal Reserve’s latest report on household wealth. Their fortunes increased by more than $12 trillion, or more than a third, during the course of the pandemic.

“The numbers are astounding,” said Edward Wolff, professor of economics at New York University. “The pandemic wealth boom certainly ranks at or near the top of all the wealth booms over the last 40 years.”

The top 1% owned a record 32.3% of the nation’s wealth as of the end of 2021, data show. The share of wealth held by the bottom 90% of Americans, likewise, has declined slightly since before the pandemic, from 30.5% to 30.2%.

The wealth growth at the top has potentially stalled or declined slightly so far this year due to stock declines.

The main drivers for the richest Americans last year were stocks and private businesses. About $4.3 trillion of the overall gains for the 1% last year came from corporate equities and mutual fund shares, according to the Fed data. The stock portfolios of the top 1% are now worth $23 trillion, and they own a record 53.9% of individually held shares, according to the central bank.

Despite claims of a democratization of the stock market, with millions of new retail investors opening trading accounts on Robinhood and other platforms, stock ownership in America has actually become more concentrated than before the pandemic. The top 10% owned a record 89% of individually held corporate equities and mutual fund shares at the end of 2021.

A Gallup in 2021 found that 56% of Americans owned at least some stock – slightly above the average of 55% in 2019 and 2020, but still down from the 62% high before the 2008 financial crisis.

More wealth inequality

Soaring stock prices have created a “feedback cycle” for wealth and inequality, said Wolff, the NYU professor. Because stock ownership is tilted toward the top of the wealth ranks, rising stock prices shifts more money to richer Americans. Since the wealthy can afford to save and invest a larger share of their added wealth, more of the nation’s wealth gains flow to the stock market. That raises stock prices even further.

“Rising wealth inequality drives the stock market, which then drives more wealth inequality,” Wolff said.

Private businesses have also been a powerful engine of wealth for those at the very top. The 1% own 57% of private companies, according to the Federal Reserve. The value of private businesses held by the wealthiest increased by 36%, or $2.2 trillion, last year.

“Small business is really key when you talk about the sources of their wealth,” Wolff said.

The 1% have also benefitted modestly from rising real-estate values. Their real-estate holdings increased by just under $1 trillion during the pandemic, to reach a high of $5.27 trillion.

But their share of the nation’s real-estate actually fell slightly during the pandemic, as home prices and home ownership also increased for rest of the country. Real estate is far more broadly owned than stocks, so the rising in home prices has helped the middle class slightly more than the wealthy. The top 1% owned 14% of the nation’s real estate at the end of 2021, down from 14.5% before the pandemic at the end of 2019.

The bottom 90% of Americans added $2.89 trillion to their wealth last year from real estate.

“The housing boom has benefitted the middle class,” Wolff said. “If it hadn’t been for that, wealth inequality would have grown even more than it did.”