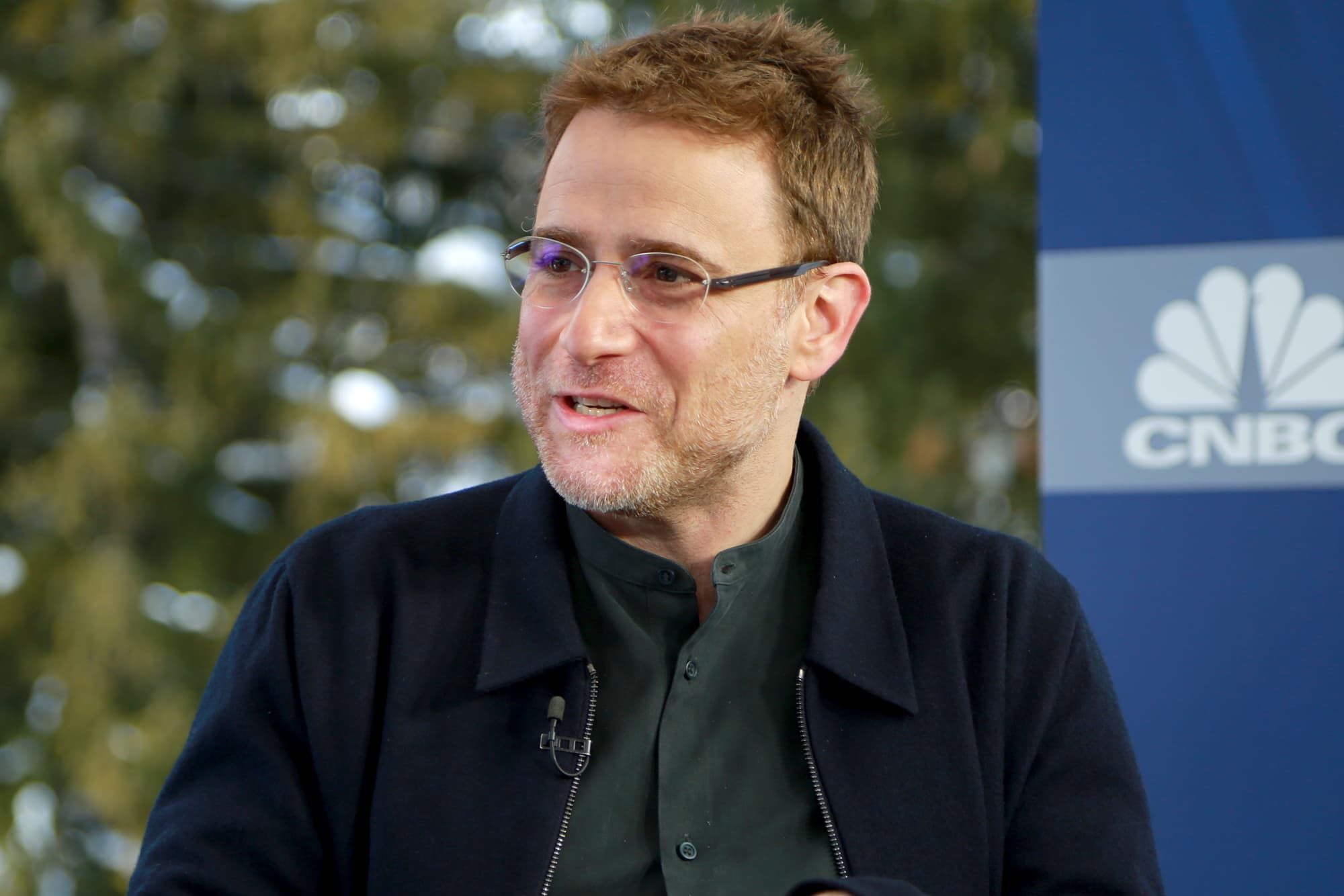

Stewart Butterfield, co-founder and CEO of Slack, at the 2018 WEF in Davos, Switzerland.

Adam Galica | CNBC

Slack, maker of the popular workplace chat app, will release its first earnings report as a public company after the market close on Wednesday.

Here are the numbers to watch for the company’s fiscal second quarter:

- Earnings: Loss of 18 cents per share, excluding certain items, as expected by analysts, according to Refinitiv.

- Revenue: $140.7 million as expected by analysts, according to Refinitiv.

Slack debuted on the New York Stock Exchange in in June through a direct listing, following the path taken by Spotify last year. A few days before its listing, Slack forecast second-quarter revenue of $139 million to $141 million, representing growth of about 52%.

The company’s main competitor is Microsoft, which includes the Teams work chat app in Office 365 business subscriptions. In July, Microsoft released statistics suggesting that Teams is more widely used than Slack.

“We see an equal opportunity for both Slack and Microsoft Teams to grow as alternatives to traditional e-mail and argue a duopoly-like market structure could form around the two most popular messaging-centric platforms at maturity,” KeyBanc Capital Markets analysts led by Brent Bracelin wrote in a note to clients on Aug. 25.

Slack’s uptime — a measure of how frequently the service is operating normally — slipped below 99.9% in June and July, wrote the KeyBanc analysts, who recommend buying the stock. Slack provides customers with credits for future use when uptime is below 99.99%. Those credits can impact revenue.

For the fiscal third quarter, analysts polled by Refinitiv expect Slack to forecast a loss of 7 cents per share, excluding certain items, on $153.2 million in revenue. Analysts expect a loss of 40 cents for the full year on revenue of $601 million.

Slack shares surged 49% in their debut on June 20 from a reference price of $26 to a close of $38.62. Since then, the stock is down about 20%.

Executives will discuss the results with analysts on a conference call at 5 p.m. Eastern time.

WATCH: MKM says Slack is a buy