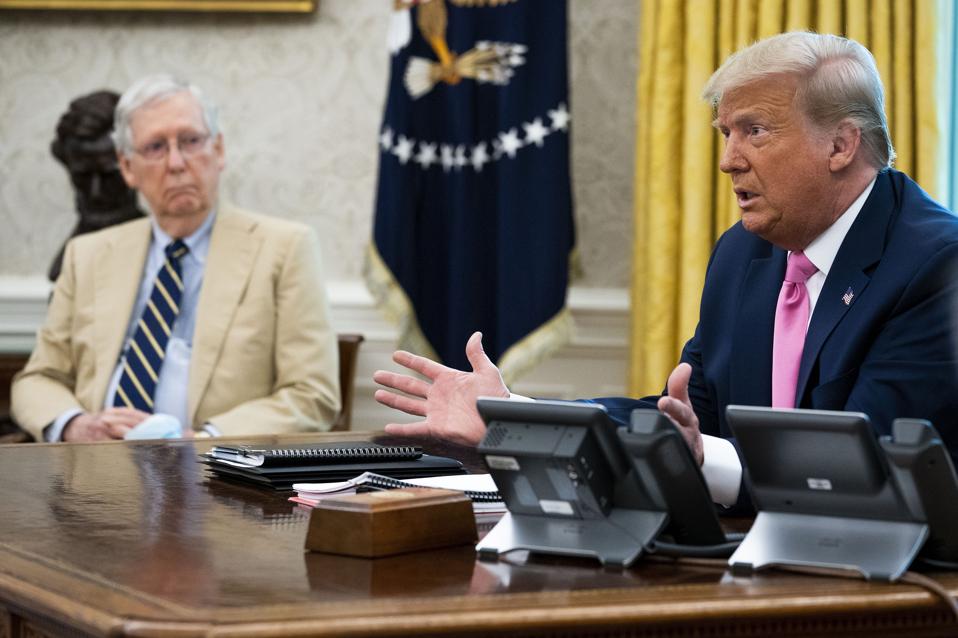

WASHINGTON, DC – JULY 20: Senate Majority Leader Mitch McConnell (R-KY) (L) listens to U.S. … [+]

Getty Images

This afternoon, Senate Finance Committee Chairman Chuck Grassley (R-IA) officially proposed the next stimulus bill, the American Workers, Families, and Employers Assistance Act, which includes a $1,200 stimulus check for individuals who earn up to $75,000. If this sounds familiar, it’s because this is the same limit as the stimulus checks provided under the original CARES Act, passed in March.

The bill is broken into five titles that cover a wide range of emergency relief acts, including:

- Expanded Federal Unemployment Benefits

- Stimulus Checks & Job Creation

- Healthcare Related Provisions

- Additional Flexibility And Accountability For Coronavirus Relief Fund Payments And State Tax Certainty For Employees And Employers

- and more

Here is how the new American Workers, Families, and Employers Assistance Act may impact your pocket book if approved.

Title 1: Further Relief For Workers Affected By Coronavirus

The CARES Act provided a $600 weekly federal unemployment benefit that expired for most unemployed workers this weekend. Replacing the lost benefit is a priority for both parties, however, the Republicans desire to decrease the amount of weekly aid provided by the federal government, with the belief that the $600 weekly benefit served as a disincentive that prevented some unemployed workers from seeking employment.

This new bill will replace the federal unemployment benefit with a lower weekly rate.

- Recipients would receive $600 per week ending on or before July 31, 2020

- Then they would receive $200 per week through October 5th,

- Followed by 70% of the individual’s lost wages or the individual’s base amount (determined prior to any reductions or offsets) through December 31, 2020.

The title includes the following line items:

- Improvements to Federal Pandemic Unemployment Compensation to better match lost wages.

- Supplemental emergency unemployment relief for governmental entities and nonprofit organizations.

- Conforming eligibility for Pandemic Unemployment Assistance to disaster unemployment assistance and accelerating appeal review.

- Improvements to State unemployment systems and strengthening program integrity.

- TANF Coronavirus Emergency Fund

Title 2: Assistance To Individuals, Families And Employers To Reopen The Economy

Title 2 includes three major relief items:

- Relief for Individuals and Families

- Job Creation and Employment

- CARES Act Clarifications and Corrections

Relief for Individuals and Families ($1,200 Stimulus Checks):

This stimulus bill also includes another stimulus check, coming in at the same amount and income limits as the stimulus check under the CARES Act. Like the CARES Act, these stimulus checks are being treated as tax rebates.

Checks are available for $1,200 per qualifying adult ($1,200 for married couples filing jointly). Here are the income limits based on Adjusted Gross Income (AGI):

- $150,000 in the case of a joint return,

- $112,500 in the case of a head of house12 hold, and

- $75,000 in the case of a taxpayer not described in paragraph (1) or (2).

Like the CARES Act, there is an additional $500 per qualifying dependent.

You can use this stimulus check calculator from Forbes to see how much you may receive for the second stimulus check.

Job Creation and Employment:

This provision includes tax breaks for businesses, including an enhanced employee hiring and retention payroll tax credit, an expansion of the work opportunity credit, a safe and healthy workplace tax credit, and COVID–19 assistance provided to independent contractors.

CARES Act Clarifications and Corrections

This section of the bill includes updates, corrections, and special rules for pension plans, clarification of delays in payments of Required Minimum Distributions, rules for certifying eligibility for increased retirement plan loans from the CARES Act, and additional updates.

Title 3: Supporting Patients, Providers, Older Americans, And Foster Youth In Responding To Covid–19

Title 3 covers health care related provisions, including:

- Promoting Access to Care and Services

- Emergency Support and COVID–19 Protection for Nursing Homes

Title 4: Additional Flexibility And Accountability For Coronavirus Relief Fund Payments And State Tax Certainty For Employees And Employers

Title 4 covers the following line items:

- Expansion of allowable use of Coronavirus Relief Fund payments by States and Tribal and Local Governments.

- Accountability for the disbursement and use of State or government relief payments.

- State tax certainty for employers and employees.

Title 5: Emergency Designation

- The Emergency Designation is a legal procedure designating the bill as necessary

This is a developing story.

Related: