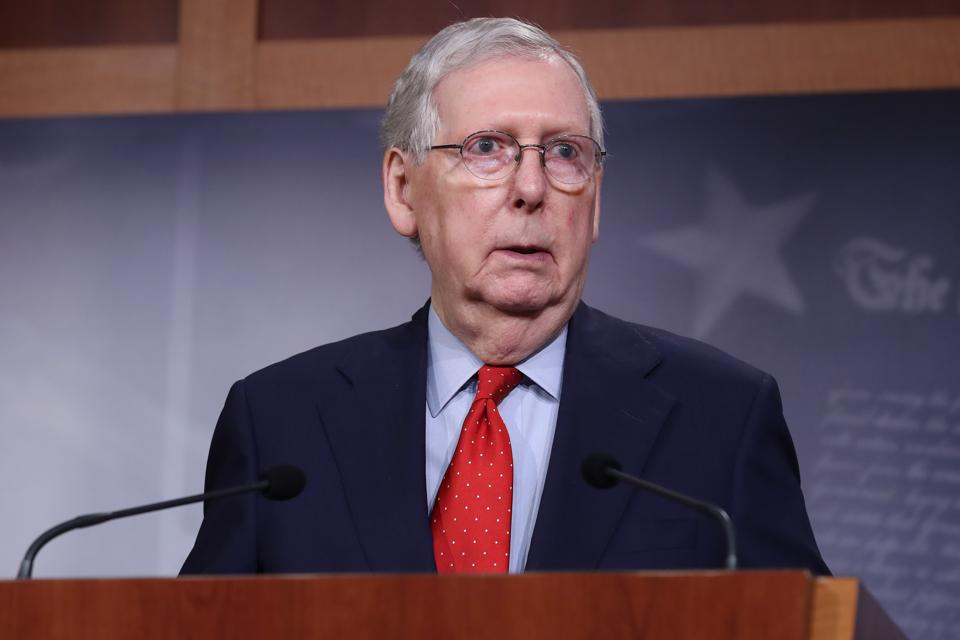

WASHINGTON, DC – APRIL 21: Senate Majority Leader Mitch McConnell (R-KY) speaks during a news … [+]

Getty Images

The Senate is due to return next week after its current recess. The next few weeks will be busy as the Senate has a limited window in which to propose and pass a new stimulus bill prior to the August recess, which begins on August 7th.

The Senate has indicated they will not pass the HEROES Act, which is a sprawling $3 trillion bill that was passed by the House. Instead, they have announced they will propose their own stimulus bill, which is widely expected to be the “fourth and final” stimulus bill related to the Covid-19 pandemic. The Senate also hopes to keep the final price tag in the $1 trillion range, which will limit the scope of this bill.

Let’s get up to speed on where things currently stand, what is on the table for the next stimulus bill proposal, and the likelihood of the various line items being passed.

Key Dates:

Congress is working with a compressed timeframe in which to pass another stimulus bill.

- July 20th – August 7th – The Senate is in session

- July 20th – July 31st – The House is in session

- August 3rd – September 8th – The House is in recess

- August 10 – September 7th – The Senate is in recess

The Senate and the House must agree on a bill by July 31st in order to get a bill to President Trump before September.

What’s on the Table for the Next Stimulus Bill:

The following items have been mentioned by prominent members of the Senate and other government leaders.

- Stimulus Checks

- Expanded Federal Unemployment Benefits

- Back to Work Bonuses

- Payroll Tax Cuts

- Business Liability Protections

- Additional Items of Interest

Let’s look at each of these in kind.

Stimulus Checks – How Much and Who Will Be Eligible?

The next stimulus bill will most likely include a direct stimulus payment—how much, and who will be eligible are the two big questions we don’t have answers to at this time.

The CARES Act provided a $1,200 stimulus payment to eligible workers and a $500 payment for dependents ages 16 and under. Income eligibility was set at $75,000 ($150,000 for married couples). The HEROES Act had similar income limits and also called for a $1,200 check to eligible individuals, and $1,200 for qualified dependents, up to 3 per family, for a maximum of $6,000 per family.

President Trump has gone on record stating that not only does he support a second stimulus check, but he also wants it to be larger than the previous stimulus checks and the checks proposed by the HEROES Act.

However, earlier this week, White House Economic Adviser Larry Kudlow said the next round of stimulus checks could be less than $1,200. He further went on to state that any additional checks would be limited to people in the lower tax brackets and to people who are unemployed.

Last week, Senate Majority Leader Mitch McConnell (R-KY) stated the next round of stimulus checks may be limited to those with an income of $40,000 or less. Later reports have surfaced stating that the income limit may be higher than $40,000.

For now, we will have to wait and see.

Likelihood of a Stimulus Check Being Included in the Next Stimulus Bill:

The likelihood of another stimulus check being included in the next bill is high. But we don’t have any additional information regarding how much the check will be, or who will be eligible.

We have to remember that the Senate can propose the next bill, but it still needs to be passed by the Democrat-led House of Representatives as well. And the House may push back on either the amount of the stimulus check, the income limits for those who are eligible for the check, or both.

When We Might See a Second Stimulus Check:

If a bill is passed in the upcoming session, it may be possible to send out stimulus checks by the end of August or early September. If no bill is passed during the upcoming session, we may need to wait until late September or early October.

Expanded Federal Unemployment Benefits

The CARES Act included a weekly $600 federal unemployment payment on top of state unemployment benefits in addition to state unemployment benefits. This is due to expire at the end of July. This payment has provided a lifeline for millions of unemployed workers, however, it has also been controversial because some unemployed workers actually receive more money from unemployment benefits than they did while working.

Several prominent Senators have called for an end to this benefit based on the belief that it disincentivizes people to return to work. However, there is still support for a continuation of this benefit in some form.

Likelihood of Expanded Unemployment Benefits Being Included in the Next Stimulus Bill:

Expanded federal unemployment benefits are likely to be included in the stimulus bill, however, it is probable the amount will be decreased from $600 per week to a lesser amount, such as $200 – $400 per week.

Back to Work Bonuses

Many Republicans see the expanded unemployment benefits as a disincentive to go back to work. They have proposed two separate “Back to Work Bonus” proposals as an alternative to extending federal unemployment benefits.

The idea is to provide those who return to work with a short term cash bonus on top of their job income. One proposal calls for a short-term $450 weekly bonus and the other calls for two $600 bonus checks.

Likelihood of Back to Work Bonuses Being Included in the Next Stimulus Bill:

While some people do earn more from unemployment benefits than they earn from working, not everyone is unemployed by choice. Rewarding those who are fortunate enough to return to work while not extending federal unemployment benefits wouldn’t send the right message to the general population. A Back to Work Bonus is possible, but extending the federal unemployment benefits at a lower rate would be an easier and cleaner solution than providing a Back to Work Bonus.

Payroll Tax Cuts

Payroll tax cuts have been mentioned by President Trump for several months now, and have the support of Larry Kudlow, the National Economic Council chief, and several prominent Senators. Payroll tax cuts work by decreasing or eliminating the federal taxes FICA taxes, which are paid into Social Security and Medicare.

Together, these taxes make up 7.65% of a typical employee’s payroll.

- 6.2% for Social Security taxes for salaries up to $137,700, and

- 1.45% for Medicare taxes for salaries up to $200,000; salaries above that level pay an additional 0.90% Additional Medicare Tax.

Employers pay a matching amount. Self-employed individuals pay both parts of this tax.

Both workers and employers would benefit from a payroll tax. In theory, this would put more money in worker’s pockets, allowing them to potentially spend the extra money. And the additional savings could potentially make it easier for business owners to make payroll and keep their businesses operational.

Likelihood of Payroll Tax Cuts Being Included in the Next Stimulus Bill:

This has the potential to be a major sticking point in the next bill. President Trump has threatened to veto the next stimulus bill if it doesn’t include a payroll tax waiver.

On the other hand, Speaker of the House Nancy Pelosi (D-CA) has gone on record stating she is not OK with a payroll tax cut being included in the next stimulus bill.

It’s too early to say whether this will or will not be included in the next bill. But we can say this will be a highly contested issue.

Business Liability Protections

This topic hasn’t received as much attention in the press as topics such as stimulus checks and unemployment benefits. However, it is another potential sticking point that could hold up an agreement between the Senate and the House.

Senate Majority Leader Mitch McConnell (R-KY) is pushing for a five-year liability shield to protect businesses from coronavirus-related lawsuits. The

Last week, Senator McConnell stated that, “No bill will pass the Senate without, liability protection for everyone related to the coronavirus.”

Unfortunately, this is not a priority for the Democrat-controlled House. It is likely they will ask for concessions in return.

Likelihood of Business Liability Protections Being Included in the Next Stimulus Bill:

This stands a chance of being passed, but it isn’t automatic. Expect this to be a point of contention that may require quid pro quo in order to make it through to the President’s desk.

Additional Items of Interest

The CARES Act included provisions for student loan deferments through September 30th for loans held by the U.S. Department of Education and a federal eviction moratorium through Jully 31st for qualifying FHA-insured and HUD multifamily properties. It is likely these topics will be addressed in the next bill, as they are both expiring soon.

Senator McConnell stated in an interview that the bill should also include provisions for “kids, jobs and health care,” while the Democratic party would like to see additional financial assistance for state and local governments. Treasury Secretary Steven Mnuchin has recommended providing targeted funding for industries that have been the hardest hit, small business owners and lower-income families.

This is Likely to be the Last Stimulus Bill—There is Pressure to Make it Count

Millions of Americans are struggling. Coronavirus numbers are rising. Many states are rolling back their reopening plans. There are a lot of competing priorities, limited funds, and a limited amount of time to make things work. To top it off, it’s an election year.

There is a lot riding on this bill and there is an immense amount of pressure to make sure it’s done right. There may not be another one this year.

Stay tuned for more updates.

Additional Resources: