Finnish satellite imagery venture ICEYE brought in new funds, the company announced on Thursday, as it looks to add to its spacecraft fleet in orbit and build out its growing natural catastrophe detection product line.

ICEYE closed an $136 million round of venture capital fundraising, led by U.K. fund Seraphim Space, bringing its total funding to date to $304 million since its founding in 2015.

“This financing has really been built around the further growth of the natural catastrophe product line,” ICEYE CEO co-founder and CEO Rafal Modrzewski told CNBC, adding that “flood monitoring is really the prime product right now … [but] we want to cover wildfire, we want to cover wind, we want to cover hail.”

Modrzewski declined to specify ICEYE’s new valuation after the fundraise, but said the increase “was comparable to the previous rounds” and that the company is “very pleased” with its growth. According to Pitchbook, ICEYE’s previous fundraise put its valuation at about $320 million – and maintaining its valuation growth rate historically would place ICEYE’s new valuation at over $1 billion.

A host of prior investors contributed in ICEYE’s latest round – including Molten Ventures, OTB Ventures, True Ventures, C16 Ventures, Space Capital, Chione, Services Group of America, and the U.K.’s National Security Strategic Investment Fund – as well as two ICEYE customers, BAE Systems and Promus Ventures.

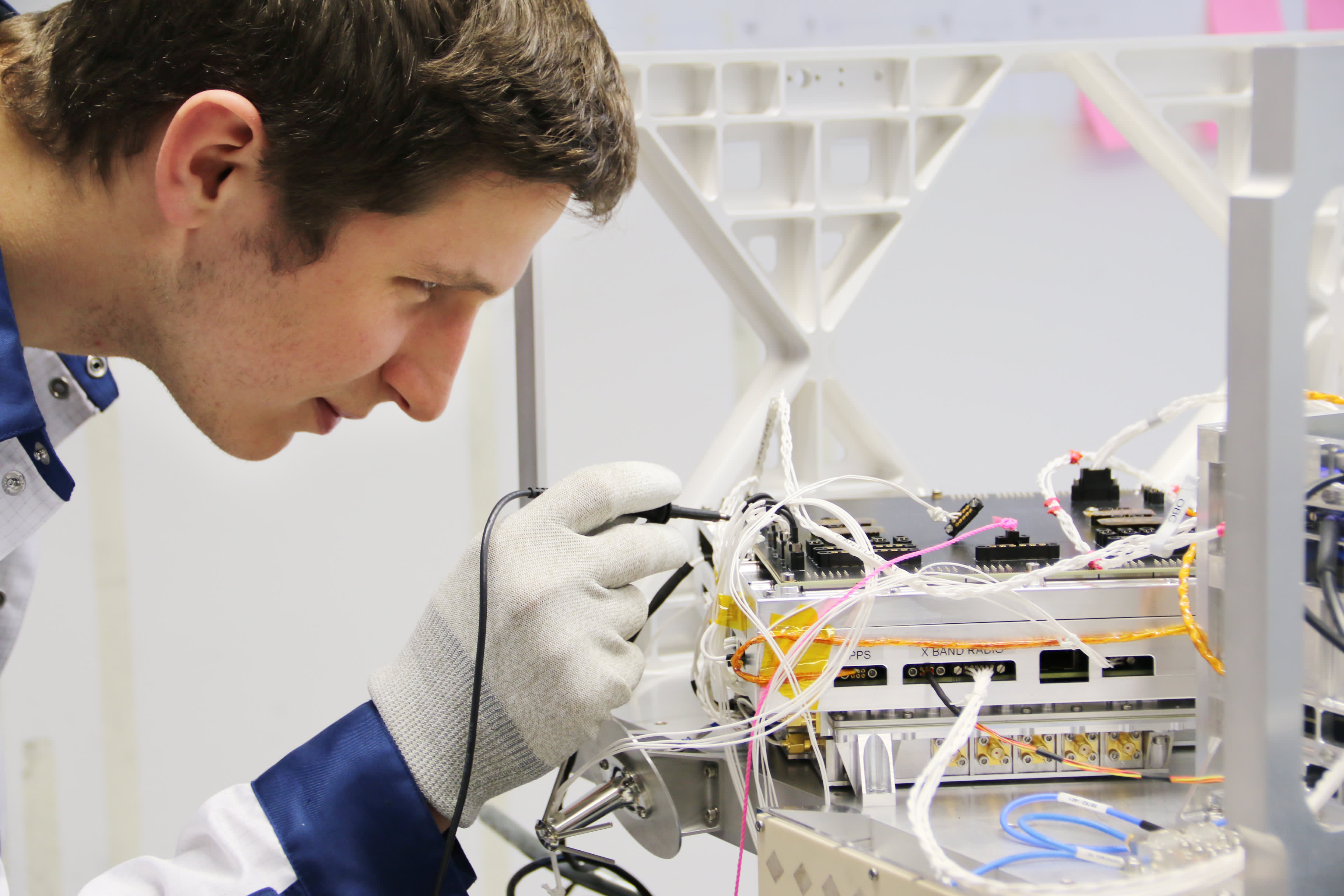

The company’s business is based upon combining a special type of imagery, called synthetic aperture radar (or SAR), with a form factor the size of a suitcase – reducing the cost of launching multiple satellites to create a network that can image places on Earth multiple times a day. SAR satellites are able to capture images of the surface at night and through clouds, a key advantage over traditional imaging satellites.

ICEYE has deployed 16 satellites in orbit to date, and the company plans to use the new funds to help launch as many as 10 more satellites in 2022.

The growth of its fleet in orbit is crucial to ICEYE expanding its “Nature Catastrophe (NatCat) Insights and Solutions” product line, as having more satellites allows the company to visit points of interest more frequently.

Modrzewski said the company’s largest customer groups for the NatCat unit are governments and insurance.

“We see huge investments from entities like FEMA or the European Space Agency to understand floods better and to respond quicker,” Modrzewski said. “But we also see a massive initiative coming from within the insurance industry – to bring new technology, given what’s happening to the climate.”

ICEYE is based in Helsinki, Finland but has quickly established a U.S. presence in the past year with a manufacturing facility in Southern California. The company launched its first U.S. built satellite in late 2021, and last month received a study contract from the National Reconnaissance Office. The NRO in many ways is the anchor customer of the U.S. Earth intelligence market, with ICEYE now able to compete against other companies for future bids.

For now, ICEYE does not have a timeline to go public, which Modrzewski called “a huge decision.” He does not think ICEYE will go public in a year or two, but added that the company “would like to have that option within that period of time.”