It’s a good time for a Roth conversion.

getty

By now, many have heard about Roth IRAs and how Roths allow tax-free growth. Often, we fail to consider the huge opportunity to accumulate wealth by the combination of the lack of RMDs and the long-term compounding opportunities presented by a Roth. Roth IRAs can allow tax-free accumulations throughout the lifespan of a married couple and then ten years beyond that. The elimination of tax friction and the massive time advantage is key to building longer-term wealth.

Simple 2020 Roth conversion. Let’s start with a simple example of Marsha and Tom. Marsha is a retired teacher; Tom is retired from a chemical company and they have regular traditional rollover IRAs worth about $1,150,000. Marsha and Tom are both 72 and in decent health. For 2020, Tom and Marsha chose not to take their Required Minimum Distribution (RMD) since the CARES Act suspended the RMD requirement for 2020. They used the $45,000 they would have taken as an RMD to make a Roth conversion. Here’s what could happen if at least one of them lived to age 90, they made 6.50%, and they left it to their kids:

Roth IRA vs. Traditional IRA – Comparison 1

Leon LaBrecque

If our couple spent the RMDs generated by the $45,000, they would have received cumulative RMDs of $58,066 with a remaining balance of $52,905 to leave their kids, versus $139,799 in the Roth. The kids in turn would have to pay taxes on the distribution of that balance, which would net them $61,975 after 10 years, versus $262,426 in the Roth. Of course, we need to account for the taxes on the Roth conversion, so the opportunity cost is this scenario is about $24,567. If we want to make a more precise comparison, suppose the couple and their kids scrupulously invested every RMD from the traditional IRA, they would have $211,628, versus the net value of $237,856. It’s worth noting that the life expectancy tables for RMD change in 2022, and we’ve incorporated that change into our analysis. Now let’s move some dials.

Time matters: convert earlier. The massive value of the Roth lies in the compounding value. Let’s suppose Joel and Debbie converted $45,000 at age 62. What would happen then?

Roth IRA vs. Traditional IRA – Comparison 2

Leon LaBrecque

MORE FOR YOU

A more dramatic difference. The one-time $45,000 Roth conversion by a 62-year-old couple who lives to 90 and leaves it to children for an additional 10 years turns into $450,927.

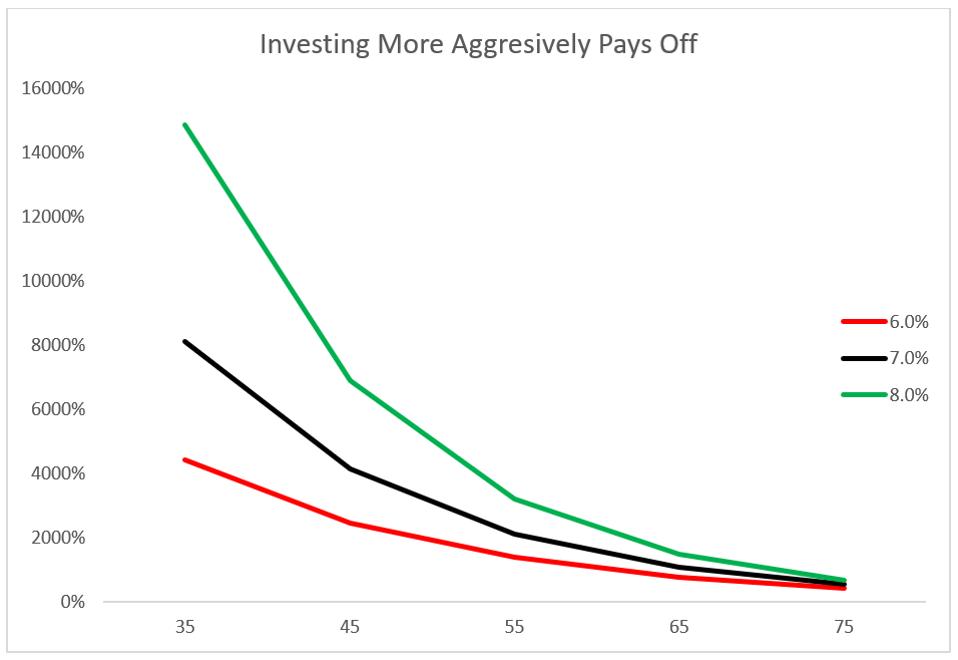

Return, the Force Multiplier. So far, all examples have used the same return assumption for the traditional IRA and the Roth. Some commentators (present company included) think that Roth assets can be invested more aggressively, since they are not required to be distributed until 10 years after the death of the last spouse. Given a longer time horizon, volatility reduction becomes less important than return, although it may increase discomfort. Here is the difference of return on Roth dollars to age 100 (think IRA owner life ends at age 90 and heirs leave the balance in the Roth for 10 years) for different rates of return:

An illustration of the affects of investing more aggressively with a Roth IRA at different rates of … [+]

Leon LaBrecque

Merely adding 2% by using a more aggressive allocation to get 8% versus 6% quadruples the return to a 35-year-old. Because of the way compound interest works, small changes in return multiply exponentially. For example, for a 65-year-old doing a Roth conversion of $50,000, getting 7% versus 6% (which may mean a 10% increased tilt to equities in asset allocation) would generate about $149,500 more funds to the heirs. Getting a 2% boost (perhaps increasing equity exposure by 20%) almost doubles the value of the Roth over 35 years, from about $384,000 at 6% to about $739,000 at 8%. The power of compounding is not to be trifled with.

If you want to see the long term return difference on different portfolios, there’s a good Vanguard study from 1926 to 2019 here.

Bottom Line: Roth IRAs are intuitively good, but we can see that the math clearly shows a powerful benefit to the Roth conversion, due to regulatory differences and the enormous power of compounding. My suggestion is to convert sooner rather than later, as the expanded time horizon allows more time for assets to compound. Also consider investing the Roth IRA more aggressively than other assets. The potential for increased returns magnifies the compounding affect, thus creating the opportunity to leave a larger legacy. It’s a good idea to consider a Roth conversion for your arsenal of planning tools. If you want more information, download our free e-book on IRAs, updated to 2020. As always. I’ll try to answer questions at llabrecque@sequoia-fiancial.com.