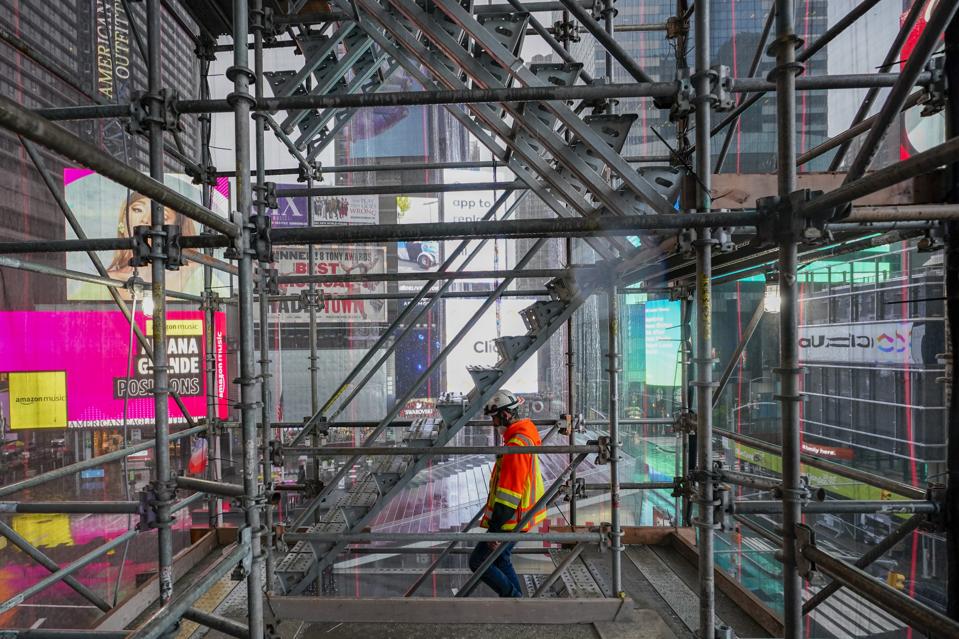

One construction worker using a staircase in the scaffolding of TSX Broadway on October 29, 2020 (AP … [+]

ASSOCIATED PRESS

Although many tourists are not coming to New York during the COVID-19 pandemic, foreigners still have their sights set on Broadway.

According to a recent court filing, the real estate developers planning to lift the Palace Theatre 29-feet above street level as part of a massive redevelopment project have secured over $100 million from foreign investors. The additional funding comes through the EB-5 visa program, which offers foreigners an American green card in exchange for $500,000 investments.

“The project continues to elicit excitement from investors, and we are pleased to have the flexibility to raise additional capital and develop an even more dynamic and valuable property for all of our stakeholders,” stated David Orowitz, a managing director at L&L Holding Company, which is one of the lead partners of the project with Maefield Development and Fortress Investment Group.

According to the blueprints for the $2.5 billion project, hoisting up the historic Broadway house will unlock 70,000 square feet of lucrative retail space. “To create retail space on four levels in the busiest place in New York, Times Square, is brilliant,” said Stewart F. Lane, the co-owner of the Palace Theatre with the Nederlander Organization, in an earlier interview.

Lifting jacks were installed underneath the Palace Theatre in October, and it is now set to be raised during the second quarter of 2021. The process is expected to take two weeks, and the key is “to go so slowly so the theater doesn’t know it’s moving,” explained Tony Mazzo, who helped move the Empire Theatre across 42nd Street in 1998.

But, “there is a lot more coming to this than just elevating the theater,” commented Lane.

As a part of the redevelopment project, the Palace Theatre will be renovated to include a larger lobby, twice as many bathrooms, and more wing space to accommodate larger Broadway shows “You’re going to get a brand-new 21st century theater there with the original interior of the theater that was built in 1913,” Lane said.

MORE FOR YOU

However, the American dream of building a Broadway theater in exchange for a green card turned into a nightmare for some foreign investors.

After Maefield Development decided to buy out its partners at 20 Times Square across the street in 2018, people who had invested in the project through the EB-5 visa program were given an option to move their money to either Maefield Development’s Palace Theatre project or a bank account. However, under the program, investments must remain “at risk” for two years after filing the initial paperwork, and stashing the cash in a bank account would not be considered to be “at risk,” meaning that the foreigners would no longer be eligible to receive a green card. Over 120 Chinese investors filed a lawsuit, alleging that the proposal forced them to “recapitalize its faltering [Palace Theatre] project, as to which construction has been lagging for lack of adequate financing from major financial institutions and banks for the past two years.”

Zoe Ma, a real estate developer working with a lawyer for the Chinese investors, complained that the Palace Theatre project is an “abyss” that will be a “bloodbath for investors.”

Although some lawsuits linger behind the scenes, the ambitious project nicknamed “TSX Broadway” is scheduled to be completed in 2023. In addition to the retail space and renovated Broadway theater, it is expected to include 30,000 square feet of dining space, a 669-room hotel, and a concert stage hanging over Times Square.

“TSX Broadway represents the impact of the EB-5 Program, which has proven to fulfill the American Dream for thousands of families,” stated Nicholas Mastroianni II, the president of the U.S. Immigration Fund, which helped line up the foreign funding. “This type of EB-5 financing provides an additional source of capital, and TSX Broadway is a prime example of how foreign investment is helping to create jobs and shape the future of our cities,” he said.