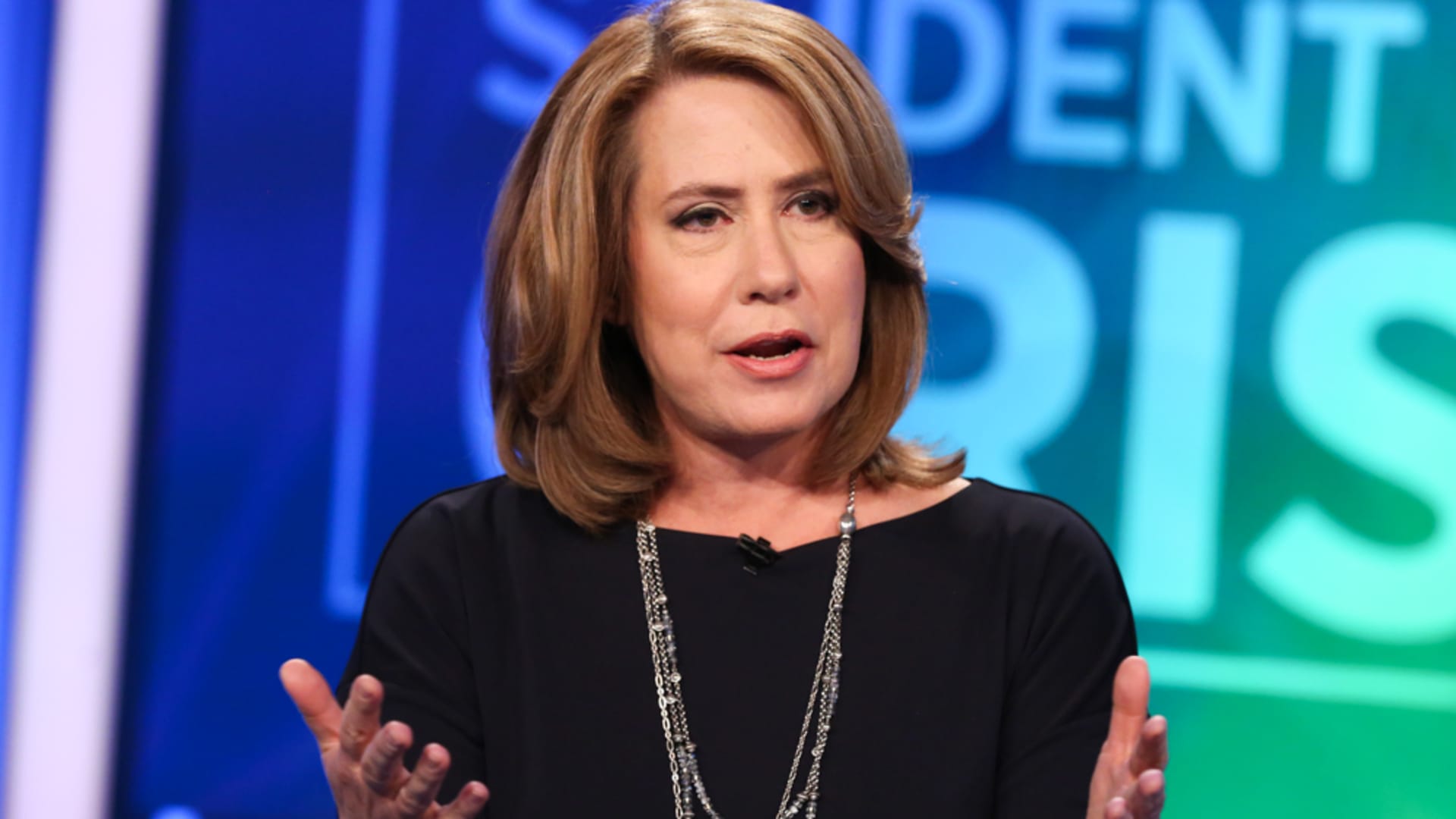

Regional bank earnings may expose critical weaknesses, according to Sheila Bair, former chair of the U.S. Federal Deposit Insurance Corp.

Their quarterly numbers begin hitting Wall Street this week.

“I’m worried about a handful of them,” Bair told CNBC’s “Fast Money” on Tuesday. “I think some of them are still overly reliant on industry deposits, have a lot of concentrated commercial real estate exposure, and then I think the larger picture really is the potential instability of their uninsured deposits even for the healthy ones if we have another bank failure.”

Bair, who ran the FDIC during the 2008 financial crisis, is nervous that regional bank issues from 2023 aren’t fully resolved.

“Congress should reinstate the FDIC’s transaction account guarantee authority so that they can stabilize those deposits,” she said. “This is still a problem for the regional banks, and fingers crossed that there’s [not] another failure. We’re just not quite sure what’s going to happen.”

Regional banks are having a tough year so far. The SPDR S&P Regional Bank ETF (KRE) is down almost 13%, and only four of its members are positive for 2024.

The ETF’s biggest laggard is New York Community Bancorp which has tumbled more than 71% this year. Metropolitan Bank Holding Corp, Kearny Financial, Columbia Banking System and Valley National Bancorp are down more than 30% in that time period.

“The big issue is whether there is another shock to uninsured deposits because of a bank failure, and I think that is really the biggest challenge confronting regional banks right now,” she said.

Her latest regional bank warning comes as the benchmark 10-year Treasury note yield topped 4.6% this week and hit its highest level since November 2023.

Bair is concerned higher yields could put more stress on commercial real estate borrowers, and regional banks have a lot of exposure.

“Part of the problem in commercial real estate is that a lot of it is refinancing this year and next,” said Bair.

“So, the higher the rates go for those refinancings, the more distress there will be with borrowers to be able to continue with their payments.”

However, regional banks’ issues could bring more business to larger institutions.

“Regional bank distress benefits the big money center banks. There’s no doubt in my mind,” Bair said.