Roth IRA vs Traditional IRA

Getty

The year 2020 is one of the most eventful in recent times, and changes to the rules that govern retirement accounts are no exception. One of these changes is the waiver of required minimum distributions (RMDs) for 2020. As a result of this waiver, you are not required to take RMDs from your IRA for 2020. But if you are of RMD age in 2021, you must resume RMDs for 2021 and continue for every year after. RMDs were waived for beneficiary IRAs as well and will need to resume in 2021 for certain beneficiaries.

Reminder: RMDs do not apply to Roth IRA owners.

RMDs- A Mild Refresher

An RMD is a minimum amount that you must distribute (or withdraw) from your retirement account for any RMD year. You can always distribute more if you want to; however, a distribution of less than your RMD amount will result in you owing the IRS an excess accumulation penalty of 50% of the RMD shortfall. For example, if your RMD for 2021 is $20,000 and your 2021 IRA distributions total only $12,000, you will owe the IRS an excess accumulation penalty of $4,000 [($20,000 – $12,000) x 50%].

If you are required to take an RMD for 2021, your IRA custodian will send you an RMD notice by January 31, 2021. This will include your calculated RMD amount or an offer to calculate the amount upon request.

New RMD Age- A Reminder

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, a new law passed in 2019, increased the RMD beginning age for IRA owners from age 70 ½ to age 72. As a result of this change, any IRA owner who reached age 70 ½ by December 31, 2019 – those born June 30, 1949, or earlier – must begin taking RMDs for the year he or she reaches age 70 ½ and continue for every year thereafter (except for 2020- where RMDs are waived). IRA owners who reach age 70 ½ after December 31, 2019, must begin RMDs for the year they reach age 72.

MORE FOR YOU

You Must Take an RMD For 2021 If…

Whether you must take an RMD from your IRA for 2021 depends on factors that include whether it is your own IRA and your age in 2021, or if it is a beneficiary IRA, and if so, when the IRA was inherited.

Your own IRAs: For 2021, you must take an RMD from your own (non-beneficiary) IRA for 2021 if you were 70 ½ or older on December 31, 2019, as would have already started your RMDs and are required to continue. And, you would be required to take an RMD for 2021 if you were born at any time in 1949 or earlier, as this means that you would be at least age 72 on December 31, 2021.

If you were born 1950 and after, you would not be subject to RMDs for 2021 because you would not have reached age 70 ½ by December 31, 2019 and you would be under age 72 as of December 31, 2021.

Your beneficiary IRAs- including beneficiary Roth IRAs: For beneficiary IRAs, whether you must take an RMD for 2021 depends on several factors, which starts with when you inherited the IRA.

A. If you inherited the IRA before 2020: If you inherited the IRA before 2020- including a Roth IRA, you must take an RMD for 2021 if:

· Your beneficiary IRA must be distributed within five years (the 5-year rule), and the IRA was inherited in 2015. This is because 2020 was not counted due to the RMD waiver, making 2021 year 5 of the 5-year period.

1. 2016

2. 2017

3. 2018

4. 2019

5. 2021

Under the 5-year rule, distributions are optional until the end of the 5th year that follows the year the IRA owner died, at which time the entire account must be distributed.

· Your distributions are taken under the life-expectancy rule. Under this option, you must take a beneficiary RMD for every year that follows the year in which the IRA owner died (except for 2020).

Please note: If you are the surviving spouse of the IRA owner, exceptions could apply. For example, if the IRA owner would have reached age 70 ½ after 2021, you would not need to start RMDs until the year your spouse would have reached age 70 ½. Also, the owner rules above would apply if the spouse beneficiary elects to move the assets to his or her own IRA.

B. If you inherited the IRA in 2020: If you inherited the IRA in 2020- including a Roth IRA, you must take an RMD for 2021 if you are an eligible designated beneficiary, and you are taking distributions over your life expectancy. You are an eligible designated beneficiary if:

a. You are the surviving spouse of the IRA owner. But, the owner rules above apply if you elect to treat the IRA as your own, instead of electing the beneficiary IRA option.

b. You are disabled

c. You are chronically ill

d. You are a minor, as defined under state law

e. You are none of the above, but you are not more than 10-years younger than the IRA owner.

In other cases, distributions for 2021 are optional.

Spouse beneficiary caveat: If you are the surviving spouse of the IRA owner and you elect to keep the funds in a beneficiary IRA, you would not need to take RMDs for 2021, if your spouse would reach age 72 in a later year.

New Rules for 2022 And After

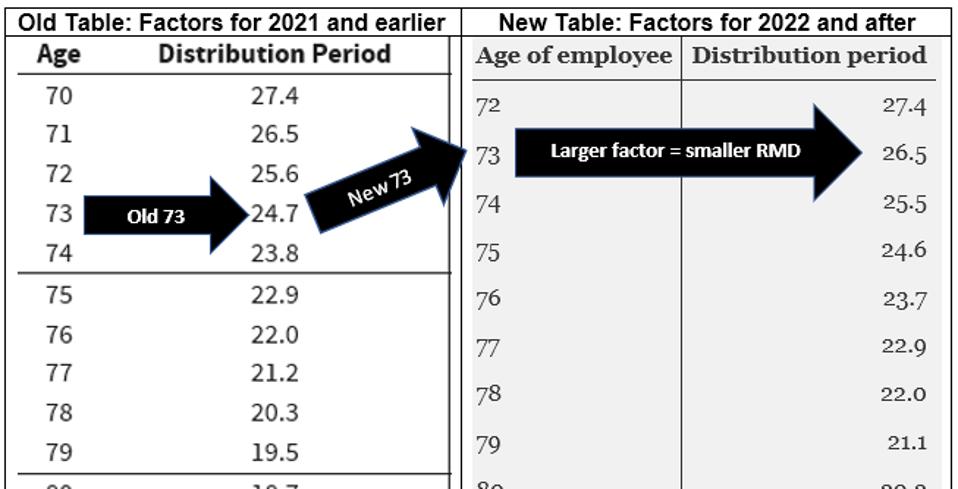

Your RMD for a year is determined by your distribution factor- which is based on your age as of the end of the RMD year, and the fair market value of your IRA balance for the preceding year. For example, assume that you will be age 72 as of December 31, 2021 and the fair market value of your traditional IRA as of December 31, 2020 is $500,000. Your distribution factor would be 25.6 (see table below) and your RMD for 2021 would be $19,531.25 ($500,000/ 25.6).

Effective for distributions made after 2021, a new table must be used, resulting in smaller RMD amounts. Under the new table, your RMD- if you reach age 73 in 2022 would be $18,867.92 assuming a December 31, 2021 fair market value of $500,000 ($500,000/26.5)-; but would have been $20,242.91 ($500,000/24.7) if the old table was still in effect. This results in a difference of $1,375 remaining in your IRA and excluded from your income.

Change in RMD Tables and the effects

www.DeniseAppleby.com

Professional Assistance Helps To Avoid Penalties

The rules explained above are very high-level professional assistance is often needed to ensure that any caveats are properly applied- thus avoiding any risk of IRS penalties. For instance, consider that your IRA custodian is permitted to make assumptions that could cause your RMD calculations to be incorrect. Therefore, even though your IRA custodian will calculate RMDs for your IRAs, it is still practical to have a professional review those calculations.

Additionally, you might need to take RMDs from accounts under employer plans- such as 401(k) and 403(b) plans. If you have assets under an employer plan, contact the plan administrator or your HR department regarding their RMD policies- to determine if they will automatically distribute your RMDs or if you are required to submit RMD instructions. If you plan to roll over amounts from these accounts, consult with your advisor to help to ensure that RMD amounts are not included in any rollover.