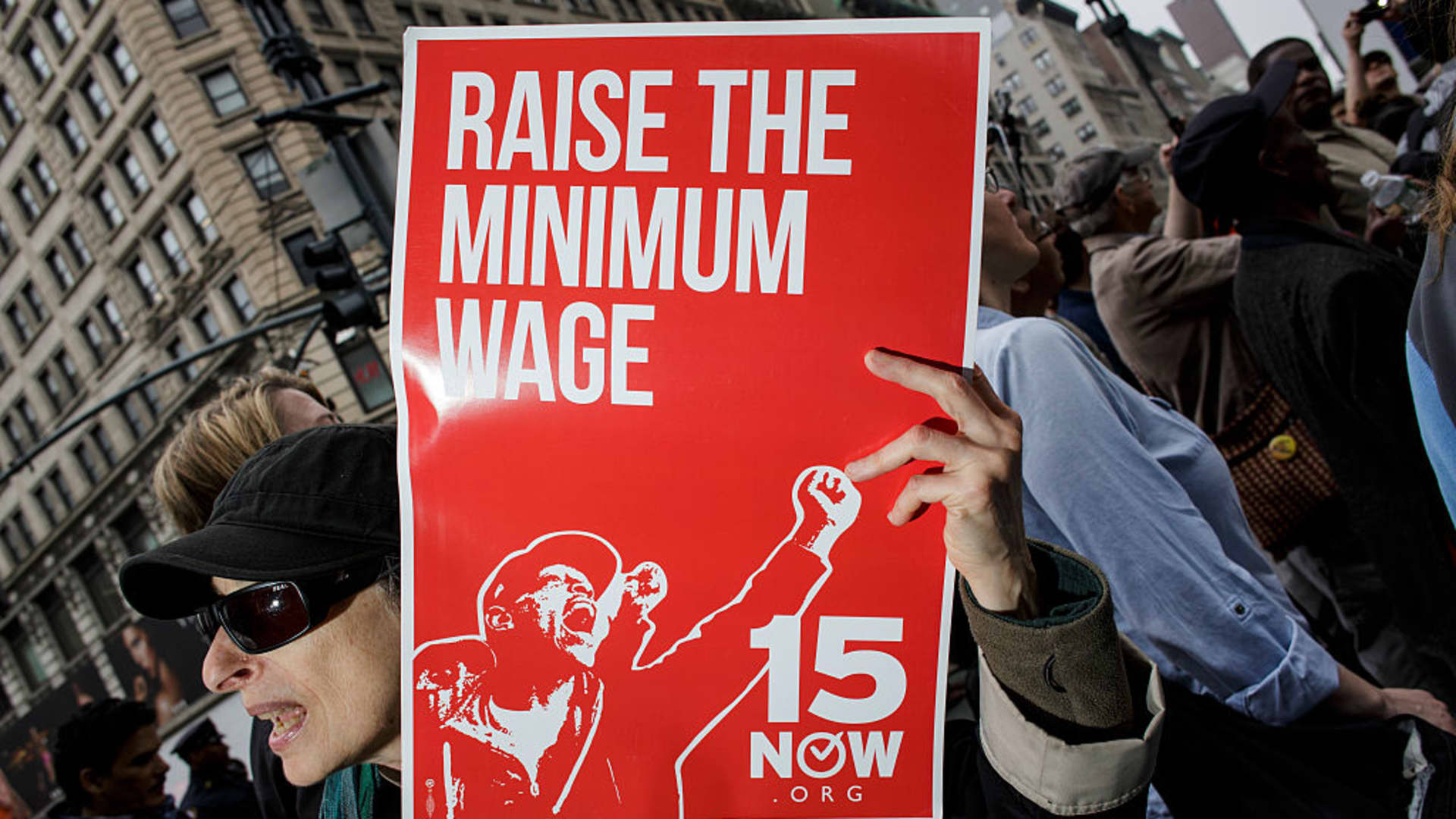

The Biden administration seems to have pegged a student loan policy announced Wednesday to its broader push for a national $15-an-hour minimum wage.

The White House detailed a long-awaited plan to forgive up to $20,000 in federal student debt for borrowers, and extended a payment pause through the end of 2022.

But tucked into the broader package of policy measures were tweaks to “income-driven repayment plans.” These plans help make monthly payments more affordable for low-income borrowers.

The administration linked one of those tweaks — specifically, one relative to a definition of “non-discretionary” income — to a $15 minimum wage.

President Biden and many Democrats have called for a $15 hourly wage floor across the U.S. The policy was scrapped as part of negotiations around a social spending package in 2021, and hasn’t yet mustered enough support for passage in Congress. Biden in January issued an executive order for federal workers and employees of federal contractors to receive a $15 minimum wage.

The current federal minimum wage is $7.25 an hour and has remained unchanged since 2009.

“It’s another way of continuing to push the idea that $15 should be the minimum wage,” Abigail Seldin, CEO of the Seldin/Haring-Smith Foundation said of the new policy.

Seldin was a former candidate to oversee student loans for the Biden administration.

The White House and U.S. Education Department didn’t respond to a request for comment.

More from Personal Finance:

How to get a student loan refund and boost forgiveness

What to know about Biden’s student loan forgiveness plan

How to know if you have a Pell Grant for student loan forgiveness

How student debt ties to a $15 minimum wage

“Non-discretionary” income is basically the income a household funnels into essentials like rent, mortgage payments and food.

For borrowers in income-driven plans, the government protects their non-discretionary income by exempting it from repayment. The amount is based on household annual income relative to the federal poverty line.

Under current rules, a borrower with income of less than 150% of the federal poverty level qualifies for a $0 monthly loan payment. In 2022, that equates to roughly $20,385 before tax for a single individual — about $9.80 an hour for a full-time worker.

President Biden proposed raising that threshold to 225% of the federal poverty level — about $30,577.50 of annual income, or $14.70 an hour.

The policy guarantees that “no borrower earning under 225% of the federal poverty level — about the annual equivalent of a $15 minimum wage for a single borrower — will have to make a monthly payment,” according to the U.S. Department of Education.

The policy — which applies to undergraduate student loans — means more borrowers in income-driven plans would qualify for a $0 monthly payment or owe a smaller monthly bill, according to student loan experts.

“These changes make things more affordable for borrowers and allow borrowers to avoid default,” according to Whitney Barkley-Denney, senior policy counsel at the Center for Responsible Lending.

Other changes to income-driven repayment plans

The administration also simultaneously announced other reforms to income-driven plans.

None of the measures are final yet. The Education Department is proposing regulations “in the coming days,” the agency said Wednesday. The public will have a 30-day window in which it can comment on the proposal, and then the Department would then use those comments to craft a final rule, which could differ from the proposal.

In addition to the higher “non-discretionary” income threshold, monthly payments for borrowers would be capped at 5% of income; that’d be half the current 10% cap.

It’s another way of continuing to push the idea that $15 should be the minimum wage.Abigail SeldinCEO of the Seldin/Haring-Smith Foundation

Barkley-Denney offered an example of how this would work for a one-person household:

Let’s say a borrower has an income of $60,000 in 2022. As noted above, the first $30,577.50 would be considered “non-discretionary” and therefore protected from repayment. The remaining $29,422.50 would be “discretionary” and used to calculate the borrower’s monthly payment.

The new rules would cap those payments at 5% of discretionary income — roughly $123 a month versus $245 a month under the current 10% maximum.

In addition, borrowers with original loan balances of $12,000 or less would have their debt erased after 10 years of consistent payments (even if that payment is $0 a month). That timeline is currently 20 years.

And interest won’t accrue on loans if borrowers make consistent monthly payments — meaning their balances won’t grow, unlike the dynamic with current income-driven repayment plans.

If these proposals survive as written, the reforms would be significant since they’d be a permanent fixture of the student-loan system, experts said.

“This is a systemic change,” Seldin said. “Debt forgiveness might be a one-time move.”