Getty

There are few sights more American than a minivan or SUV with a precariously packed car-top carrier on the holiday family journey. You pack your suitcase, you repack the kids’ suitcases, you hope that plastic shell and all its bungee cords will hold, and you head off into the rising sun.

You’re packing list has to account for everything you’ll need. You don’t want to get to bedtime without that favorite blankie or forget to bring socks, so you go back over your list a couple times – just to make sure your luggage meets your needs. You pack one way for an overnight, another way for a two-week trek.

Financial planning is much the same this time of year. You’re wrapping up matters from this year and preparing for the journey of 2020. As you may have learned from stress of those family trips, the more you plan, the better.

Let’s look at a few year-end “packing” tips to help you prepare for 2020. Some of them require action right away and some are simply good to be aware of in the long run. Just make sure everything is in place before you hit the road.

Check It!

These are those items you want to make sure have in place before the year ends. Time-sensitive pieces that should be securely in place this month.

Itemized vs. Standard Deduction

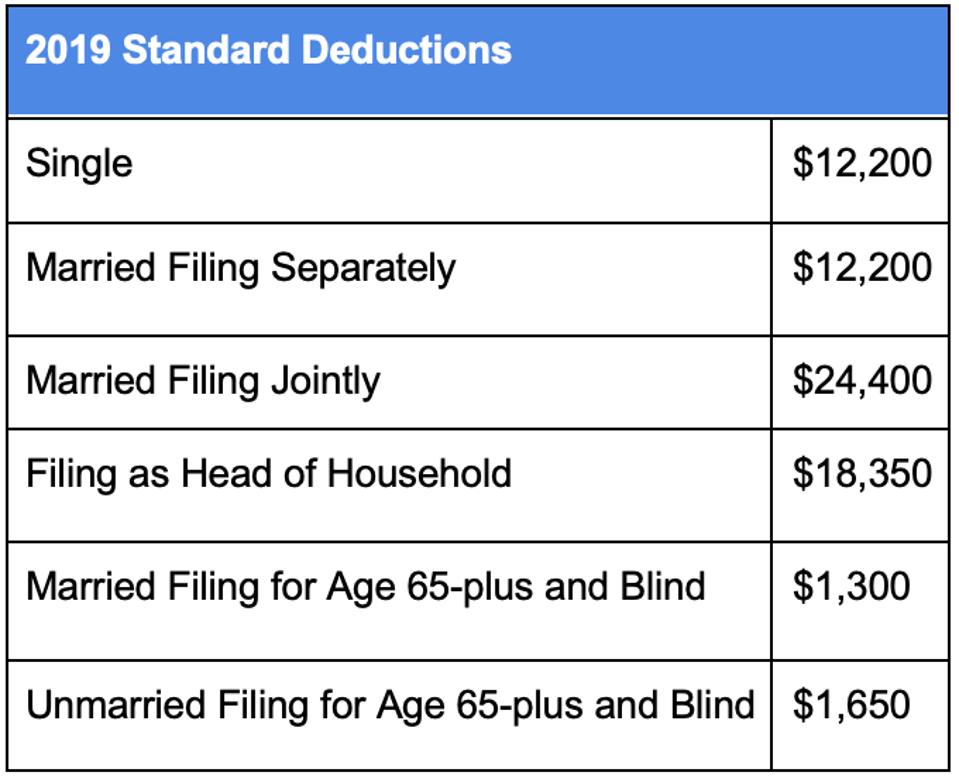

Your federal income taxes have shifted quite a bit since the Tax Cuts and Jobs Act of 2017 (TCJA). Many who took itemized deductions have now gone to a standardized deduction because the TCJA placed those so high.

It’s good to make sure you check the number again. If you bought a new home, had a lot of medical bills or gave a lot to charity, it is possible you now could benefit from itemized deductions. If you were close to the threshold in itemized deductions last year, there’s still a little time to look find more itemized deductions by year’s end.

Carson

These numbers are indexes and are adjusted for inflation each year.

Retirement Plans

Make sure you are maxing out your 401(k) payments and adjust accordingly so you are doing so in 2020. Your employer match, often 3 to 4%, is free money on the table which you should never ignore. If you haven’t maxed out contributions, certain plans allow you to contribute a lump sum before the end of the year – get in touch with your provider for details.

Your 401(k) max for this year is $19,000 with a $6,000 catch-up contribution if you are age 50 and older. When open enrollment time comes, make sure you are maximizing contributions to catch all the interest you can.

Roth IRA Conversions are another powerful tool for growing wealth for your retirement plan. Remember, you are allowed one conversion per year – it can be any size and there are no income limits, but you only get the one annual conversion.

Get in touch with your advisor to arrange your Roth conversion and be prepared for your initial tax bill, just remember that this is setting you up for tax-free growth and withdrawals in the future.

Tax Realities

There are two tax issues to keep in mind as you go up to the attic for those string lights and ornaments. First, be aware of your Required Minimum Distributions (RMDs).

Once you reach 70.5 years old, the government will be looking for the taxes on all that tax-deferred money you put in your 401(k) over the years. The RMD is a distribution of a certain percentage that you are required to take in order to increase your taxable income. These distributions are mandatory and the consequences for not taking them can be severe, so talk with your advisor and plan provider to make sure you’re on track.

The other tax issue at play is tax-loss harvesting, which, explained briefly, means to sell off some of your stocks with gains and sell some off with losses, realizing both. The IRS allows you to offset $3,000 in non-investment income from losses, which you can use to rebalance your portfolio.

Tax Loopholes (P.S. One that Doesn’t Work Anymore)

The end of the year is prime time to make sure your charitable giving is in place. About one-third of charitable giving happens in December, and 12% of all giving happens at the end of the year. With giving and gratitude in the air during the holidays, it’s a good time to take care of this.

Again, the tax landscape has changed dramatically on this. If you’ve been a lifelong giver, itemized deductions have helped you reduce your tax footprint every year. That may have changed with the TCJA raising the standard deduction substantially.

One strategy to realize the tax savings here is to “bundle” or “bunch” your giving for a few years to help you get above the standard-to-itemized threshold. If you have the capital on hand, bundling $10,000 for this year and next, taking you up to $20,000, will get you much closer to tax savings.

A 529 Plan for education savings could give you state tax relief. Federal income tax deductions are not given for these, but state taxes sometimes are depending on where you live. You could save for grandkids college expenses while simultaneously saving in your own taxes.

Finally, mortgage tax relief has changed since the TCJA. Home equity indebtedness is no longer deductible. If you took out a line of credit on your home to pay off something like credit card debt or college education expenses, the interest on that debt is no longer deductible. Make sure you check over what used to be “givens” in a tax plan.

Double-Check It!

There are some items that need to be double-checked, just to make sure they’re still in place. Think of the old hooks and hinges on your car-top carrier that you don’t want falling off at 70 mph!

Estate Planning

Make sure your estate plan is up to date in terms of legal details, current assets and beneficiaries. You don’t want your family scrambling with no plan or working with something written 20 years ago. Your wealth has changed, and so has the law and some of your relationships.

Double-check beneficiaries. There are multiple cases of an ex-spouse receiving someone’s estate because the beneficiary designations hadn’t been refreshed. Also, be careful with leaving assets directly to minor children and consider setting up a trust to direct assets in this case.

Accounts and Assets

Make sure your accounts are set up correctly and fully funded for next year. Remember that your Flexible Savings Account is a “use it or lose it” account every year, so now’s the time to take care of medical needs. Your Health Savings Account will roll over to next year untouched, but make sure you are maximizing contributions ($7,100 for 2020).

Make sure your asset allocation reflects your risk capacity and current market conditions. The market is always moving, so talk with your advisor about a portfolio balance that works for you at this point in your wealth journey.

Think Ahead!

Most of your tax planning needs to be done before the new year kicks off. While there are still a few things you can do up until tax filing time, your options for tax planning become much more limited after the year ends.

So, now is also a good time to think about 2020. This can be broader than just your financial planning goals. Think about your savings goals, investing goals, retirement planning goals, career goals and investing back into yourself. What worked last year and what needs to change? Are there new long-term goals that need to be put in place? What will your wealth picture look like five years from now? What do you want it to look like? Which life events are coming up that will change the landscape?

Prepare for Tax Season

It is also a good time to start gathering receipts, bills, accounts and documentation for tax season. Additionally, if you typically owe taxes come April, you can start to think about where you want to pay these taxes from. Try to plan ahead so April doesn’t come as a shock.

Talk with an Advisor

Lastly, if all of this seems overwhelming, take some time to speak with a qualified financial advisor that will work with your CPA. The reality is that many CPAs focus on tax filing and not tax planning. In order to engage this next level of planning, you will need a time of trusted professionals on your side to help drive and navigate your tax planning in connection with your broader financial goals.