There are only two certainties in life – death and taxes

There’s never enough time to do all the nothing you want.

Happy Halloween

Did you know that only 20% of people are worried about dying vs. 58% of people are worried about running out of money in retirement? In fact running out of money in the future is Americans #1 financial fear. It makes sense when you think about it – people are great at avoiding thinking about unpleasant issues that they don’t need to deal with now (like dying), but the whole financial services industry is interested in cranking up your anxiety level about running out of money since it leads to people saving and investing as much as possible and that leads to more fees for them.

So don’t feel bad – there is a lot of money being spent to dial up the fear level and then funnel you into a system that makes it hard to take control of your future.

This Simple Step Can Address Americans #1 Financial Fear

One simple thing people can do to address their fear of running out of money in the future is to build a retirement plan to get educated and take control of their finances.

There are several reasons this is a good idea:

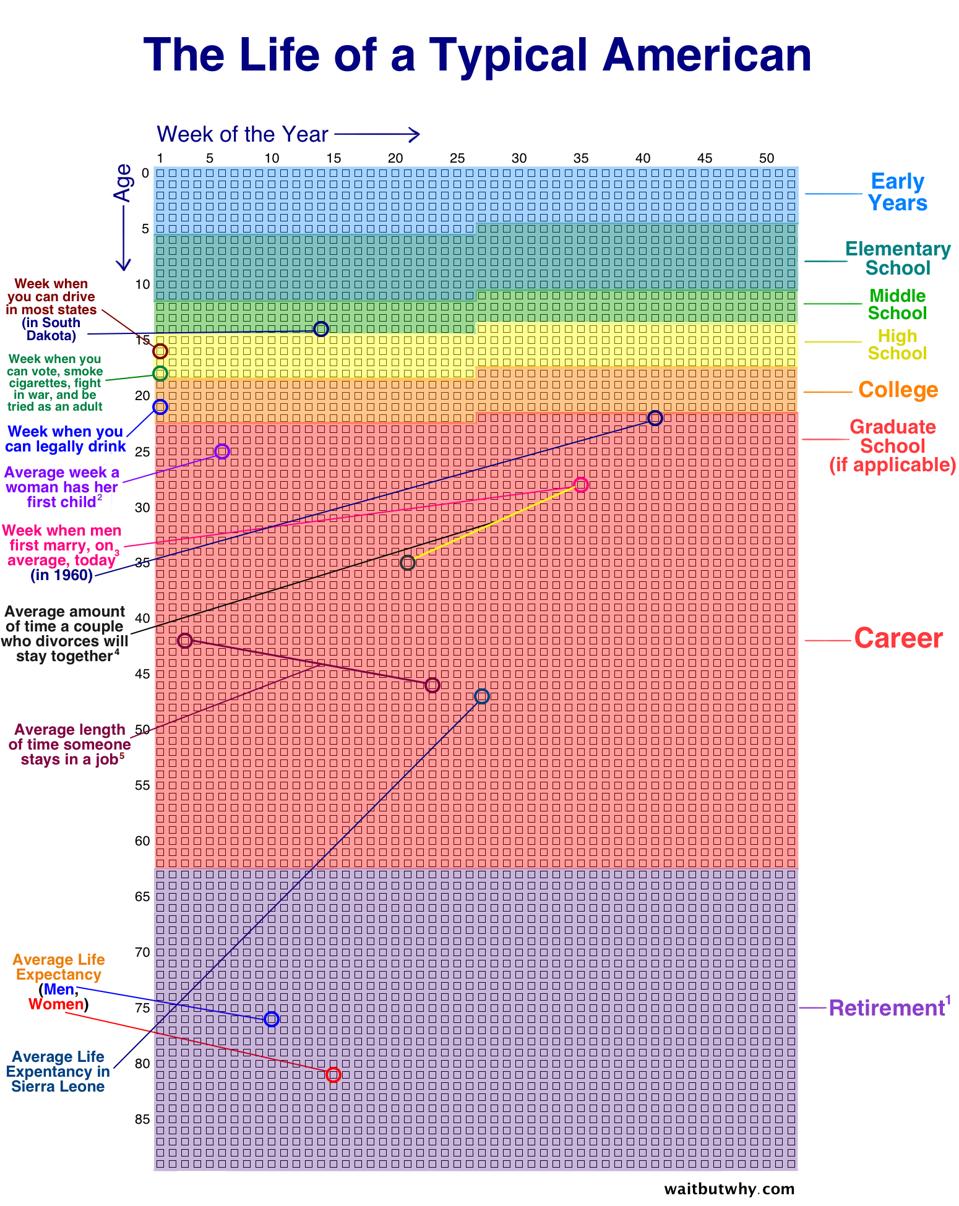

First: Life is short and having a plan helps you make the most of it. The average person has about 4,000 healthy weeks of life (assuming you remain healthy through 80 years old). If you’re around 50 then you’ve lived about 2,600 weeks. Around this age many people start looking at their time as a scarce resource and try to use it accordingly – focusing on people, activities and work that has real meaning to them. You may even want to build a bucket list.

Your life in weeks from https://waitbutwhy.com/2014/05/life-weeks.html

Second: Your family is counting on you. Getting organized pays big dividends for your children and parents no matter how much money you have. If you make smart choices you’ll have more assets to help them and also make their lives a lot easier if something happens. There are often big benefits for your spouse if you claim Social Security in a way that maximizes survivor benefits. I recently hosted a podcast with Cameron Huddleston about the big benefits of doing intergenerational planning with your parents.

Third: Your wealth will appreciate it. People with a financial plan are twice as confident as those without one. There is a lot to be gained by making smart choices around the big decisions you’ll face.

- Where to retire – this is a huge driver of your long term expenses, taxes and happiness. The average household has half their net worth tied up in home equity, so relocation can create opportunities to unlock this source of wealth.

- Savings & Investing – it’s worth assessing whether your investments are aligned with your goals. If you are over 50 there are also IRS catch up provisions for most qualified accounts like 401(k), IRA and 403(b) accounts.

- Withdrawals & tax efficiency – as you transition into retirement there can be opportunities to reposition assets into more tax efficient accounts (like Roth IRAs) and be smart about drawing down your assets in a way that minimizes your taxes.

- Social Security & Medicare – these twin pillars of everyone’s retirement require big decisions about how to claim them, so it makes sense to invest the time to think this through.

How to build a plan

Until recently building a plan was only available through a financial advisor who used special software written for them or done by planning enthusiasts who built their own spreadsheets. The average financial plan from an advisor costs $2,400.

Just like there are now powerful low cost tools for travel planning and doing your taxes, there are now great tools that let you build your own retirement plan. In a few minutes you can build a plan that offers key benefits across:

- Getting organized for yourself and your family

- Seeing your net worth today and over time

- Building a projection of what your retirement income will be and what drives it (such as Social Security, part time work, any pension, Required Minimum Distributions (RMDs)

- Seeing what your expenses are likely to be based on your current lifestyle, future moves, healthcare and taxes

- Getting help thinking through Social Security and Medicare claiming strategies

- Exploring “What If” scenarios – for example what happens if you retire at 60 vs 65, work part time at 55 or move abroad for a few years

- Making smart choices around the things you can control (savings, investing, when you retire, where you live) and understanding your options to manage the risks you can’t control (inflation, market returns and longevity)

The only thing you can count on is change and a great way to embrace that is to build a plan that you can manage over time as the world evolves around you.

It is also worth reviewing your plan with a fee only fiduciary financial advisor – they can offer huge value by helping people manage one of their biggest risks – their own behavior. If you want to get started on your own plan you can check out this new free retirement planning tool.