My passions in life include family, cooking, board games, taxes, and small businesses. However, sometimes small businesses struggle to be heard by Congressional leadership is over lobbyists for large multinational corporations. After all, if I am operating a small business in Upstate New York what is the best way to make sure my view is heard with regards to potential federal tax proposals?

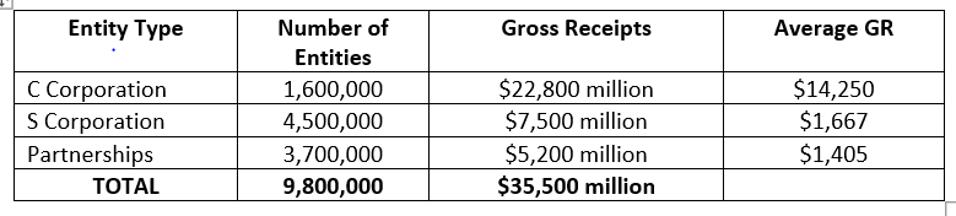

In 2015, which is the most recent IRS reporting for all entity types, there was a reported 1.6 million C Corporation returns reflecting $22.8 billion of gross receipts. Alternatively, there were 4.5 million S Corporations and 3.7 partnerships with combined gross receipts reported of approximately $12.8 billion, $5.2 billion for partnerships and $7.5 billion for S Corporations, respectively.

IRS 2015 Business Entity Reporting

IRS 2015 Business Entity Reporting

The old hypothesis still holds true. C corporations bring in more than 4 times the amount of gross receipts of S Corporation and pass-through entities combined but make up less than twenty percent of business entities. Therefore, it is not unusual that they would be targeted for a potential revenue raiser in Biden’s tax proposal. Increasing the C Corporate income tax rate from 21% to 28% should bring in a revenue windfall, although many speculate whether the bill will be able to pass with a full increase to 28% and expect it to be more likely to land around 25%. However, pass-through business owners, including partners and S Corporation shareholders, should monitor the Biden proposal carefully. While the Build Back Better recovery plan, released on March 31, 2021, did not specifically list an increase in the top individual tax rate from 37% to 39.6% or a phase out of the 199A deduction (20% pass-through deduction), it was part of Biden’s campaign tax proposal and both would create a significant impact on small businesses throughout the United States. Individual taxation is expected to be part of the second element of the recovery plan and should be announced in the coming weeks.

President Biden’s campaign tax proposal raises taxes on individuals with income above $400,000, including raising the individual income tax rates top bracket to 39.6% and completely phasing out the 199A deduction for filers with taxable income over $400,000.

Let us take a basic example to see the impact. Assume that we have a married couple where the husband earns $200,000 through W-2 income, and the wife earns $300,000 of ordinary income through her interest in a manufacturing partnership. We will assume that the partnership reports sufficient qualified wages to avoid a 199A limitation.

Potential Individual Tax Changes under Biden Proposal

Potential Individual Tax Changes under Biden Proposal

The cash impact to the taxpayer in our example is an increase of approximately $18,000 of federal income taxes, when only adjusting for the 199A removal and increased marginal tax rate to 39.6%. Some readers may view the effective rate increase from 23% to 25%, and argue it is still better than the C Corporation tax rate moving from 21% to potentially 28%. However, it should be noted that while the effective tax rate is relevant, the marginal tax rate is what most tax accountants will focus on for planning and growth. A C corporation has a flat federal income tax rate, potentially increased to 28%, no matter the amount of taxable income made. Meanwhile, if the partnership in the above example has an increase in income, they will have to pay a tax rate of 39.6% for every additional dollar. That is over 10% higher (39.6%-28%) than the similar C Corporation and could result in a significant decrease in growth transactions for flow-through businesses.

Double Tax?

Many of you may be shouting, “What about the double taxation that impacts C Corporations? Doesn’t that increase the C Corporations overall effective tax rate?” That’s a point worth exploring. Let us assume the above C Corporation has taxable income of $475,000. Assuming the federal C Corporation income tax rate increases to 28%, the income tax due would only be $133,000 ($475,000 x 28%). In addition, there will be an additional capital gains tax assessed at the owner level ranging from 15%-20%, provided the dividends are qualified. Therefore, if the after-tax earnings are distributed, an additional $51,300 of capital gains tax could be assessed (475,000-133,000 x 15%). In short, their effective tax rate just jumped from 28% at the C Corporation level to 38.8% (($51,300 + $133,000)/$475,000) when factoring in the tax paid at the C Corporation and by the individual on qualified dividends. Too much math? Yes, I agree. But if the earnings are made in a C Corporation and distributed in the same year, the marginal tax rates are not that different from individuals of 39.6%. So, what is the big deal?

As we all know, timing is everything. An owner in a C Corporation may be able to choose when they want those earnings to be distributed. Unlike flow-through entities, the same dollar earned by the business entity in year 1 does not have to be taxed at the owner level in year 1. A C Corporation owner can decide when those earnings from the C Corporation are distributed which allows them better planning opportunities. For example, they may potentially wait until they can guarantee a lower capital gains tax rate before a distribution occurs.

However, going one step further, Section 1202 of the Internal Revenue Code allows for the sale of qualified small business stock to avoid capital gain taxation all together. For example, an owner was paid a reasonable salary compensation for six years and then decides to sell his stock. Under the double taxation methodology, the owner would be assessed a capital gains tax on the sale of stock as well as paying ordinary income tax rate on the salary earned. However, that owner could potentially recognize zero capital gain on the sale of their stock by applying Section 1202 and essentially bring the effective tax rate of the C Corporation back down to 21%. While some might be shocked to hear of Section 1202, or qualified small business stock exclusions, the ability for small business to qualify for this exclusion is real and is becoming more relevant when the individual tax rate keeps going up and the C Corporate tax rate remains to be low. The history of Section 1202 dates back to 1993. However, before Tax Cut and Jobs Act (TCJA ), the C corporate tax rates were as high as 35% and individual tax rates were up to 39.6%, decreasing incentive for structing 1202 corporations. Then the TCJA passed, and the C Corporate tax rate plummeted to 21% while the pass-through effective tax rate with 199A benefits hovered around 30%. At that time, discussions increased with regards to exploring Section 1202, but there was a fear by pass-through entity owners that if they were to convert, the C Corporation tax rate would skyrocket. More information on Section 1202 corporations, including how and when they can be utilized will be discussed in next months article.

But what now? It appears based on commentary that there is potential that the C Corporation federal income tax rate could increase to 25% (and a smaller chance it increases to 28%), and that the 199A deduction could be completely phased out for taxpayers with taxable income over $400,000 coupled with an increased in the individual income tax rate to 39.6%. That would leave C Corporations with a marginal tax rate of 25%, while pass-through owners would be experiencing a marginal tax rate of 39.6%. This would result in a marginal tax rate differential of almost 15% (39.6%-28%), and would result in flow-through entities to further scrutinize the possibility of Section 1202 corporations.

Pass-through entity owners are not out of the woods yet. While the 199A deduction and increased individual tax rate were not addressed in the most recent discussions on the Build Back Better recovery plan, individual taxation is expected to be part of the second element of the recovery. The infrastructure bill will demand significant funding and focusing on corporate taxation proposal first for public buy-in makes sense. However, the Biden administration and the Democrat-controlled Congress can pursue a range of tax and spending initiatives through budget reconciliation, which only requires a simple majority vote with limited debate. President Trump and President Obama also used the budget reconciliation process to push through their tax proposals. Tax reform does not require bi-partisan support and could move through Congress as rapidly as the TCJA. Taxpayers should be forecasting and planning 2021 strategies transactions with the understanding we very well could be applying a significantly different tax code in 2022.