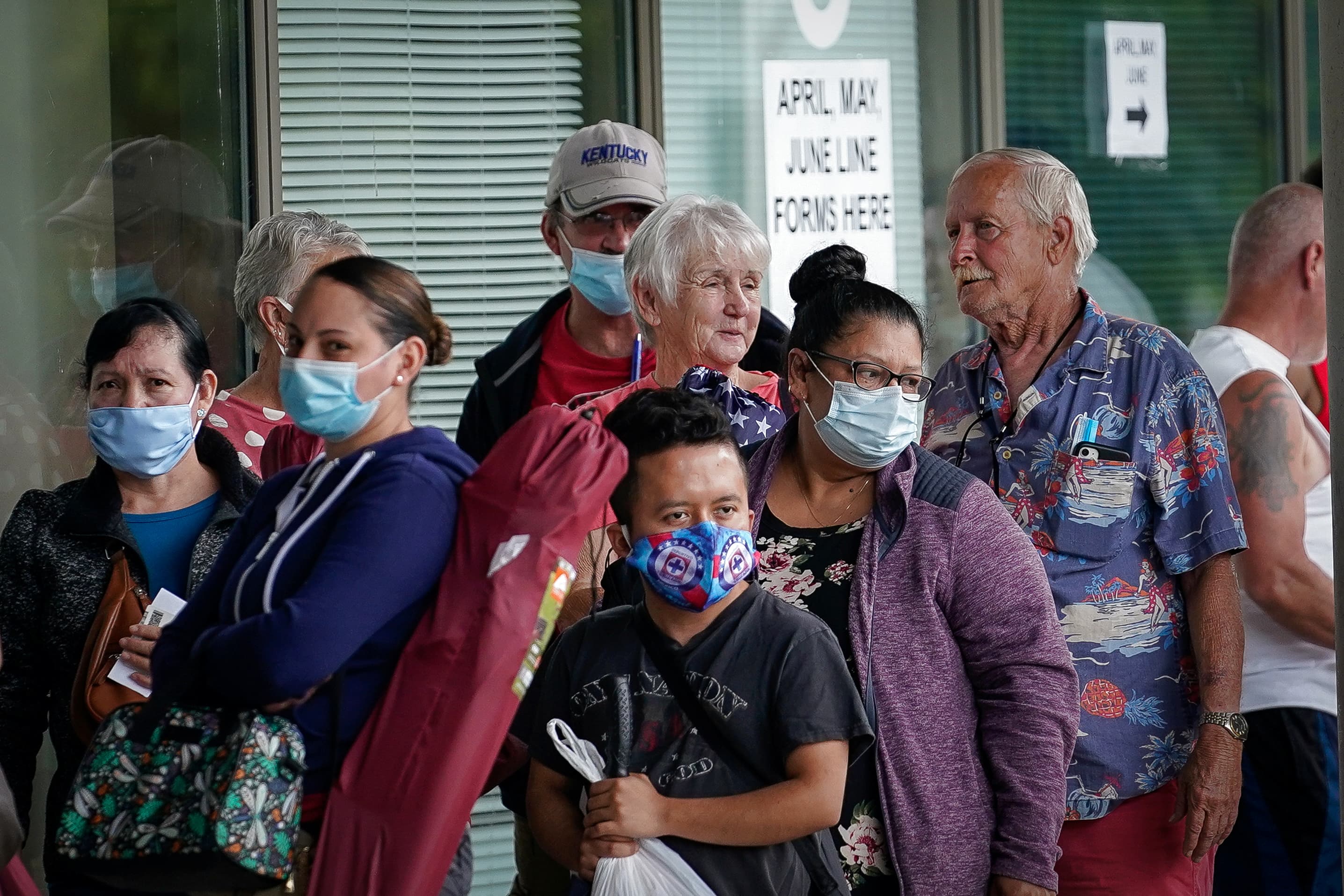

People line up outside a Kentucky Career Center hoping to find assistance with their unemployment claim in Frankfort, Kentucky, June 18, 2020.

Bryan Woolston | Reuters

You would think having decades of experience should help in a job search.

Yet it’s holding many older unemployed workers back during the coronavirus pandemic.

Harry Hache, 59, was laid off in March from his job as a technical project manager for a Park n’ Fly in Atlanta, when Covid-19 devastated the airline business.

He was able to get unemployment benefits, but his weekly amount dropped from more than $800 per week to about $300 when the additional $600 established by the CARES Act expired. Now, the assistance he gets doesn’t even cover his rent, so he’s had to dip into savings.

“I can’t afford car insurance, can’t afford medical insurance,” he said. “I can pay for rent and food.”

Hache has spent months applying for jobs and had a few interviews, but “no one wants to hire a nearly 60-year old,” he said, adding that many positions he’s seen have very low pay, sometimes less than $15 an hour, an amount that won’t cover his expenses.

During his job search, he’s also learning new software skills, trying to stay active and writing his senators with the help of social action group Extend PUA.

“The worst thing you can do is get old,” said Hache, adding that he doesn’t plan to ever retire.

“The worst thing you can do is get old,” said Harry Hache, 59. He’s been unemployed since March and struggled to find a new job even with decades of experience.

Harry Hache

The picture for workers over 55

Massive unemployment has impacted American workers of all ages, and those over 55 face challenges in reentering the workforce amid a recession.

The average duration of unemployment for older workers is much longer than those experienced by younger groups. The number of long-term unemployed jobseekers, meaning those that’ve been out of work for more than 27 weeks and are still seeking jobs, jumped to 26.4% from 14% in September for those 55 and older, according to the Bureau of Labor Statistics.

That’s higher than for the total workforce, where long-term unemployed jobseekers rose to 18.2% from 11.3% in September.

Some older workers never fully recover after long-term unemployment, said Susan Weinstock, vice president of financial resilience programing at AARP.

“It’s devastating to someone who might consider themselves at the top of their career,” she said.

More from Invest in You:

‘Predictably Irrational’ author says this is what investors should be doing during the pandemic

Coronavirus forced this couple into a 27-day quarantine amid their honeymoon cruise

How to prepare for a family member with Covid-19

There are several reasons older workers struggle to find jobs, especially during a recession, according to Richard Johnson, a senior fellow and director of the program on retirement policy at the Urban Institute.

Employers sometimes view them as too expensive, are concerned that older employees may not have the right set of technical skills needed for a job or may think older workers aren’t going to stay at a job for very long, making them not worth the investment.

While ageism is illegal, it’s still a big concern for many, said Weinstock. Losing the experience of older people in the workplace is a detriment to the entire society, she said.

Exacerbating inequality

The coronavirus pandemic has exacerbated inequality across the age spectrum and has made Americans near retirement particularly vulnerable – especially if they weren’t yet ready to leave the workforce.

“The only way that people were able to prepare for retirement was to stick around. That doesn’t work if the jobs aren’t there,” said Matthew Rutledge, a research fellow at the Center for Retirement Research at Boston College.

“Even if this is all temporary – there are still months of bills that have racked up, credit card debt, deferred mortgages and loans,” he said.

It’s also an issue for women and people of color, who were already at a disadvantage when it came to retirement savings and earnings.

“Working longer is an important way to improve retirement security for women,” said Johnson. “If they lose their job they can’t do that.”

Jody Frisch lost work earlier this year when the coronavirus pandemic shut down the entertainment industry. She’s been unable to find another job and unemployment benefits will stop at the end of the year because she’s on PUA.

Jody Frisch, who declined to give her age, lost work as a strategic public affairs and advocacy consultant for entertainment union SAG-AFTRA earlier this year due to the coronavirus pandemic. She’s now one of millions of Americans staring down a huge fiscal cliff because she’s on Pandemic Unemployment Assistance, a program established by the CARES Act that expires at the end of the year.

Even the money she is getting on unemployment isn’t enough to cover rent, a car payment and other basic expenses in Los Angeles, where she lives so she’s had to dip into savings to stay afloat. She hadn’t intended to retire within the next ten years, and even though she has decades of industry experience, is struggling to find another job.

“Work is not about an income, it’s who I am, it’s more than what I do,” said Frisch, who has been actively volunteering with Unemployed Action at the Center for Popular Democracy and the Pennsylvania Democrats Voter Protection Program.

“I miss it terribly, I want to continue my career, I think I’m good at it and I think I still have a lot to offer,” she said.

Options for older workers

There are a few options that older workers have when dealing with long-term unemployment before they’re ready to retire, according to financial experts.

“If you have cash reserves, you’re in pretty good shape,” said certified financial planner Diahann Lassus, co-founder, president and chief investment officer of wealth-management firm Lassus Wherley, a subsidiary of Peapack-Gladstone Bank. “If you don’t, the next question is how are you going to pay your bills while you figure this out?”

People over 65 may be able to start receiving Social Security, though Lassus recommends waiting if possible before starting the benefit.

“If you’re 62, it’s absolutely a last resort – you don’t want to take the discount on that benefit,” said Lassus, a member of CNBC’s Financial Advisor Council. “If you’re able to wait until 70, that’s an 8% return per year.”

Still, some people may not have the luxury of waiting, said Paul Fenner, a certified financial planner, president and founder of TAMMA Capital LLC. If you’re in a position where you need to draw on Social Security early, he recommends calling the agency directly to ask for help.

Even though taking it early will result in a lower payment, there are some options to defer the benefit later if you find work again. If you’re within one year of starting Social Security, you can stop and pay back all the money you’ve received.

If you’re past one year, you can suspend Social Security, which can help restore some of the benefit from delayed claiming, according to Rutledge of CRR.

Depending on one’s age, it may be possible to start drawing down a retirement account without penalty. Fenner recommends starting with any post-tax accounts, such as a Roth IRA, to minimize any fines for early withdrawals.

For those with retirement accounts such as a 401(k), it’s never been easier to take an early distribution because of the CARES Act.

Still, Fenner recommends proceeding with caution to avoid taking a tax hit. He also recommends that if people are laid off, they roll over their employer-sponsored 401(k) plan to an IRA as soon as they can.

Work is not about an income, it’s who I am, it’s more than what I do

Jody Frisch

Former strategic public affairs and advocacy consultant, SAG-AFTRA