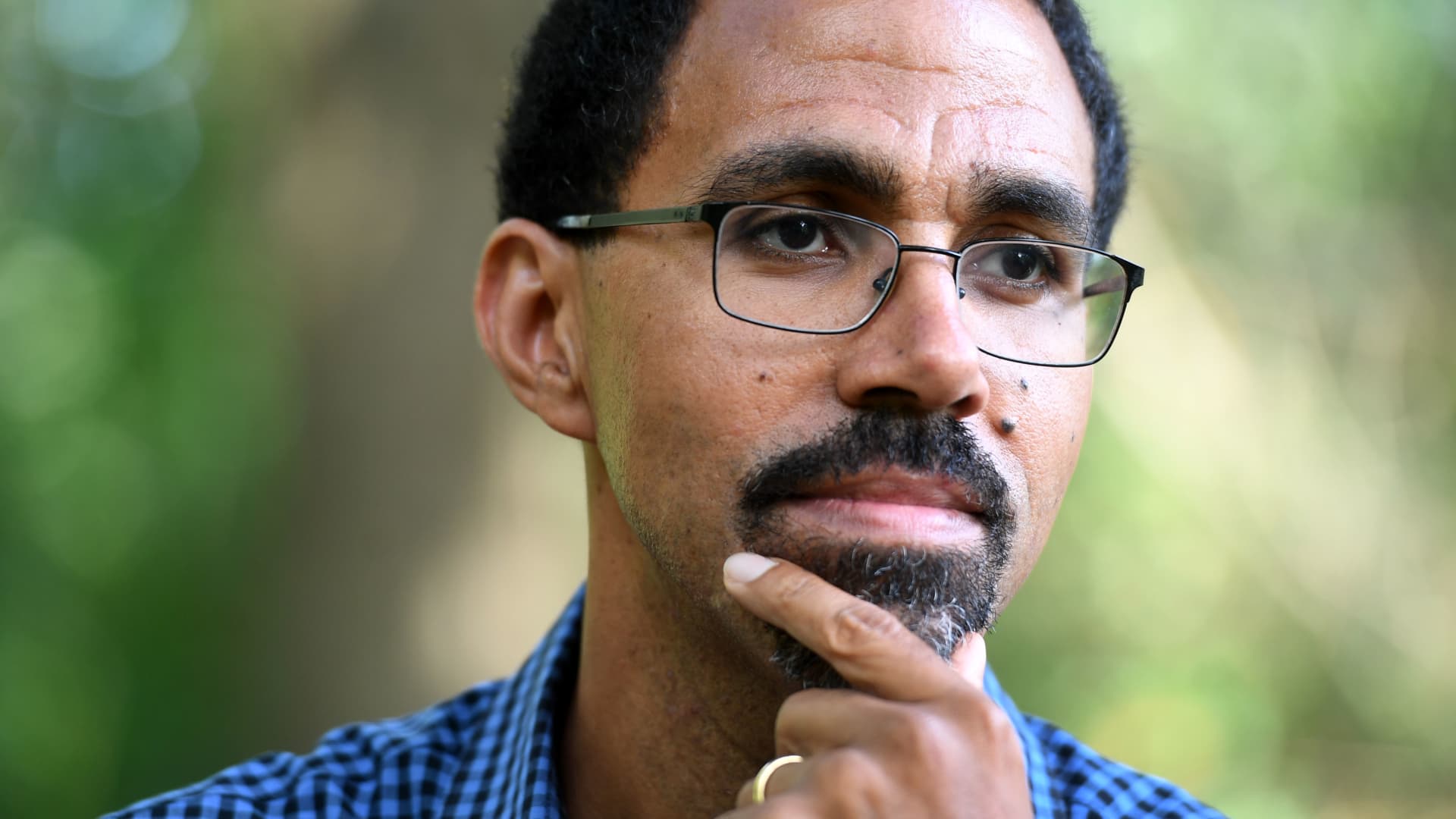

It was only after John King left office as education secretary under then-President Barack Obama that he finished off paying his own student loans.

“I have spent a lot of my adult life paying it down,” said King, who studied government at Harvard and law at Yale. He wouldn’t reveal how much he owed, but, he said: “It was quite a bit, many tens of thousands of dollars.”

King, 47, who’s currently running for governor of Maryland as a Democrat, has now become one of the many people calling on President Joe Biden to cancel student debt through executive action. “We have an opportunity in this moment to lift this burden for people, and I think really help accelerate our economic recovery from Covid,” King said.

He also had warnings about what will happen if Biden doesn’t act. A spokesperson for the White House says the administration continues to consider the options for loan forgiveness.

The interview has been edited and condensed for clarity.

Annie Nova: What was it about your time as education secretary that makes you now support student loan forgiveness?

JK: During the Obama administration, we were very focused on addressing the burden on students who’d been taken advantage of by predatory, for-profit colleges. We also put in place income-based repayment programs. Looking back, those plans weren’t enough. And in this moment, given the Covid crisis and the economic crisis that came along with the pandemic, we have an opportunity to make this a New Deal moment, where we cancel debt for all.

AN: Do you believe President Biden has the ability to forgive student debt on his own, without Congress?

JK: Yes. We were able to put in place in the Obama administration a process for debt cancellation. And the vast majority of lawyers who’ve looked at this question believe there is the executive authority for broad forgiveness.

AN: Have you had any conversations with the current education secretary, Miguel Cardona, about debt cancellation?

JK: I have talked with him. This decision will come down to the president.

AN: More than 40 million Americans carry student debt. The average burden is more than $30,000. A quarter of borrowers are behind on their payments. How did we get here?

JK: This student debt crisis is the product of a 40-year policy mistake. The purchasing power of the Pell Grant has been allowed to diminish. In 1980, Pell Grants accounted for nearly 80% of the cost of a public higher education degree; now it’s less than a third. As a country, we’ve shifted from seeing higher education as a public good to putting a large share of the burden on students and families.

AN: If student loans get cancelled, how do you avoid the debt from just spiraling out of control again?

JK: Solving the problem going forward requires doing the things that are necessary to make public higher education available to all students without debt. And that is achievable. It really comes down to this idea that debt-free college is a public good, and just as we think about K-12 education as serving the public interest, the health of our economy and the health of our democracy, so, too, should we think about higher education.

AN: What do you think will happen if Biden doesn’t forgive student debt?

JK: There would be tremendous disillusionment from key constituents who are crucial for the health of the Democratic Party.

More from Personal Finance:

7 things to know about the SEC climate rule

Here’s the average tax refund so far this year

How to avoid a 6-figure tax penalty on foreign bank accounts