Outer Borough multifamily activity is on the upswing.

Ariel Property Advisors

New York City’s multifamily market has begun to show positive signs of recovery in Q3, and while Manhattan’s sales activity has slowed, investors are looking for returns in Brooklyn, the Bronx and Queens, and it’s signaling that the overall market may be pulling out of the depths of the Q2 slowdown. Though Q2 marked the lowest transactional quarter recorded across New York City multifamily in more than a decade, outer-borough activity is helping the investment sales market tick back up toward pre-pandemic levels.

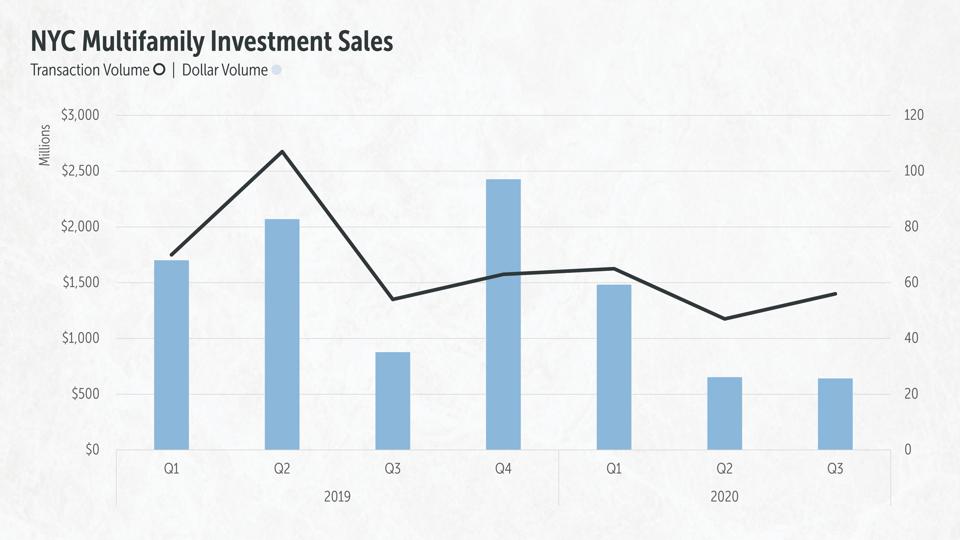

Overall, New York City multifamily investment volume in Q3 2020 totaled approximately $642 million across 56 transactions and 95 properties. Though total dollar volume has remained relatively the same, both the number of transactions and the number of properties sold did show increased activity.

As institutional transactions slowed in Manhattan, Brooklyn led the way with $254 million across 15 transactions. Manhattan multifamily sales, meanwhile, totaled approximately $134.6 million. The most significant move was SL Green Realty Corp’s

SLG

NYC Multifamily Investment Sales

Ariel Property Advisors

Price per square foot dropped an average of 20% across all the boroughs. The Bronx weathered the storm with the smallest drop at -8% compared to the numbers for Manhattan (-58%), Northern Manhattan (-30%), Brooklyn (-30%) and Queens (-27%). The Bronx recorded $96.5 million in sales during Q3, a 101% increase compared to Q2. The quarter’s largest sale was PRB Realty Corp.’s 98,982-square-foot, 112-unit apartment portfolio, purchased by the Workforce Housing Group for $14.5 million.

MORE FOR YOU

Investors kept Northern Manhattan front-of-mind in Q3 as well, making the area another bright spot. Larger deals within Northern Manhattan during the third quarter accounted for a 95% increase in dollar volume compared to Q2. Average deal size grew about $4.8 million in light of a limited pool of for-sale properties. Year-over-year dollar volume growth was even more impressive, spiking 356%, indicating the Housing Stabilization and Tenant Protection Act (HSTPA) has been worse than Covid for transaction volume. The largest transaction was Prana Investments’ $15.8 million acquisition of BlackRock’s

BLK

The Queens apartment market experienced more fervent demand this quarter compared to Q2. Investors traded $112.9 million in sales across 10 transactions, a busier pace than Q2, when only four transactions closed. Dollar volume experienced an 176% jump compared to Q2 and a 402% boost year-over-year. Parkoff Management bought the largest transaction in Queens property this quarter, purchasing 162-15 Highland Avenue from Camby’s International Group for $22.5 million.

Northern Manhattan and Queens’ largest transactions provide some evidence that well-positioned operators have significant appetite for rent-stabilized assets, seeing the only slightly diminished collection figures as a positive sign. Similarly, lenders see these assets as less exposed to market risk.

As we move into the coming year, what remains to be seen is the extent to which the presidential election breeds buyer hesitancy as well as how quickly the City is able to reopen. Though some of the City’s largest universities are still open with a percentage of in-person classes, Governor Cuomo halted plans to allow 50% capacity for indoor dining, and with new restrictions in the wake of a rise in Covid-19 rates, such as a 10 PM curfew on bars, restaurants and gyms, there will likely be further downward pressure on the retail and dining markets.

Still, investors are betting long on the City’s housing, with opportunistic capital and operators making plays, even with Covid fundamentals still in effect and the fallout from the HSTPA still lingering. More specifically, this means that rents are lower and vacancies are higher for free market units, while rent-stabilized units are seeing slightly lower collections figures. It should be noted, though, that pricing discovery is still difficult, given the lower amount of transactions. With more owners and buyers waiting to see how the market settles, there is less certainty about what already-closed transactions mean for pricing trends.