Nvidia reported first-quarter earnings for its fiscal 2024 on Wednesday, with a stronger-than-expected forecast that drove shares up 19% in extended trading.

Here’s how the company did versus Refinitiv consensus estimates for the quarter ending in April:

- EPS: $1.09, adjusted, versus $0.92 expected

- Revenue: $7.19 billion, versus $6.52 billion expected

related investing news

Net income for the quarter was $2.04 billion, versus $1.61 billion from the same period last year. However, Nvidia’s overall sales fell 13% on a year-over-year basis.

Nvidia said it expected about $11 billion in revenue, far surpassing Refinitiv expectations of $1.06 per share on $7.15 billion in sales.

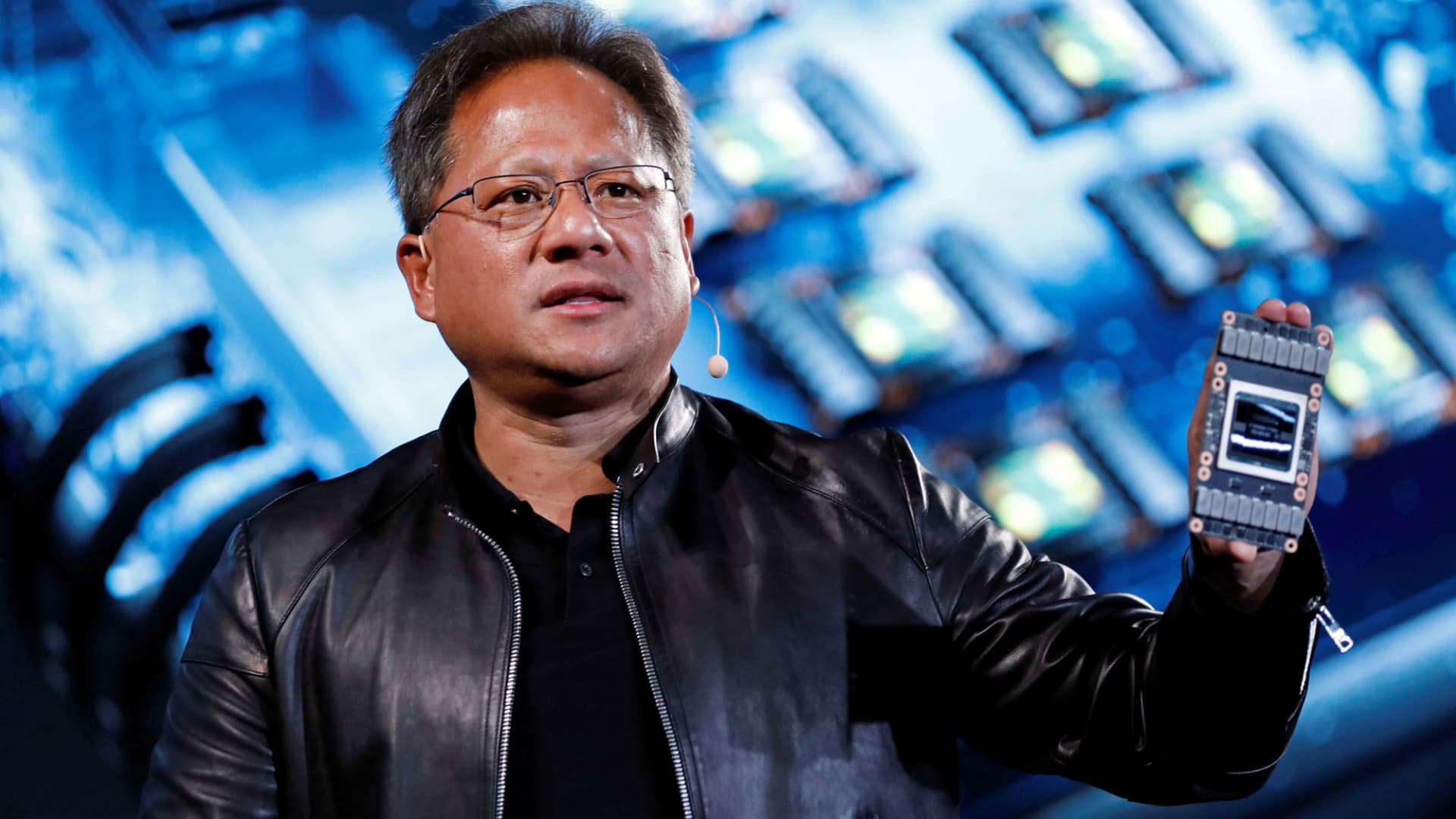

Nvidia stock is up 109% so far in 2023, mostly driven by optimism stemming from the company’s leading position in the market for AI chips. Nvidia CEO Jensen Huang said the company was seeing “surging demand” for its data center products.

Nvidia’s datacenter group reported $4.28 billion in sales, versus expectations of $3.9 billion, a 14% annual increase. Nvidia said that the company’s performance was driven by demand for the company’s GPU chips from cloud companies as well and large consumer internet companies, which use Nvidia chips to train and deploy generative AI applications like OpenAI’s ChatGPT.

However, Nvidia’s gaming division, which includes the company’s graphics cards for PC sales, reported $2.24 billion in sales, versus expectations of $1.98 billion, although overall revenue for the category was down 38% on an annual basis. Nvidia blamed a slower macroeconomic environment as well the ramp of the company’s latest GPUs for gaming for the decline.

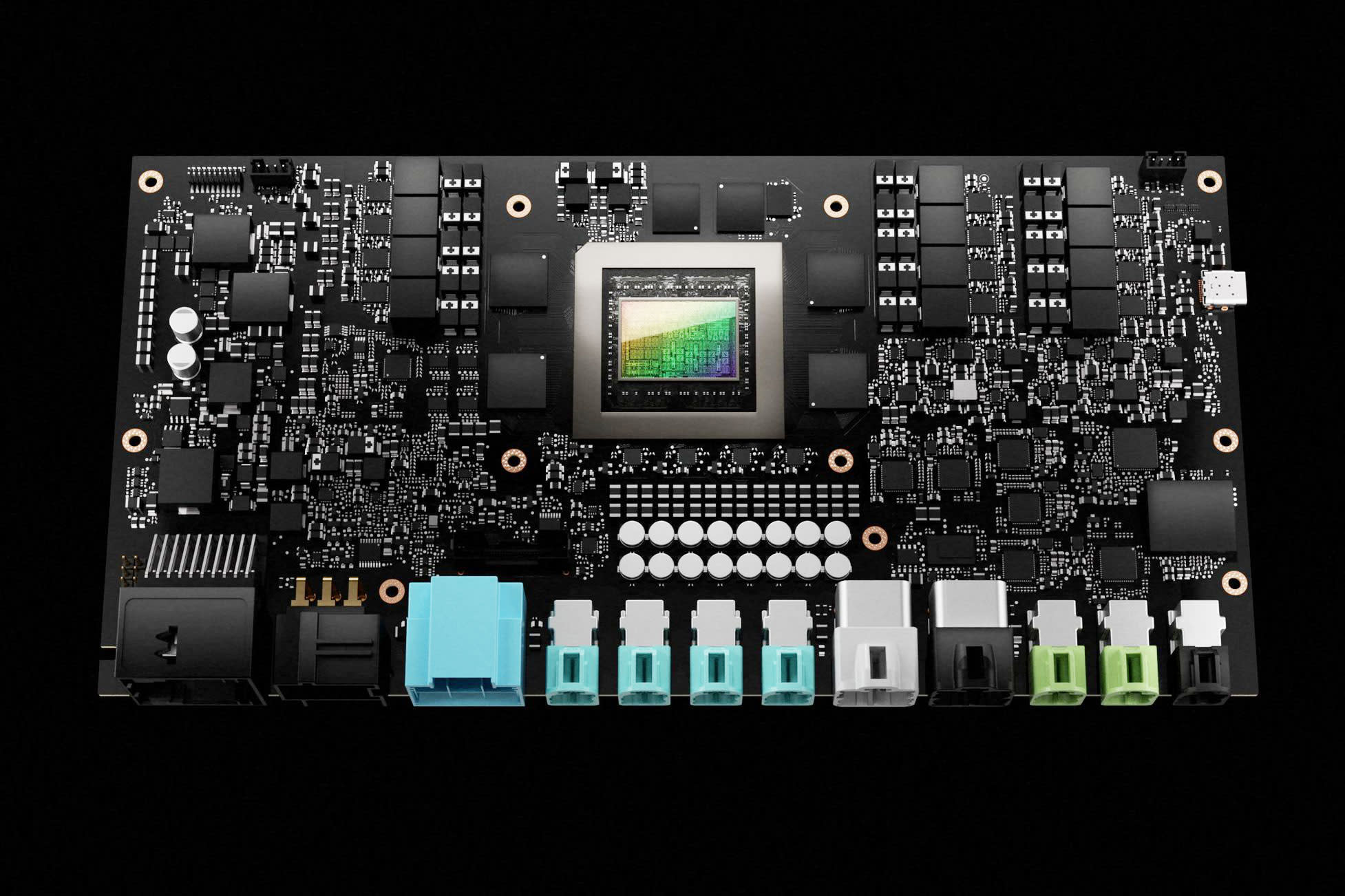

Nvidia’s automotive division, including chips and software to develop self-driving cars grew 114% on a year-over-year basis, but remains small at under $300 million in sales for the quarter.