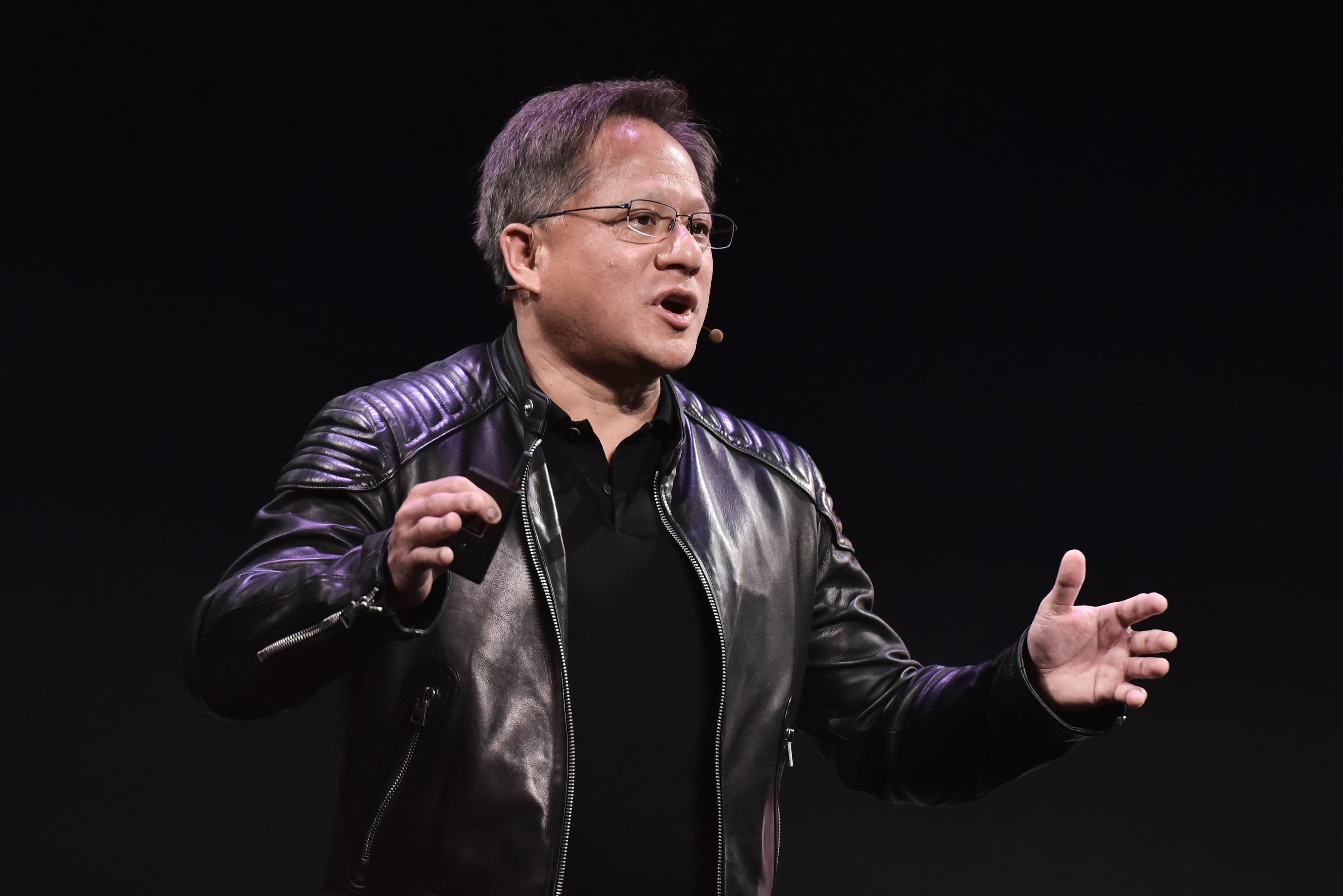

Nvidia founder, President and CEO Jen-Hsun Huang

Getty Images

Nvidia beat elevated analyst expectations for both earnings and revenue for the fourth quarter of its fiscal year, which ended in December.

Nvidia stock rose under 2% in extended trading.

Here’s how Nvidia did:

- Earnings: $3.10 per share, adjusted, vs. $2.81 per share as expected by analysts, according to Refinitiv.

- Revenue: $5.00 billion, versus $4.82 billion as expected by analysts, according to Refinitiv.

Sales were up 61% year-over-year.

Investors had been expecting revenue growth over 55% from last year and Nvidia beat those expectations, even during a worldwide semiconductor shortage.

Nvidia also suggested that its hot streak would continue by forecasting $5.3 billion in revenue for the current quarter, ahead of investor expectations of $4.51 billion.

Nvidia stock has had a lot of momentum in recent months, with the stock rising over 106% in the past year. Investors see the Santa Clara, California chipmaker as a key supplier to several new technology trends. It sells semiconductor components for gaming, artificial intelligence, data centers, and automobiles.

Nvidia has two primary segments: Graphics, which is primarily its graphics cards for consumers and professionals, and Compute and Networking, which includes chips for data centers, automobiles, and robots.

Both had impressive quarters, which the company attributed in part to impact from the Covid-19 pandemic. Graphics reported $3.06 billion in revenue, which was up 47% from the same period last year. Compute and networking, the data center division, was up 91% year-over-year to $1.95 billion.

PC gaming has been a hot market during the pandemic, and Nvidia is perhaps best known for its graphics cards that enable high-performance gaming. It has had issues keeping its newest graphics cards in stock. Nvidia said that its gaming performance was driven by sales of its newest graphics cards.

Nvidia’s automotive business did not perform well during this quarter. It was down 11% to $145 million, Nvidia said, and it ended up down 23% for the entire year.

Last September, Nvidia said it planned to buy ARM from Softbank for $40 billion in a transaction with deep implications for the semiconductor industry. ARM develops low-level technology widely used across the industry to develop low-power chips for mobile devices — and it supplies technology to most of Nvidia’s competitors. Companies are already lining up to object to the deal through regulatory channels.

“We are making good progress toward acquiring Arm, which will create enormous new opportunities for the entire ecosystem,” Nvidia CEO Jensen Huang said in a statement.