Getty

How much do you need to save in order to retire? This is a very common question, and the answer sometimes gives people sticker shock. Fortunately, simply working a bit longer or taking a closer look at spending can make a very big difference.

One rule heard often, for example, is that by 67 people should have saved 10 times their salary in order to retire. How realistic is this?

The median (or most common) wage for individuals in the U.S. is $33,000. That would mean that by age 67 they should have saved $330,000 in order to retire. But median savings are nowhere close to that; at $172,000, they fall far short of what is supposedly needed. According to these numbers, the most likely outcome for Americans would be to end their days in poverty.

Yet, this is not the case: estimates of U.S. seniors living in poverty range from 9% to 15% – a large number, to be sure, and one that demands policy solutions, but not as dire as one would think under some guidelines of how much Americans need to save.

Part of the reason is that the answer to “how much you need” is based on the assumption that you will demand no changes in lifestyle after you retire. This, however, is not how people do it.

Consider that the average weekly wage in the borough of Manhattan is $3,153 (about $160,000/yr) which is more than two and a half times the national average of $1,184 (less than $62,000/yr). According to the 10X rule, people in their 60s would need $1.6M to retire – quite a challenge in a city where taxes can take more than half of a person’s salary.

Instead, many people opt to move. In Fort Lauderdale, FL, the cost of living is less than half of Manhattan’s, and a person could have a comparable lifestyle with just $74,000 per year. This suggests that a person with just 4.5 times the annual Manhattan salary can retire well in Ft. Lauderdale.

Moving is not the only way to stretch out retirement savings. Another is to work a little longer.

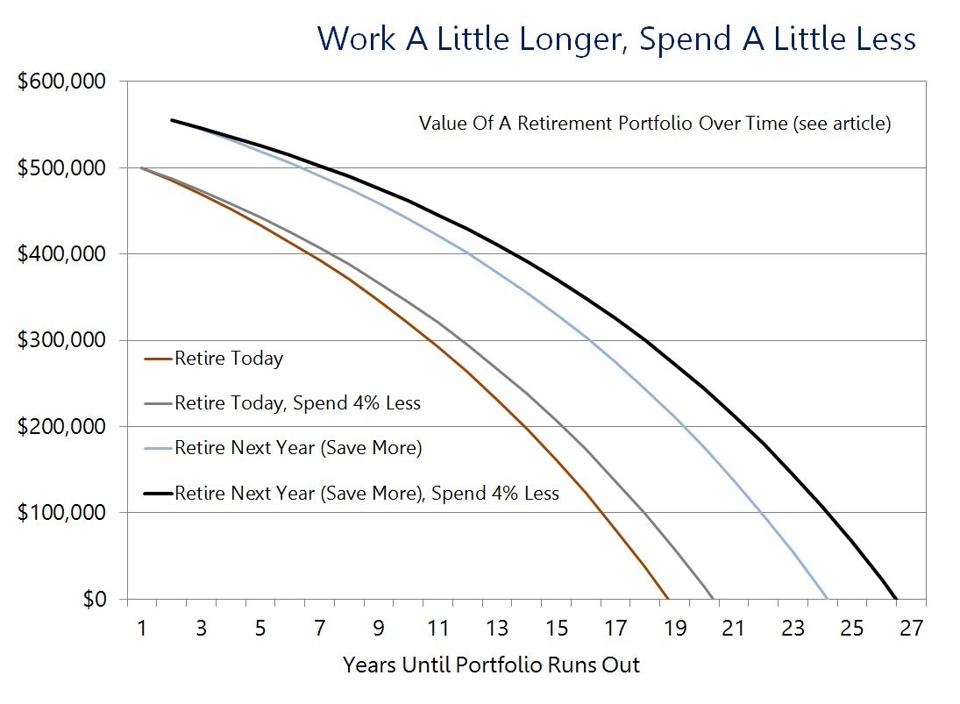

Consider a working person with savings of $500,000 and the ability to put aside $20,000 every year. If that person wanted to retire today, assuming a fixed 7% annual return on savings and an annual portfolio draw of $50,000 to supplement Social Security, that person would see the portfolio run out in about eighteen years.

In this example, spending a little less during retirement can go a long way towards making savings last longer. Lowering the withdrawal amount to $48,000, for instance, would prolong the life of the original $500,000 by 1.5 years.

Delaying retirement by one year has a bigger impact. In this scenario, the portfolio would grow by $20,000 from the salary put-aside plus $35,000 from the 7% annual return. This alone would make it last four more years. When also considering that this person will now retire one year later, he or she will be five years older when savings run out – or close to 8 years when spending is also reduced by $2,000.

A person with $500,000 in savings who can save $20,000 working an extra year can stretch the … [+]

Working not just one but four additional years would make an enormous difference. The funds would grow to $745,000 through a combination of additional savings and returns on a growing portfolio. This would be well above the $715,000 needed to equate the 7% return with the $50,000 annual draw, and the portfolio principal would never go down.

The fixed 7% return assumption is, of course, highly unrealistic: while 7% is in the range of the average annual stock market return, volatility is very high. In fact, volatility is a key factor in determining the success of any retirement portfolio, especially if returns are negative in the crucial early years. Here is where having a solid investment strategy to assess the kind of risks you can reasonably take comes into play.

Still, the comparisons hold: whether market gyrations can overpower almost any portfolio, in all cases a retiree will benefit by taking less money from a larger pot. Even small adjustments can have a big impact later on.