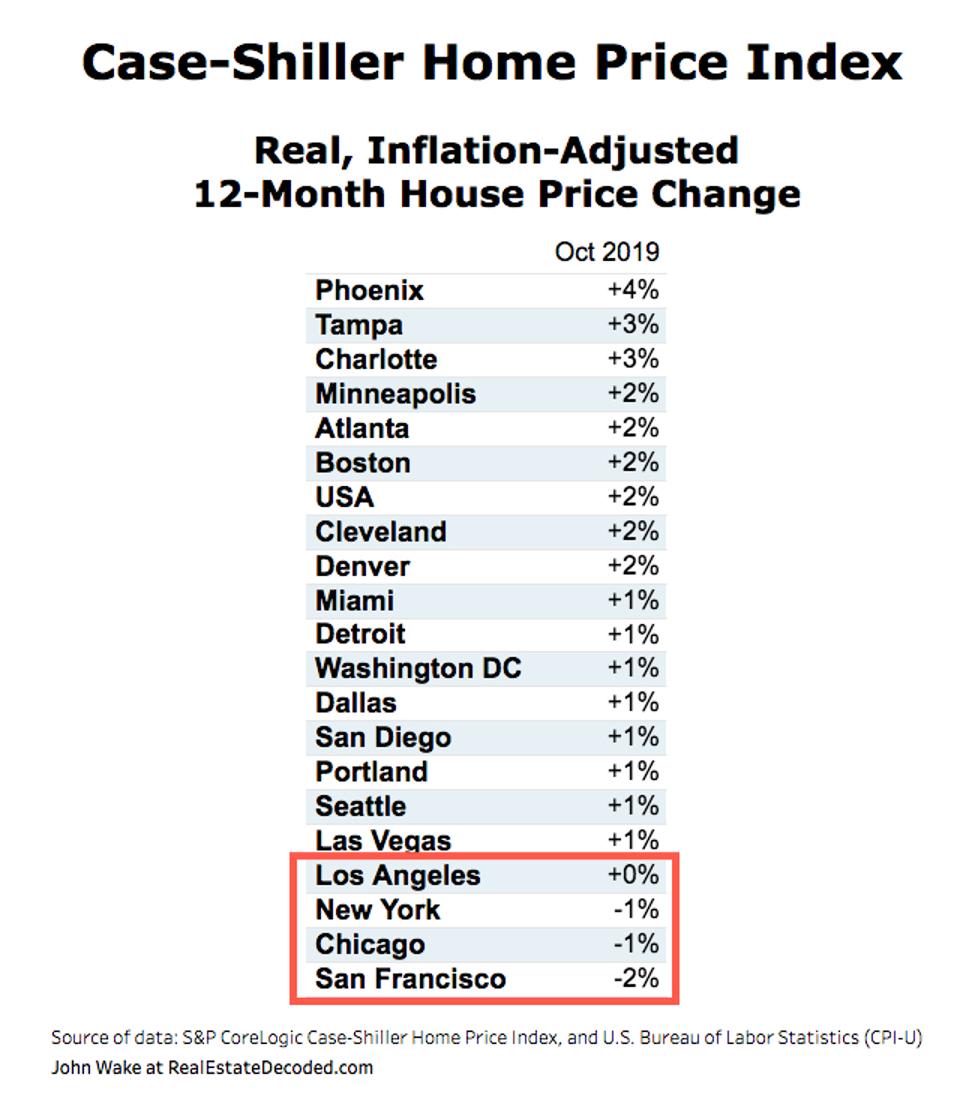

House prices appreciated faster in Phoenix than in any of the other 20 metro areas covered by the S&P CoreLogic Case-Shiller Home Price Index. In real, inflation-adjusted values, house prices in Phoenix only increased 4% from October 2018 to October 2019. That 4% is good but nothing like the numbers we’ve seen for the hottest U.S. metros the previous few years.

Source of data: S&P CoreLogic Case-Shiller Home Price Index, and U.S. Bureau of Labor Statistics (CPI-U). Graphic: RealEstateDecoded.com.

Real house prices fell in metropolitan San Francisco, Chicago and New York from 12 months earlier.

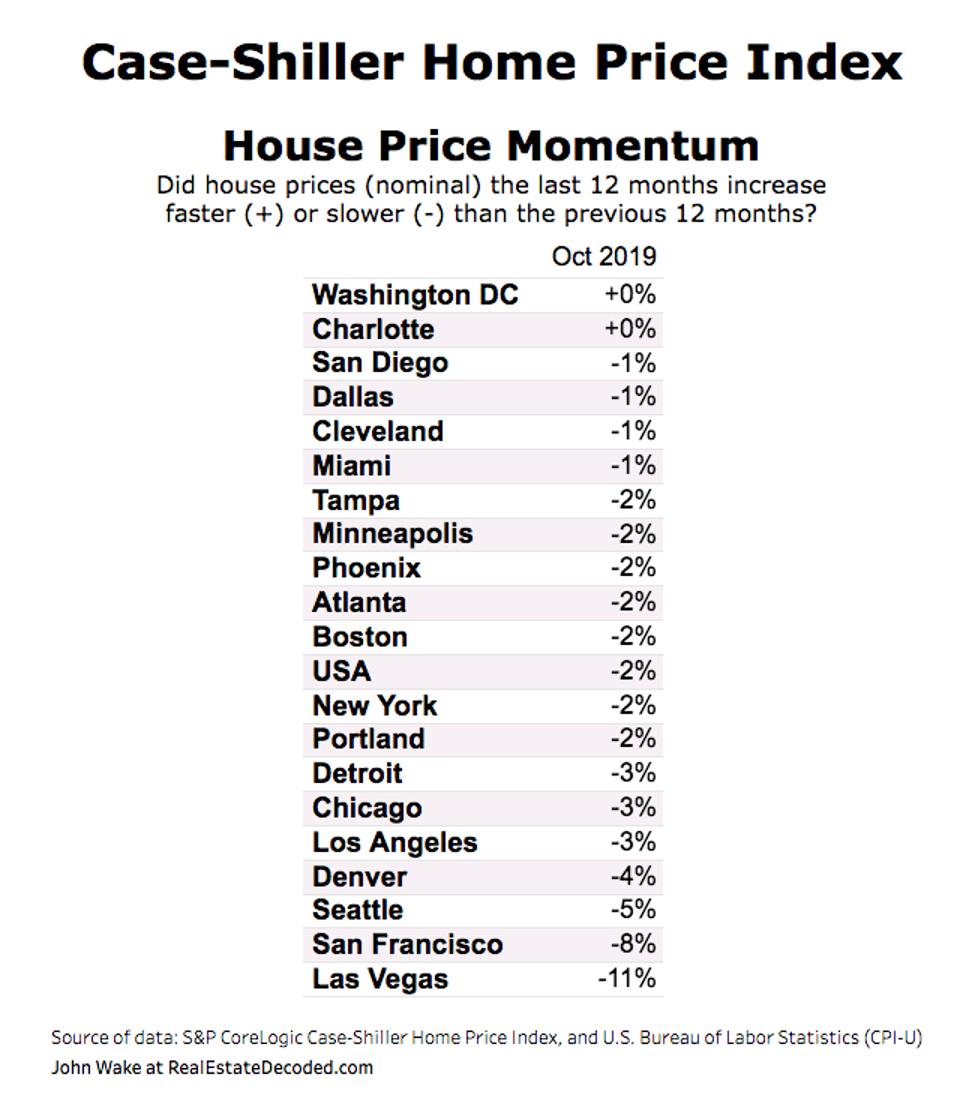

Upward Price Momentum is Slowing

House prices appreciated more slowly the last 12 months compared to the previous 12 months in 18 of the 20 metros covered by Case-Shiller. In the other two metros, house price appreciation was flat.

Source of data. S&P CoreLogic Case-Shiller Home Price Index. Graphic from RealEstateDecoded.com.

Two of the fastest appreciating markets in 2017 and 2018, Las Vegas and San Francisco, slowed the most.

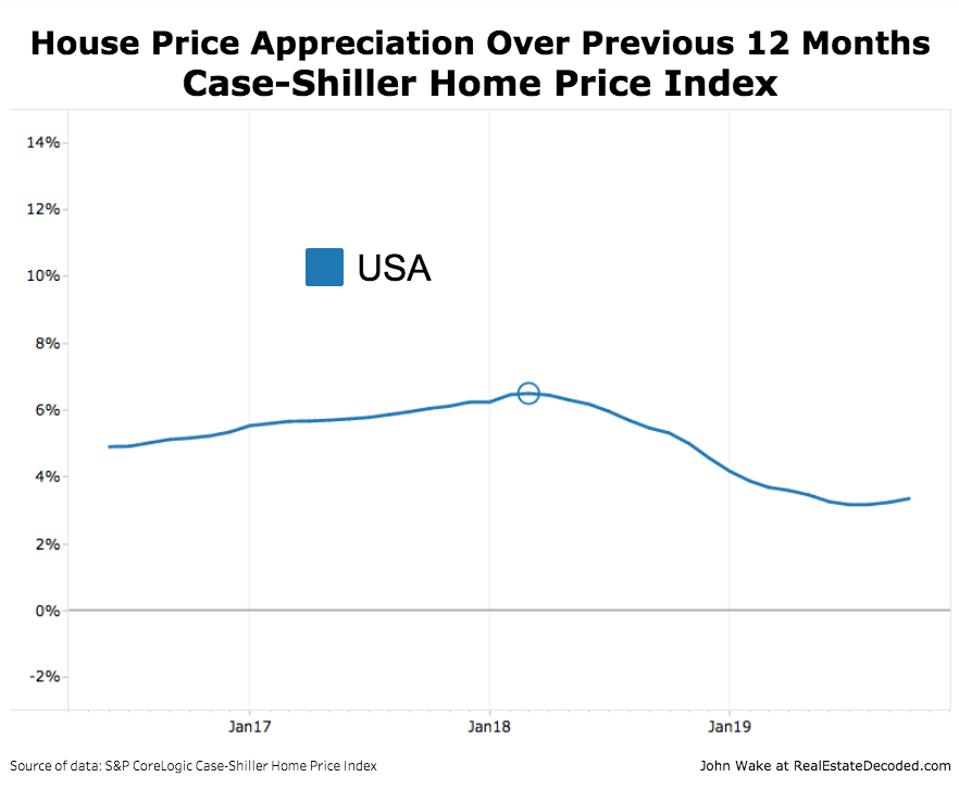

Price Appreciation Over Time

Seattle was the hottest market in 2016 and the first half of 2017 but it barely appreciated over the last 12 months, just 2%.

Similarly, Las Vegas, in August 2018, had 14% appreciation over the previous 12 months but only had 2% appreciation over the last 12 months.

Source of data: S&P CoreLogic Case-Shiller Home Price Index. Graphic: RealEstateDecoded.com

Nationally, in recent years, house price appreciation peaked at 6% in early 2018. After fading for over a year, the 12-month appreciation stopped falling and increased slightly in September and October. It’s been running at 3% the last several months.

Source of data: S&P CoreLogic Case-Shiller Home Price Index. Graph: RealEstateDecoded.com.

Note. You can find interactive versions of these charts for all 20 Case-Shiller metros here.

The October data is the latest available from Case-Shiller. The data is a 3-month moving average so what they call October is the August-October average. It might be better to think of the October data as running quarterly data, that is, data for the quarter ending in October.