Good News: You Don’t Need An Existing Relationship With A Lender To Get A PPP Loan

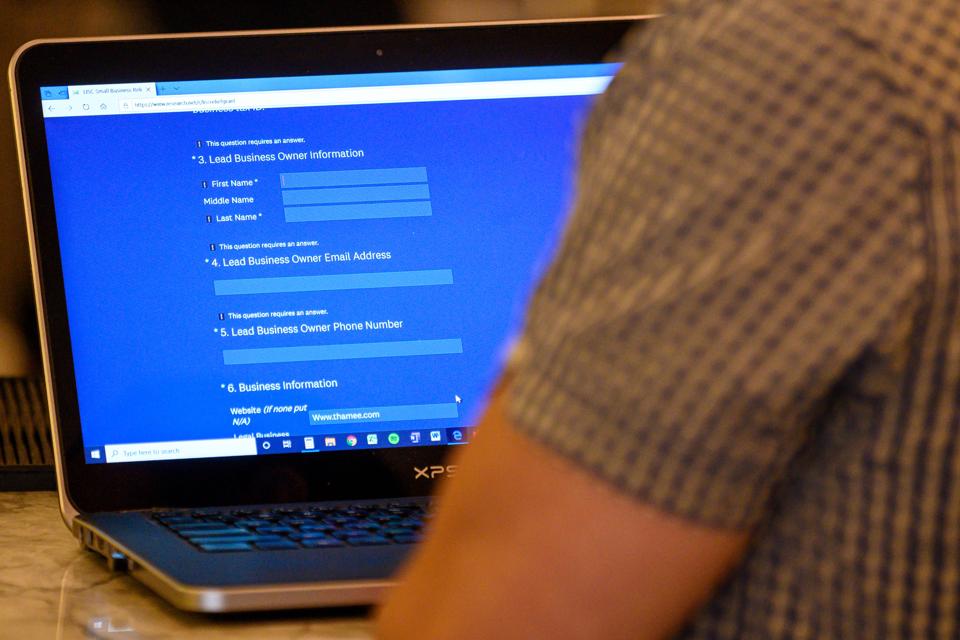

Deadline for small business owners to apply for financial aid is June 30, 2020. (Photo by ERIC … [+]

AFP via Getty Images

Yesterday (June 19), the Small Business Administration (SBA) launched a free online tool to connect small businesses with Paycheck Protection Program (PPP) lenders. As a result, businesses in “underserved and disadvantage communities will have a better chance to apply for PPP loans,” explained Carol R. Wilkerson, SBA spokesperson.

The PPP loans provide incentives for small businesses to keep their workers on the payroll. The loans essentially turn in to grants if the funds are used for approved expenditures during the “covered period.”

Deadline Approaching

But businesses have to act quickly. The deadline, June 30, 2020, is just around the corner. $100 billion is still available, according to Wilkerson.

Tools

The online tool is called Lender Match, which helps you locate a lender who can process your PPP loan.

But first, I highly recommend that you use another PPP tool on the SBA website to review PPP requirements. Find it here.

I also suggest you read PPP FAQs.

When you are ready, log onto Lender Match. The tool asks you to enter your email address. Within two business days, you’ll receive emails from lenders who could process your PPP loan. Then you will provide information to the lender of your choice to begin the PPP application process.

A Note Of Caution

When lenders contact you, don’t assume you’ve been approved. It’s just the start of the process.

The tool will help you find lenders in your community. The lenders are participating Community Development Financial Institutions and small asset lenders.

Reaching More Small Businesses

“As communities begin to carefully reopen across the country, there are still many more opportunities to provide this assistance to businesses who have yet to access these forgivable loans. SBA is utilizing these partnerships with CDFIs, MDIs, CDCs, Farm Credit System lenders, Microlenders and many other participating small asset lenders to ensure that access to this emergency funding reaches the most small businesses and their employees in need – a key priority for President Trump,” said SBA Administrator Jovita Carranza.

Lender Match also addresses non-PPP loans, which are described in more detail here.

If you need to talk to someone about Lender Match, you can contact the SBA or send an email to lendermatch@sba.gov. Note that Lender Match does not accept Economic Injury Disaster Loan applications. Information on EIDL loans can be found here.

Through June 12, the SBA had guaranteed more than 4.5 million PPP loans worth a total of more than $500 billion and involving more than 5,400 lenders. For more information on PPP loan activity, click here.