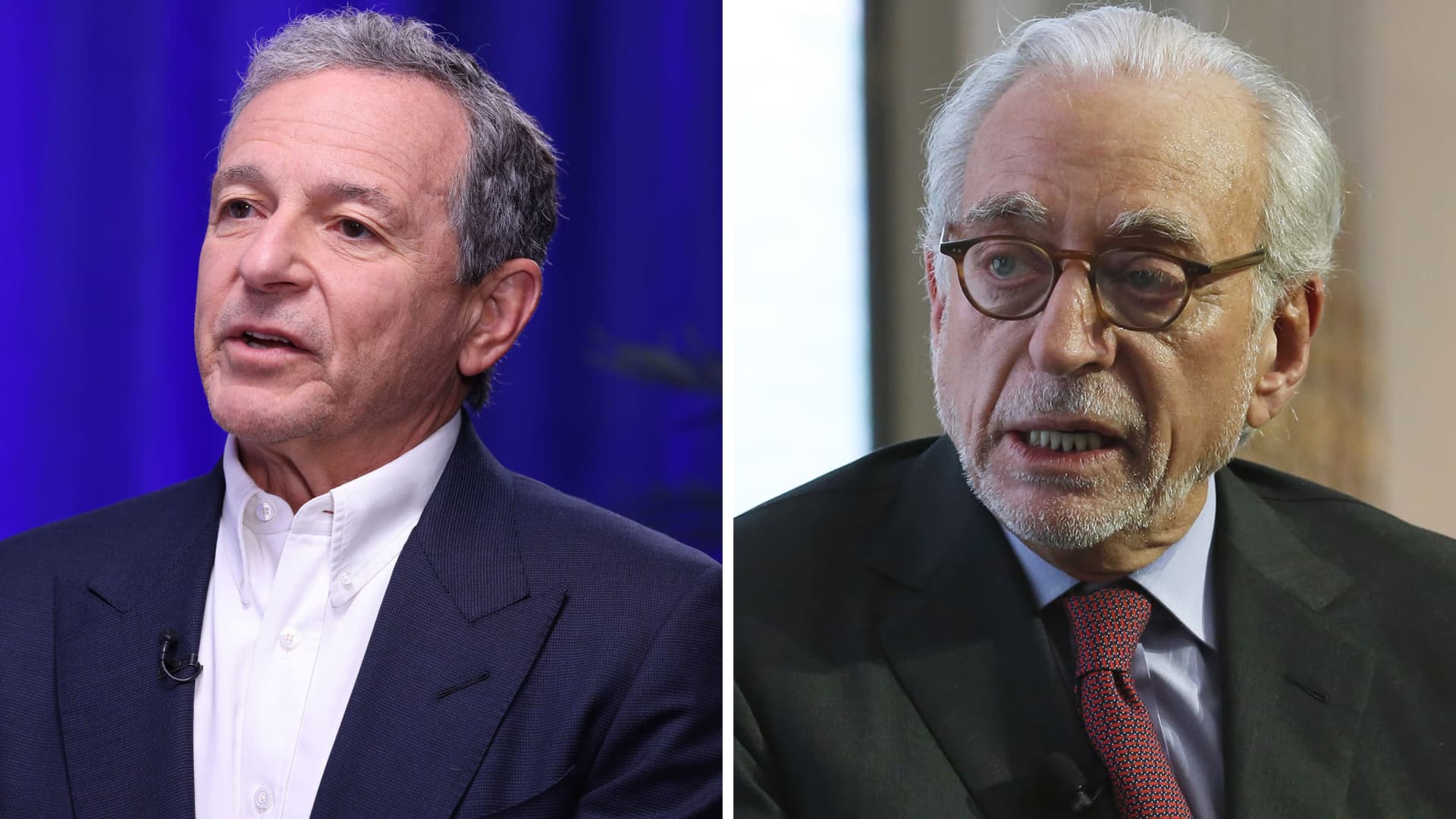

Activist investor Nelson Peltz has sold his entire stake in Disney, a person familiar with the matter tells CNBC.

Peltz sold all of his Disney stock at roughly $120 dollars a share, the person said, making about $1 billion on the position. The stock currently trades for about $100 per share.

The exit comes weeks after Peltz’s Trian Partners lost a proxy battle at Disney in early April as shareholders reelected the company’s full slate of board nominees. Peltz had been seeking to elect himself and former Disney Chief Financial Officer Jay Rasulo to the company’s board.

Peltz had long taken issue with Disney governance. In October, CNBC reported he upped his stake in the company to about 30 million shares and had reignited his proxy campaign, taking particular aim at the company’s streaming strategy and a failed succession plan for CEO Bob Iger.

“We are proud of the impact we have had in refocusing this Company on value creation and good governance,” Trian said in a statement following the April shareholder vote.

Shares of Disney are up about 11% so far this year, slightly edging out the S&P 500.

Disney didn’t immediately return request for comment.