Congress spending and wasting your money.

getty

The coronavirus pandemic pushed the government into the proverbial corner, prompting it to borrow heavily from the future to ward off a serious threat today. Without this intervention, the U.S. economy would be in a much worse recession or possibly even a depression. Even though borrowing excessively may have been the lesser of two evils, the burgeoning debt will have ramifications in the future. With the debt approaching $27 trillion, and projected to rise to $78 trillion by 2028, it will present significant challenges. How has the national debt changed during past presidential administrations? How will a Biden or Trump win in November impact the future? How will the current fiscal crisis affect future taxation?

National Debt: An Historical Perspective

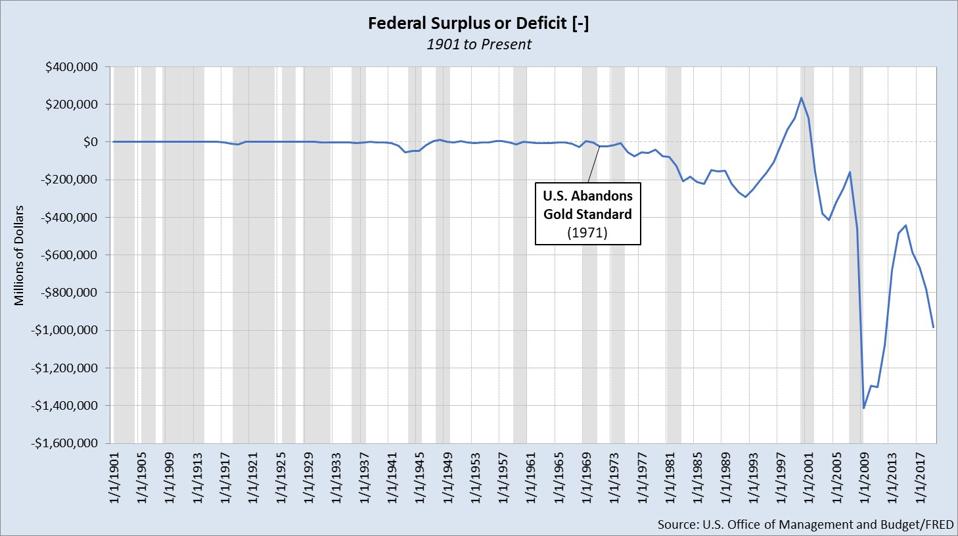

The national debt has been a routine part of the federal budget since President Nixon abandoned the gold standard in 1971. Since 1971, the federal budget has had a surplus in only 4 of 48 years or 8.0% of the time. Moreover, the average fiscal deficit was minor before 1971 as Washington exercised greater restraint with its spending. Once the gold standard was removed however, the shackles fell away as Congress could vote to establish a new, higher credit limit, as needed. The following chart reveals the federal government surplus/shortfall from June 30, 1901 through September 30, 2019. Again, note how things changed drastically after the gold standard was removed.

Federal Budget Surplus/Deficit 1901 to 2020

Federal Reserve Data: FRED

The next chart shows the amount of debt at the start of each president’s term beginning with Jimmy Carter in January 1977. The graph is color coded to denote political party affiliation.

National Debt from Jimmy Carter to Donald Trump

MJP

When Jimmy Carter took office, the debt was $669.2 billion. Four years later, at the end of his term, the debt had risen to $964.5 billion. The debt increased by $1.77 trillion during Reagan’s two terms; $1.4 trillion under Bush the elder; $1.5 trillion under Clinton; $5.3 trillion under Bush the younger; $8.7 trillion during the Obama presidency; and $3.3 trillion under President Trump, thus far.

The following chart shows the percentage increase during each president.

National Debt: Percentage Increase by President from Carter to Trump

MJP

President Carter, along with a democrat-controlled Congress, presided over a 44.1% increase in the national debt. His successor, President Reagan, oversaw a 77.4% and a 60.2% rise in the debt during his two terms while working with a split Congress in all but his final two years in office. During the George H. W. Bush presidency, the federal debt rose 54.4% as democrats controlled both houses in Congress. When President Clinton was in office, the federal debt rose as well, but only modestly. Democrats controlled Congress during his first two years, but republicans regained control for the remaining six years. When George W. Bush occupied the White House, the national debt rose 34.7% in his first term and 43.1% in his second. Republicans controlled Congress in all but his final two years. Under President Obama, the debt increased 50.7% in his first term and 18.3% in his second. During the first three years under President Trump, the debt rose 17.0%. Then came the pandemic.

The following table shows the amount of debt at the start of each presidential term (includes midterms), the percentage of increase during each president, and the party that controlled Congress.

Table: National Debt by President and Control of Congress

MJP

How Much Debt is Too Much?

Most understand, to some extent, that excessive debt will hurt future generations. But to understand the full impact, we will reference a 2011 study conducted by the Bank of International Settlements. The BIS, located in Basel, Switzerland, is owned by 62 central banks from countries around the world that collectively represent 95% of total global GDP. It is the bank of central banks. In the study entitled, “The Real Effects of Debt,” the BIS found, “At moderate levels, debt improves welfare and enhances growth. But high levels can be damaging.” The research examined data from 18 countries from 1980 to 2010. The conclusion? When government debt exceeds 85% of GDP, economic growth slows. Currently, the federal debt to GDP ratio is 136.58%. Thus, we can expect slower economic growth in the future. The report also states that as federal debt rises beyond this threshold, a country’s is less able to handle an unexpected crisis.

Excessive Federal Debt: What Does it Mean?

A government is only as solvent as its citizens. If jobs are plentiful and wages are decent, the economy will fare better, and tax revenues will follow. However, with such a high level of debt, if Washington fails to get the budget under control, it will seek to raise taxes. However, you cannot tax your way to prosperity, and in fact, increased taxation is an economic headwind.

How will the November election affect things? If Trump wins, he will continue to deregulate and cut taxes to stimulate economic growth. Trump is very much like Reagan on economic growth. If Biden wins, there will be increased regulation, higher taxation, and an increase in social programs. As government expands, it will require even more revenue and taxes will be the vehicle. However, with an already burgeoning debt, which is expected to grow substantially in the coming years, additional debt will create systemic problems which, at some point, may be impossible to escape.

America is at a crossroad. If the national debt rises as projected ($45 trillion in 2024 and $78 trillion in 2028), Americans will feel the pain as labor markets tighten, the gap between the top 10% and the bottom 50% widens, and social unrest grows.

To quote Ronald Reagan, “There is a clear cause and effect here that is as neat and predictable as a law of physics: As government expands, liberty contracts.”