Getty

What’s does 2020 hold for your utility stocks (and closed-end funds)? Will these steady income plays hand us another round of big gains and dividends? Or is there trouble ahead?

These are reasonable questions to ask after these “boring” stocks poured on a huge—and rather “un-utility-like”—26% total return last year!

Let’s dive into three critical factors that will tell the tale for utilities in 2020. And because it’s the season for forecasts, I’ll throw in my verdict on the sector for the coming year, too, and name five utility closed-end funds (CEFs) paying huge dividends of 6.3% to 9.4%.

2019’s Gain: Not What It Seems

First, bear in mind that 2019’s big return comes after a 2018 in which utility stocks did, well, very little, with a total return of just 3.9%. Strip out dividends and that drops to roughly zero!

With that in mind, 2019’s monster run doesn’t seem out of line: when we calculate utilities’ total returns over the last two years, we get an annualized 14.9%. That’s close to the 13.7% yearly average they’ve returned in the past decade, so there’s little worry of a correction here.

Let’s move on.

Utilities Were Actually Laggards in 2019

Another way to put utilities’ 2019 gain in perspective is to ask if they crushed other sectors and the S&P 500 as a whole.

They didn’t. Not by a longshot.

Utilities: “We’re No. 8!”

SPDR

There’s a lot of small print in this chart, so let me break it down for you: on a price basis, utilities were eighth of the 11 S&P 500 sectors—far from outperformers! And even when you include their bigger-than-average dividends, utilities underperformed the S&P 500 as a whole and have mostly traded flat since mid-September.

In fact, as steady income producers, this kind of modest return relative to other sectors is what we’d expect, which is another argument against a major correction in 2020. However, utilities’ weakness in the past few months could set us up for a smaller downtick in the near term.

Finally, let’s talk about profits, the driving force behind our gains (and dividends).

2020 Earnings Look Strong—With a Catch

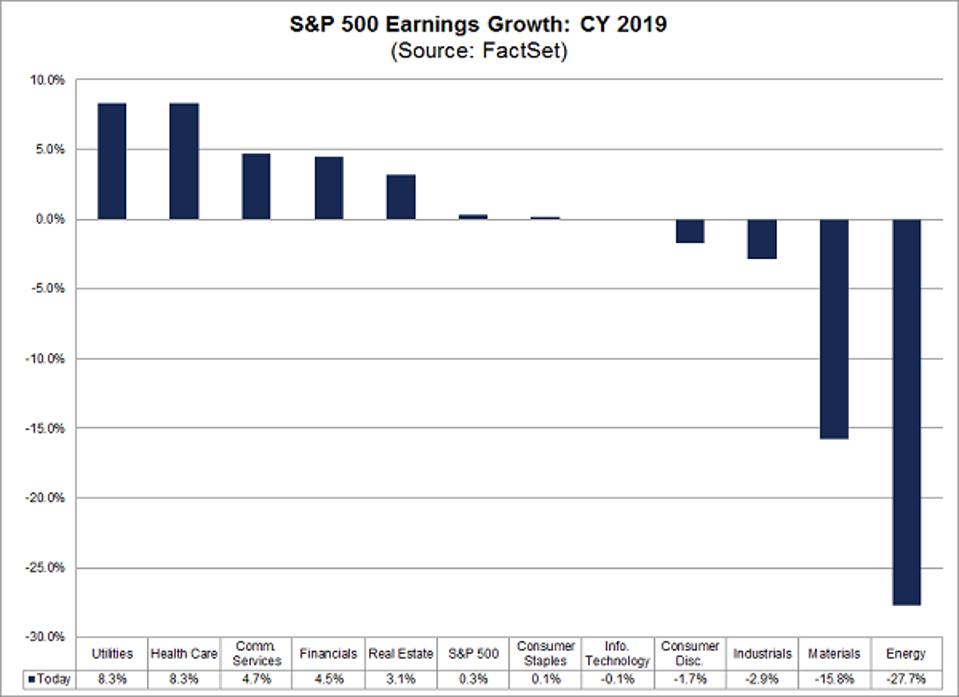

Here’s one spot where we see a yellow light, because utilities posted 8.3% earnings growth in 2019, tied with healthcare for top spot in the S&P 500.

FactSet

As a result, expectations for 2020 are modest: just 5% profit growth, the lowest of all S&P 500 sectors (tied with financials). In short, the strong 2019 was great for last year, but it could set us up for a correction in the months ahead.

5 Utility CEFs for Your Watch List

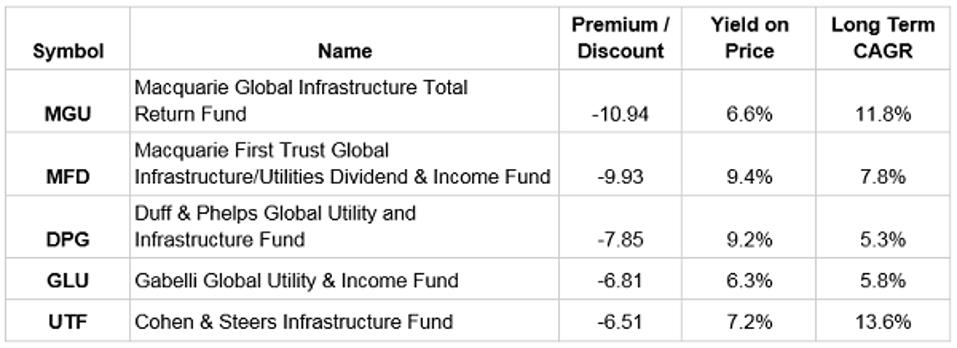

While now may not be the best time to buy utilities, it is a great time to bulk up your watch list so you’re ready to pounce when a utility correction comes along. Here are five CEFs to add to yours now. All trade at discounts, and all boast S&P 500–busting yields of 6.3% to 9.4%.

Contrarian Outlook

Michael Foster is the Lead Research Analyst for Contrarian Outlook. For more great income ideas, click here for our latest report “Indestructible Income: 5 Bargain Funds with Safe 8.5% Dividends.”

Disclosure: none