A “sold” sign is posted on a home in Westfield, Ind., Friday, Sept. 25, 2020. The housing market has … [+]

ASSOCIATED PRESS

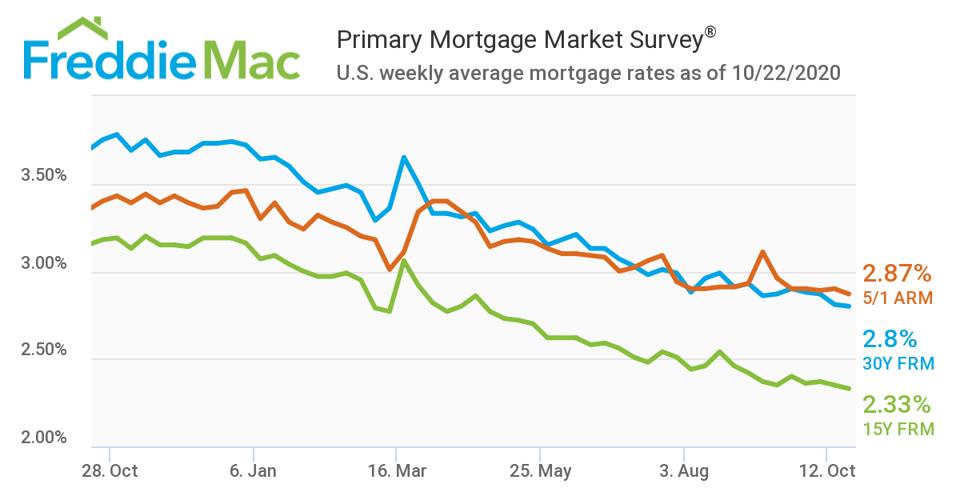

Mortgage rates have never been lower. That’s the upshot from Freddie Mac’s weekly Primary Mortgage Market Survey. As of October 22, 2020, Freddie Mac reported that rates on a 30-year fixed-rate mortgage (FRM) had dropped to 2.8%. The rate on a 15-year mortgage declined to 2.33%. Both had additional fees and mortgage points totaling 0.6% of the mortgage amount.

A 5/1 adjustable-rate mortgage (ARM) often has an initial interest rate that’s lower than a fixed-rate mortgage. Freddie Mac, however, reported that a 5/1 ARM had a higher rate of 2.87%. Its fees and mortgage points were a bit lower at 0.3%.

Freddie Mac’s Primary Mortgage Market Survey for the week ending October 22, 2020

Freddie Mac

As the chart above reflects, mortgage rates have come down significantly over the past year. A 30-year fixed-rate mortgage a year ago charged interest of about 3.7%, nearly 1.5% higher than today’s rates. On a $300,000 mortgage, today’s lower rate translates into a savings of about $225 a month, before factoring in taxes.

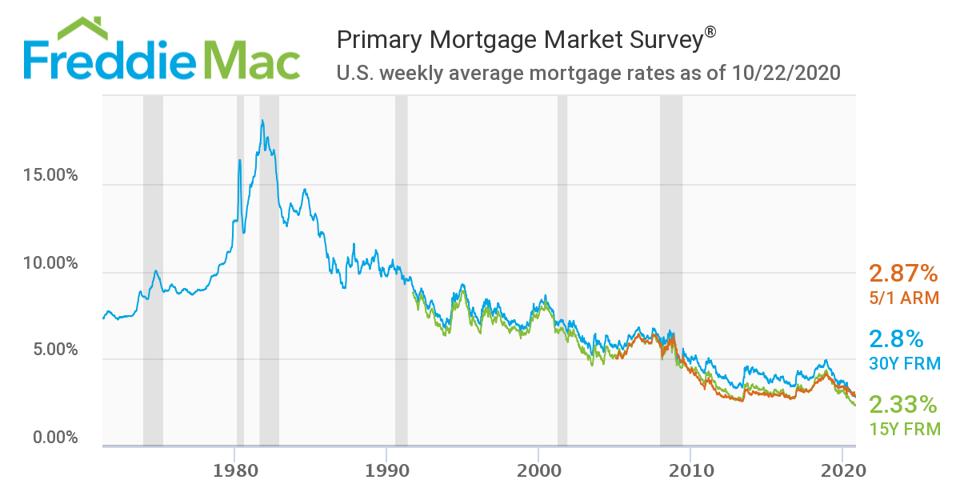

Mortgage Rates at Historic Lows

Freddie Mac’s PMMS dates back to April 1971. For those history buffs among you, the rate on a 30-year fixed-rate mortgage on April 2, 1971, was 7.33%. It hit its high-water mark on the week of October 9, 1981, at an unthinkable 18.63%. To put that number into perspective. the principal and interest on a $300,000 30-year mortgage at today’s rate would cost $1,159 a month. At the rates prevailing in October 1981, the monthly payment on the same home loan would skyrocket to $4,676.

A chart from Freddie Mac shows the downward trend in rates over the past four decades.

Freddie Mac mortgage survey from 1971 to 2020.

Freddie Mac

Note that Freddie Mac didn’t track 15-year mortgages until 1991 and the 5/1 hybrid ARM until 2005.

Low Rates Drive Housing Costs Higher

One of many things I’ve learned from Warren Buffett is that low interest rates drive asset prices higher. That’s certainly true in the housing market. As reported by Forbes Advisor, single-family home prices rose in 174 of 181 metropolitan areas over the past year. Some areas have seen double-digit gains. Huntsville, Alabama, for example, saw a 13.5% rising in single-family homes.

More recently, the National Association of Realtors reported this month that existing home sales grew for the fourth consecutive month. As of September, sales grew at a seasonally-adjusted annual rate of 6.54 million, up 9.4% from the prior month and almost 21% from one year ago. At the same time, the median existing-home price was $311,800, up almost 15% from a year ago.

Low rates aren’t the only driver behind the rise of housing costs. As NAR reported, total housing inventory decline month-over-month and year-over-year to 1.47 million. NAR said it was a record low that at current prices is enough to last just 2.7 months. Mark Zandi of Moody’s Analytics also noted the move away from urban centers to single-family homes in the suburbs as a factor in driving up housing costs. Both a shift to work-from-home arrangements and a desire to move out of densely populated areas have driven this change.

Refinancing Accelerates

The low rates have also caused an uptick in refinancing. According to the Washington Post, a key metric showing home owners paying off mortgages early rose to its highest level in 16 years. Prepayment activity reached more than 3% of all mortgages, up 12.7% from the prior month, according to mortgage data analytics firm Black Knight.

The low rates can make refinancing enticing even for those who purchased or refinanced a home just one year ago. As noted above, today’s lower rates could save a borrower over $200 a month on a $300,000 30-year fixed rate mortgage. According to the Mortgage Bankers Association, mortgage applications volume decreased 0.6% on a seasonally adjusted basis from the prior week. This could be due in part to higher housing costs. Yet the Refinance Index shows an increase of 0.2% from the previous week and was 74% higher than a year ago.

Covid-19 Can’t Slow the Housing Boom

The housing market is one of the few economic bright spots during the Covid-19 inspired recession. The increase in housing costs raises the question of whether we are in another housing bubble reminiscent of the 2007 crisis. Those in the real estate business naturally dismiss the idea of a housing bubble. While they acknowledge that some markets are overvalued, they believe this is driven by high demand and low supply. The numbers do support this theory.

At the same time, one can’t help but recall these words: “Those who cannot remember the past are condemned to repeat it.”