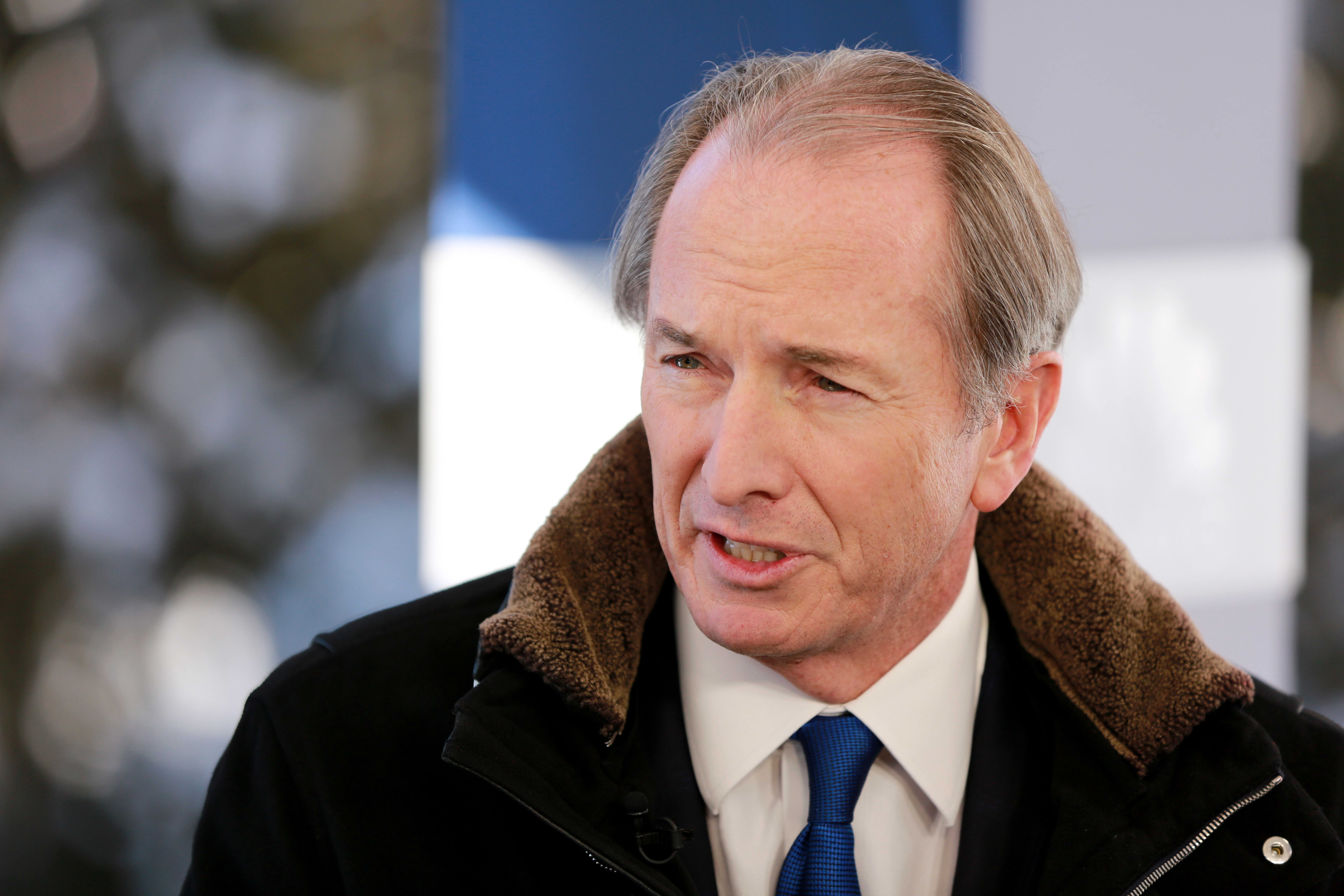

Morgan Stanley CEO James Gorman sees the coronavirus-induced global recession lasting for the entirety of this year and 2021.

When asked about how a potential economic recovery expected in the second half of this year would take shape, Gorman said that while he hopes it will be a sharp “V” recovery, in reality it will probably take longer to reopen cities and factories.

“If I were a betting man, it’s somewhere between a `U’ or ‘L'” shaped recovery, Gorman told CNBC Thursday in an interview. “I would say through the end of next year, we’re going to be working through the global recession.”

As parts of the country have shown signs that social isolation-tactics have begun to moderate the spread of the coronavirus, the discourse among CEOs and elected officials has turned to when the economy can be reopened. JPMorgan Chase CEO Jamie Dimon said this week that he thinks the process can begin in June, July or August, and that it will occur in phases by regions and individual companies.

But a prolonged recession like the one feared by Gorman could mean millions more job losses and individual and corporate borrowers defaulting on more loans than is currently expected by the banking industry.

“This is not going to turn on a dime,” Gorman said. “We’re not going to get to the point where everybody is on the subway in one day. To get consumers and small businesses back and to get everybody feeling like the world is stable again, that’s going to take months.”

Gorman, who was speaking after his company posted first-quarter results, noted that the bank’s trading desks functioned well despite operating during the ten highest-volume trading days on record in March. Each of those days was more than 50% higher than the previous record, he added.

“If you told me three months ago we could have 90% of employees out of the office and be functioning with the volumes we have had,” Gorman said, “I would’ve said the probability of that being pulled off is close to zero, but it happened.”

Read more: Jamie Dimon says US companies might send employees back to work by ‘June, July, August’