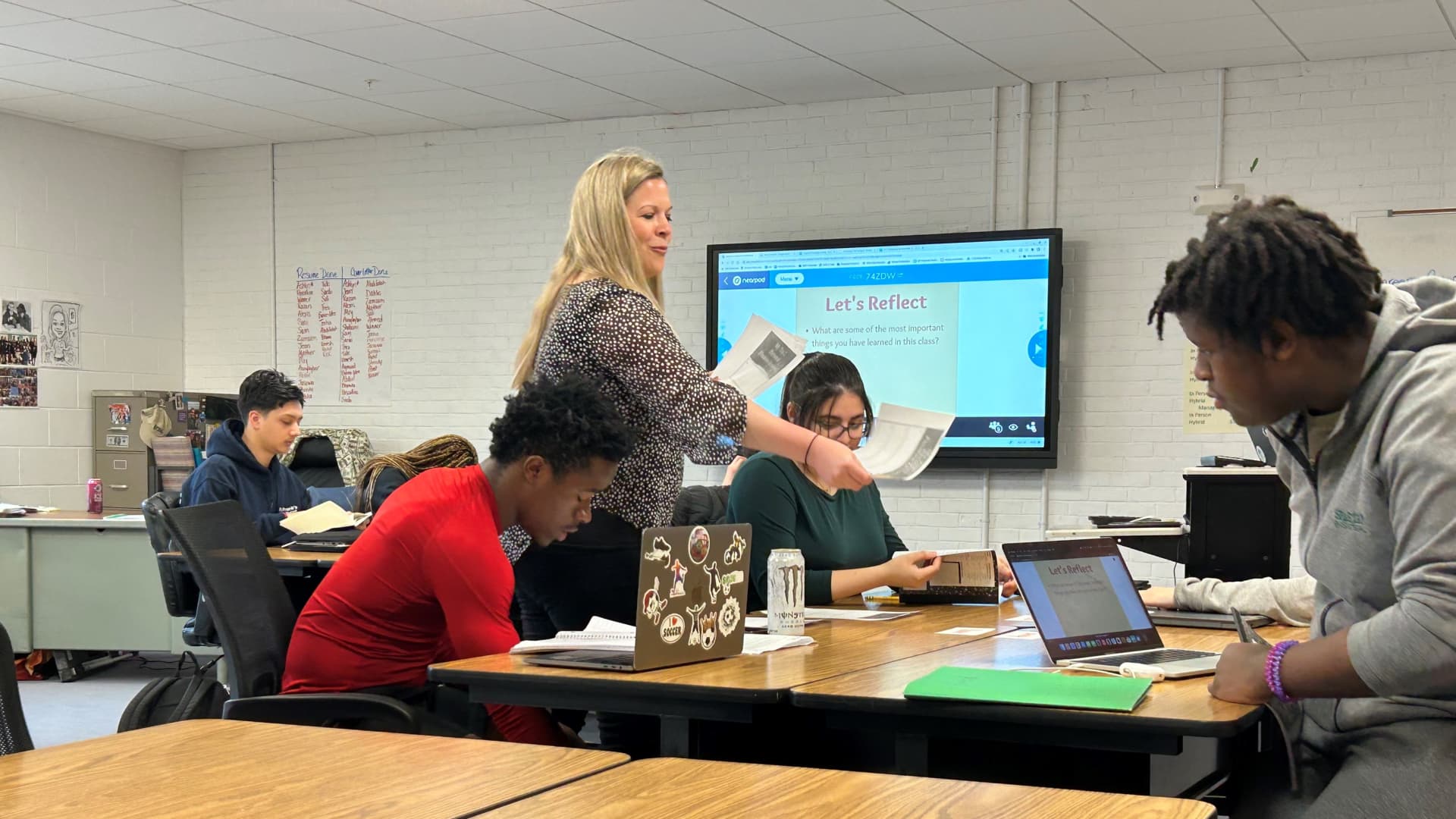

At Winooski High School in Winooski, Vermont, students in Courtney Poquette’s personal finance class are learning about money management, including figuring out how they can afford items they may want to have in their first apartment.

“You’re going to have to buy all of the things that you want,” she explains to her students. “And then figure out how many hours you have to work for them.”

Poquette provides the class with a list of recommended home furnishings and appliances, including a bed frame, mattress, desk and microwave. Students search on Amazon, Walmart and other retailer websites on their laptops to find the cost of the items they choose. Then, they calculate how many hours it would take to work a minimum wage job to afford those items.

“It’s just so helpful for them when they’re thinking about monthly bills and expenses and salaries and choices that they’re going to make after high school,” said Poquette, adding she wants “to make sure that they can maintain the lifestyle that they want for themselves.”

Budgeting, banking and building credit are among the many real-life money lessons taught in this personal finance class that all students in the small school district, located outside of Burlington, are required to take before graduating from high school.

More personal finance courses but no guarantees

An increasing number of states are adding financial education to the curriculum in public high schools, but it’s not a guarantee that the schools will offer a dedicated course or that students will take it. While schools may teach some personal finance topics, most do not require students take a semester-long personal finance class to graduate.

Often, “it’s a matter of priorities,” said Laura Levine, president and CEO of the Jumpstart Coalition, a Washington, D.C.-based nonprofit focused on financial education for students. “It is finding time in the day. It’s finding the budget to implement. And then sometimes with legislation, it’s other factors that really don’t even, you know, relate directly to the education itself.”

Only eight states require all high school students to take a semester-long personal finance course before graduation — and 10 states are in the process of implementing that requirement, according to Next Gen Personal Finance, a non-profit organization that tracks the progress of financial literacy legislation in states.

However, the momentum for states to guarantee financial education for students has been growing — with legislation introduced in 30 states this year, including Vermont.

In 2018, Vermont’s State Board of Education adopted standards to teach personal finance in kindergarten through 12th grade, but the board left it up to local school districts to implement. A bill to make a personal finance class a high school graduation requirement statewide that was introduced earlier this year has stalled in the Vermont legislature.

Winooski is one of only about 20% of high schools in the state that requires students to take a personal finance class to graduate, Poquette said. Yet, some of her students are advocating for everyone to take it.

When personal finance is required in high school, you see improvements in credit scores.Carly Urbaneconomics professor at Montana State University

Alexis Blend, a 10th grader, said she now reads the pay slip from her part-time job more carefully since taking the class. “I realized that I had been paid wrong a couple of times and I just didn’t notice,” she said. “So I think I’m already more alert and aware.”

Senior Tide Gully agreed. “I think it’s going to help me understand a lot more ways that I can avoid getting into debt, which I know is a big problem,” he said.

“It’s one of the few classes that no matter what you’re gonna do, it can apply to your life in some sort of aspect,” said senior Dahlia Maynard.

And, research shows high school students who take a personal finance class make better financial decisions as young adults.

“When personal finance is required in high school, you see improvements in credit scores,” said Carly Urban, an economics professor at Montana State University. ”You see reductions in delinquency rates, you see fewer payday borrowing choices, you see less reliance on credit cards.”

Poquette, a business educator for 17 years, continues to advocate for personal finance education being offered throughout the Vermont and the country.

‘We really need to make sure that every student gets in the class, because once they get in the class, they realize, ‘I needed to learn this’,” Poquette said. “So that’s why a guarantee in every state is so important.”

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version Dinero 101, click here.