Caregivers Face Dual Challenges From Caring And From Working For Pay

November is National Family Caregivers Month, honoring those who care for their loved ones. More than 40 million people provide care for their parents, a sick spouse, a disabled child or an ailing friend. Older adults often have to rely on help from family to manage health issues as they get older because they don’t have enough money to pay for care. Women, especially single women, are still more likely to be caregivers and they often provide more intense caregiving than men do. Most women who help their loved ones also work for pay. The unexpected demands from caring for others can disrupt their work and careers. These challenges worsen an already wide gender retirement savings gap. Single women already face more financial challenges in retirement than either married women or single men. This gender retirement gap will only increase unless policymakers finally take family caregiving challenges seriously and address it comprehensively.

Wealth inequality has grown to record levels, leaving many middle-class families ill-prepared for the future as they get older. In June 2019, the average household in the bottom half of the wealth distribution had $32,598 (in 2019 dollars). This is about the same level working-class families had before the Great Recession got under way at the end of 2007 and it is well below the $44,761 working-class families owned on average in March 2000 (see figure below). Working-class families have fewer resources than in the past to pay for key costs such as long-term care.

Single Women Have a Lot Less Wealth Than Single Men

Yet people face increasing costs in retirement. They live longer, making the population 85 years old and older the fastest growing group. Many of those living to older ages will need some help in managing their lives as health issues inevitably arise.

Many families will not have enough resources to pay for care nor are they poor enough to qualify for public assistance, especially from Medicaid. Family caregivers, often wives and single daughters, will fill the void and help their ailing loved ones.

Caregiving poses substantial economic risks for caregivers. Caregivers often earn less than non-caregivers, in part because they get less attractive assignments at work and get fewer promotions. They also have to unexpectedly take time off, cut back on their regular work hours or quit their jobs all together to juggle the dual demands from both paid work and caring for others.

All of these aspects of caregiving translate into less wealth. Lower pay obviously means that people have less money to save. Fewer hours and more frequent job switches make it harder for people to qualify for an employer’s retirement plan. And, caregivers’ incur additional costs as they often financially support care recipients.

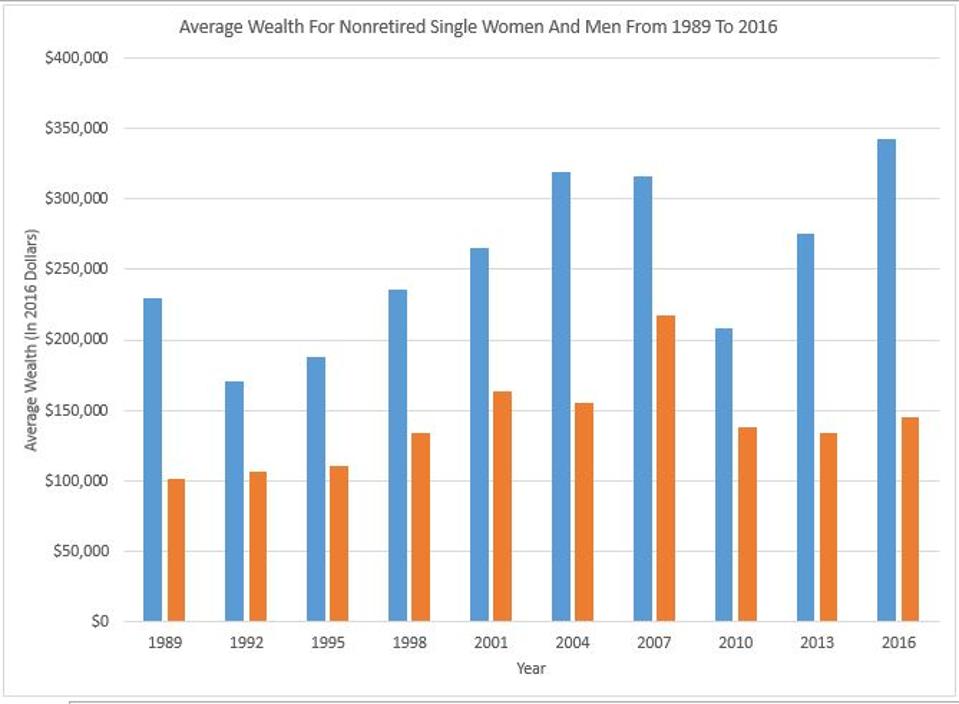

Women already fall behind men with their retirement savings. Single women had on average about 42% of the average wealth of single men in 2016. In fact, the average wealth gap among singles, who were not retired had widened in the wake of the Great Recession (see figure below).

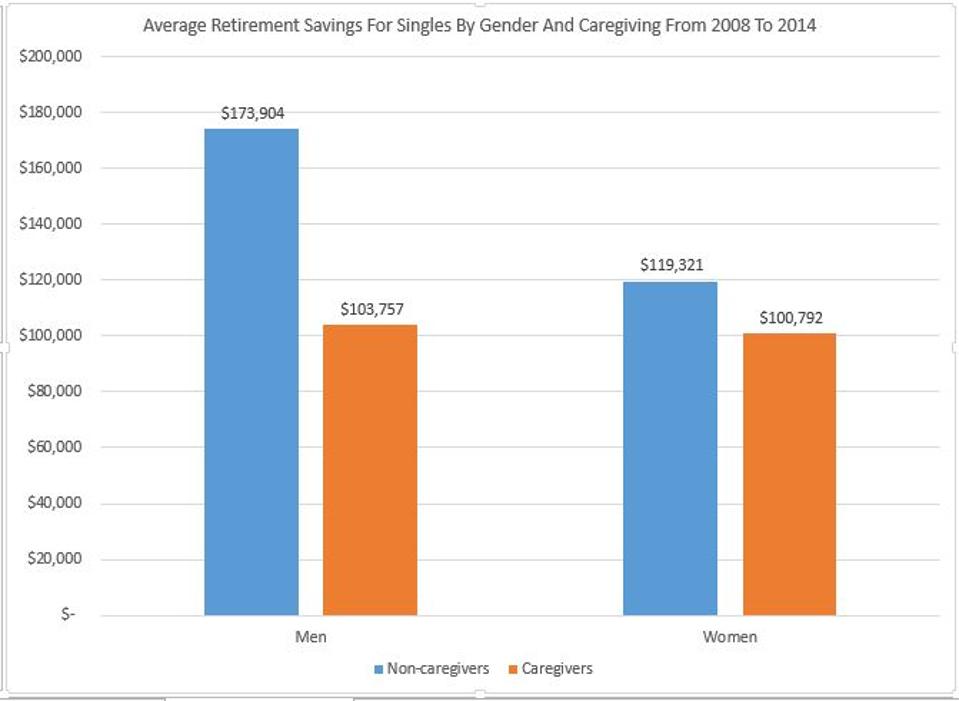

Caregiving Widens The Gender Wealth Gap

Family caregiving often widens the gender wealth gap. The data in the Health and Retirement Study show that single women who helped their parents with personal tasks such as clothing and bathing had an average wealth of $221,984 (in 2014 dollars) from 2008 to 2014. In comparison, single women who were not caregivers had average wealth of $244,983, putting them further behind the average wealth of men who weren’t caregivers.

Other factors contribute to the gender wealth gap by caregiving. It is not just worse labor market outcomes – fewer hours, less stable jobs and lower pay – that holds back caregivers, but caregiving also frequently contributes to worse health outcomes such as back pain and depression. Those raise costs and make it harder for people to continue working. Moreover, caregiving is often more a marathon than a sprint. The longer it lasts, the worse the effects of caregiving are on caregivers’ finances.

As an ever larger share of older households enter retirement with few savings, demands on family caregivers will rise. A disproportionate share of caregiving responsibilities still falls on women. Family caregiving thus widens the already large gender wealth gap, unless policymakers step up and provide more than lip service to those helping others. And this policy approach will need to be comprehensive to ultimately help shrink the gender wealth gap.