lechatnoir

Millennial investors residing in California are packing their bags for friendlier tax climes.

That was one of the findings from a recent analysis by financial services firm Wealthfront. The company studied more than 200,000 clients, defining millennials as those born between 1980 and 1994.

Half of the young clients who are planning to leave California are fleeing to locales with lower taxes, according to the data.

More from Personal Finance:

Someone won the $372 million jackpot. What to do next

Paid parental leave is coming for more than 2 million people

This company’s average employee is getting a $50,000 bonus

More than 1 in 3 millennials who are moving from the Golden State are heading to states with no income tax, Wealthfront found.

Meanwhile, 14% of these young investors are leaving California for places with low property taxes.

Wealthfront’s findings are reflective of a larger trend. Last year, a total of 691,145 Californians packed up for other destinations, according to Census data.

More than 86,000 of these individuals wound up settling in Texas, making it the top landing place for people departing California, the Census found.

Living on the Pacific coast comes at a steep cost. California has a top individual income tax rate of 13.3% — the highest in the country, according to the Tax Foundation.

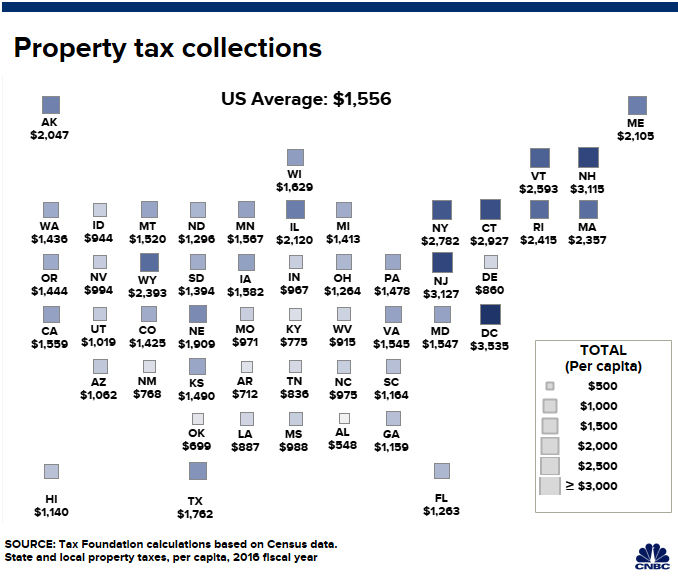

The state also collected $1,559 in property taxes per capita in 2016, according to the foundation.

The Tax Cuts and Jobs Act has also made it costlier to live in high-tax areas.

For example, taxpayers are only able to claim up to $10,000 in state and local tax (or SALT) deductions on their federal return.

Back in 2017, prior to the overhaul of the federal tax code, Californians who itemized deductions claimed an average SALT deduction of $20,451, according to the Tax Policy Center.

Taxes should only be one factor in the decision to relocate. Consider the cost of living in your new area, as well as whether the place will be a fit.

“Spend some quality time there and understand the people and the culture,” said Dan Herron, CPA and principal of Elemental Wealth Advisors in San Luis Obispo, California. “The last thing you want to do is move and find out you don’t mesh with the people.”

Here are the top destinations for millennial investors in California, based on Wealthfront’s findings.

Texas

Downtown Austin, Texas.

John Coletti

The Lone Star state doesn’t tax individual income, making it a welcome change for high-earners based in California.

Don’t rent the U-Haul just yet. When a state skimps on individual income, it needs to collect revenue from other sources, including levies on property.

Property taxes on a per capita basis are slightly higher in Texas than they are in the Golden State: $1,762, according to the Tax Foundation.

Washington state

Didier Marti | Moment | Getty Images

Residents of the Evergreen State also avoid individual income taxes at the state level.

Be aware that retail sales taxes are a principal source of revenue for Washington state.

It has a combined state and local tax rate of 9.18% — the state with the fourth-highest average rate — according to the Tax Foundation.

Colorado

Jacobs Stock Photography Ltd

Colorado isn’t an income tax-free haven, but it does offer lower levies on income compared to California: a top rate of 4.63%.

The Centennial State is also among the locales with the lowest property tax rates, according to ATTOM Data Solutions.

The effective property tax rate there is 0.51%, compared to New Jersey’s effective property tax rate of 2.25% — the highest in the nation, ATTOM found.