When you’re saving for retirement, keep in mind that Medicare premiums include surcharges for … [+]

getty

The Centers for Medicare & Medicaid Services has announced Medicare Part B premiums for 2021, and the base premium increases just 2.7% from $144.60 a month to $148.50 a month. That $3.90 monthly increase compares to a big $9.10 monthly increase last year, after a $1.50 monthly increase the year before. Meanwhile high earners are still getting used to income-related surcharges that kicked into higher gear in 2018, and those have been bumped up again too. The wealthiest senior couples will be paying more than $12,000 a year in Medicare Part B premiums. Part B (the base and the surcharge) covers doctors’ and outpatient services.

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of just $5 from the annual deductible of $198 in 2020. What kept the increases n the Part B premiums and the deductible in check this year? As part of the short-term budget bill in October, Congress capped the increases. Yet Medicare spending is expected to grow this year as people seek care they may have delayed due to Covid-19, CMS says.

The CMS announcement comes after last month’s Social Security Administration’s COLA announcement: a 1.3% cost of living adjustment for 2021. The average Social Security benefit for a retired worker will rise by $20 a month to $1,543 in 2021, while the average benefit for a retired couple will grow $33 a month to $2,596. The higher Medicare Part B premium cuts into retirees’ monthly Social Security payments. Part B premiums typically are deducted from monthly Social Security checks.

While most of the 60 million Medicare recipients will pay the new $148.50 standard monthly premium, some will pay less because of a “hold harmless” provision that limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

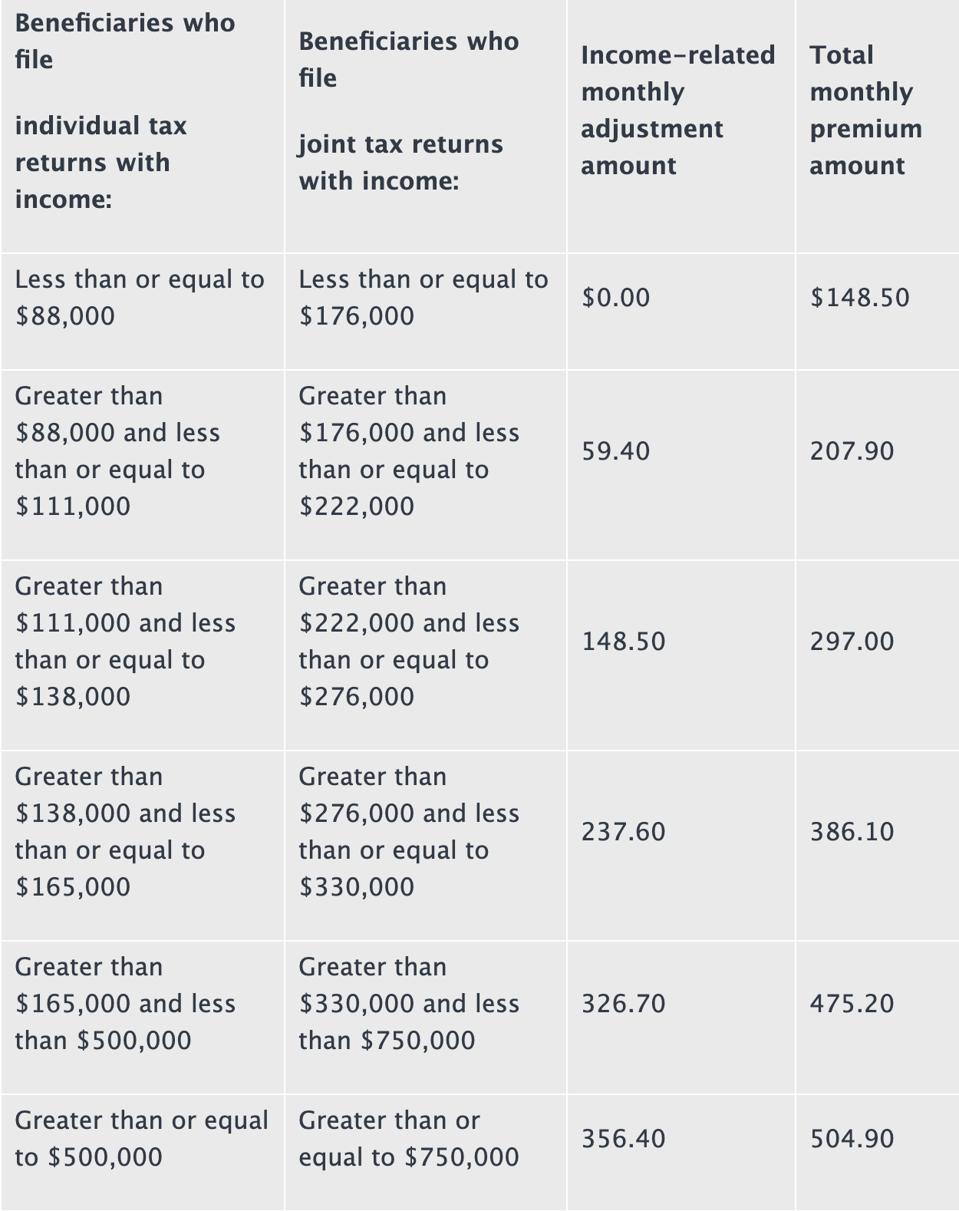

CMS says 7% of Medicare recipients will have to pay income-related surcharges. The graduated surcharges for high-income seniors kick in for singles with modified adjusted gross income of more than $88,000 and for couples with a MAGI of more than $176,000. An individual earning more than $88,000, but less than or equal to $111,000, will pay $207.90 in total a month for Part B premiums in 2021, including a $59.40 surcharge. That’s up 2.7% from 2020, when they paid $202.4 total in a month, including a $57 surcharge.

By comparison, the wealthiest retirees—singles with $500,000 of income or more and couples with $750,000 of income or more—will face total premiums of $504.90 a month per person, including a $356.40 surcharge, in 2020. That comes to $12,117.60 a year f0r a couple.

The income-related premium surcharges apply to Part D premiums for drug coverage too.

Here are the official numbers from the CMS release, what you’ll pay per month for 2021, depending on your income, for individuals and couples filing a joint tax return (the 2021 income-related surcharges are based on AGI reported on 2019 tax returns):

2021 Income-Related Surcharges

CMS

CMS announced in July that the average basic premium for Part D, private health plans which cover prescription drugs, is $30.50 for 2021. But it’s still important to shop around for a plan. Even as Part D premiums fall, there may be higher costs elsewhere, such as higher co-pays, narrower formularies, or a drug may not be covered altogether, says Mary Johnson, Social Security and Medicare policy analyst with The Senior Citizens League. The State Health Insurance Programs National Network lists places where you can get free help locally to compare plans. Medicare open enrollment runs from October 15, 2020 through December 7, 2020 for the 2021 plan year.