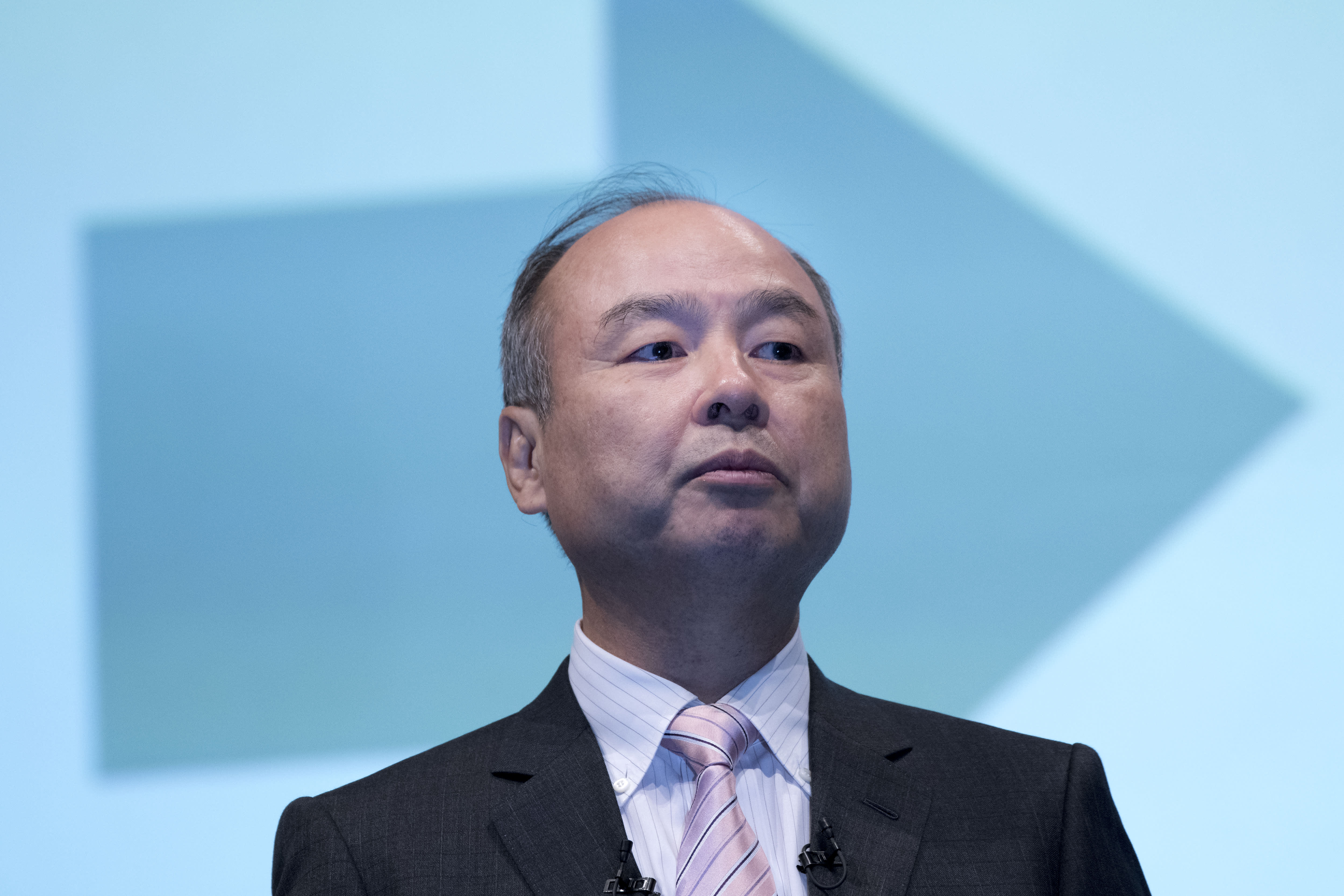

Corp. Chief Executive Officer Masayoshi Son speaks during a joint announcement with Toyota Motor Corp. to make new venture to develop mobility services in Tokyo, Japan, 04 October 2018.

Alessandro Di Ciommo | NurPhoto | Getty Images

The whole WeWork debacle, from the botched IPO to the removal this week of Adam Neumann as CEO, may have been avoided if SoftBank had simply valued the company more like a real-estate business and less like a high-growth tech company.

So how did SoftBank CEO Masayoshi Son and his lieutenants decide WeWork was worth $47 billion, a number public market investors viewed as nearly four times too high?

The answer is a combination of abounding optimism from Son, SoftBank president Ron Fisher and Vision Fund chief Rajeev Misra, and the elimination of dissenting viewpoints around Son, according to people familiar with the matter, who asked not to be named because the valuation discussions were private. A spokesperson at SoftBank declined to comment.

It’s not exactly fair to say SoftBank was on the hook at $47 billion, as only $1 billion of its $10.65 billion investment in the company came at that valuation. SoftBank has put money in WeWork several times, including a $4.4 billion investment in 2017 at a valuation of about $20 billion.

That’s still far more than the likely public market valuation of WeWork, which had fallen as low as $10 billion, Reuters reported two weeks ago.

‘They thought they could flip it’

WeWork’s botched plan to go public is the latest example of financial realities clashing with Masayoshi’s Son 300-year vision and the long-term investment thesis of his $100 billion Vision Fund.

At one point, Son’s optimism about WeWork was countered by dissenting voices, such as Nikesh Arora and Alok Sama, according to people familiar with the matter. But Arora departed SoftBank in 2016 after serving as SoftBank’s president for two years, reportedly after Son told him he wasn’t planning on giving up his job as CEO for another five to ten years.

Sama departed earlier this year after serving as president and chief financial officer of SoftBank Group International after being barred from working on the Vision Fund, a result of a mysterious shareholder campaign that sought to oust both Sama and Arora, The Wall Street Journal reported last year.

While the Vision Fund has brought in veteran bankers and investors including Deep Nishar, Jeff Housenbold and Michael Ronen in recent years, Son’s opinion on investments is the only one that truly matters, and he’s less likely to be challenged than before, according to people familiar with the fund’s operations.

Arora and Sama did a lot of the early detective work around WeWork for SoftBank, advising Son that he should not invest in WeWork in 2016 at an $8 billion valuation, two of the people said.

But Fisher and Son liked Neumann’s drive and saw potential in WeWork’s expanding growth, believing the company would be a good fit as a Vision Fund investment — a potentially dominant company in an industry that needed substantial growth funding to expand globally. WeWork cited China 173 times in its IPO prospectus, most of which related to its ChinaCo joint venture. While most U.S. tech companies have failed to make meaningful inroads in China, WeWork has 115 buildings across 12 cities in Greater China, about 15% of its total office space locations.

The growth prospects prompted SoftBank to be extremely aggressive with its valuation estimates. WeWork competitor IWG has a market capitalization of $3.6 billion on trailing 12-month revenue of $2.7 billion, a 1.3x price-to-revenue multiple. WeWork’s comparable revenue as of June 30, 2019, was $2.6 billion. A valuation of $47 billion marked SoftBank at an 18x price-to-revenue multiple.

Misra eventually came to agree with Fisher and Son, saying in 2018 that the company will “be a $100 billion company in the next few years,” according to Business Insider.

And growth did seem to be there. WeWork’s revenue more than quadrupled to $1.82 billion from 2016 to 2018, according to its S-1 filing. In just the first half of 2019, sales were $1.53 billion. But losses also deepened, to about $690 million over the same six-month time period in 2019.

Others around Son began to push back on his excitement with WeWork, including Saudi Arabia’s Public Investment Fund, which was uncomfortable about committing so much of the Vision Fund’s proceeds to one company. That led Son to pull back on a proposed $16 billion infusion of capital of 2019 and make a much smaller $2 billion investment.

At the same time, SoftBank was also trying to raise billions more for a second Vision Fund — and printing a headline valuation of $47 billion for WeWork would signal the first fund was firing on all cylinders. Son claimed his Vision Fund limited partners had already earned a 45% return on their money on Vision Fund 1 earlier this year — but that included paper gains, such as WeWork and Uber, another large SoftBank investment, which has lost value since going public.

Those close to Son say his faith in WeWork isn’t based on misdirection as much as it’s founded in his belief that the company will turn into a massive financial success with time and others would view it in a similar light. CNBC and other publications have confirmed JPMorgan, Goldman Sachs and Morgan Stanley told Son and Neumann they could find buyers for WeWork between $60 billion and $100 billion, according to people familiar with the matter.

“Basically, they paid $47 billion because they thought they could flip it,” said Aswath Damodaran, who teaches corporate finance and valuation at the Stern School of Business at New York University, in an interview. “The kind of numbers that were being thrown around before the IPO were great. So I think Softbank just got greedy and stupid at $47 [billion] because the IPO was imminent and people will see what we paid. It’s a combination of arrogance and greed.”

Damodoran said in a blog post that he valued WeWork at $14 billion, tempering growth expectations by noting that WeWork has close to $24 billion in “conventional” debt and could be at risk to an economic downturn. He also notes that WeWork’s closest competitor, IWG (formerly Regus), has had recent operating margins of about 11%. If WeWork’s margins are similar in the coming years, there’s little chance the company could be valued close to $40 billion.

“To the question of whether WeWork could be worth $40 billion, $50 billion or more, the answer is that it is possible but only if the company can deliver well-above average margins, while maintaining sky-high growth,” wrote Damodaran.

— CNBC’s Kate Rooney contributed to this report.

Follow @CNBCtech on Twitter for the latest tech industry news.