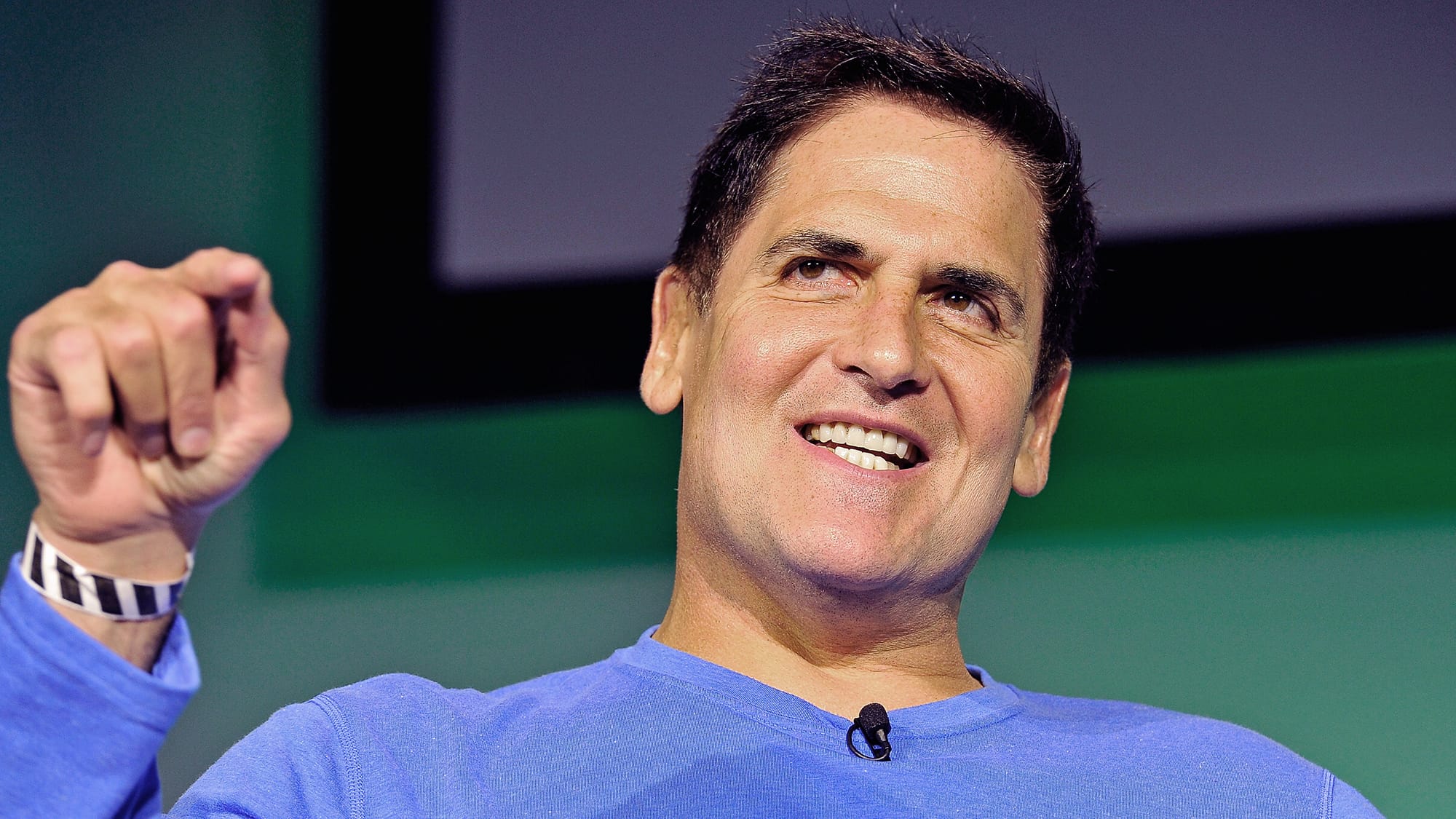

Though billionaire investor Mark Cuban has warned people to be cautious with cryptocurrency, he recently said digital assets — from digital goods to cryptocurrencies like bitcoin — will be the future of business.

And Cuban has invested in cryptocurrency himself, both in business and personally. In fact, Cuban has an extensive cryptocurrency wallet, which he shared on Tuesday in a Reddit AMA: “I own AAVE and Sushi, along with Eth, BTC and LTC,” Cuban said. (AAVE, Sushi and ETH, or ether, are cryptos that run on Ethereum blockchain. LTC, or litecoin, a bitcoin spinoff.)

So what about the much talked about dogecoin? The cryptocurrency was created as a parody in 2013, but it surged over 50% on Thursday after Elon Musk tweeted his support and it also had the attention of Reddit group SatoshiStreetBets in January. (Dogecoin was based on the “doge” meme, which involved a Shiba Inu dog.)

Still, even with the surge, dogecoin is still only priced at $0.0462 as of 10:49 a.m. ET on Friday. And Cuban does not seem to be a fan.

“If I had to choose between buying a lottery ticket and #Dogecoin … I would buy #Dogecoin,” Cuban tweeted on Wednesday. “But please don’t ask me to choose between it and anything else.”

And that’s because buying “lottery tickets are worse than any investment,” according to Cuban.

Indeed, the odds of winning the recent billion-dollar Mega Millions jackpot were 1 in nearly 302.6 million. (Though perhaps the single winner of that jackpot might disagree.)

Disclosure: CNBC owns the exclusive off-network cable rights to “Shark Tank.”

Don’t miss: The best credit cards for building credit of 2021

Check out: