Money stack us dollar finance concept

Getty

The concept behind identifying stocks with lower than average price/earnings ratio is that the investor is receiving more in earnings for the price paid than with higher p/e issues.

With the multiple of the S&P 500 now sitting at 21, it’s interesting to screen for what Benjamin Graham might call bargain stocks at much lower multiples.

By adding a screen of those low p/e stocks which are now making new price highs, it’s possible to come up with a list of apparent value stocks outperforming the so-called growth stocks with the sky high p/e’s.

The S&P 500 peaked out in July – but each of these has continued to higher highs since then.

Here are 4 that seem to fit this initial criteria:

Great Ajax Corp is a diversified real estate investment trust, New York Stock Exchange traded and based in Beaverton, Oregon.

Great Ajax Corp weekly price chart, 10 9 19.

stockcharts.com

Their price/earnings ratio is 12 and the company trades at an 8% discount to book value. A concern here would be that their long-term debt exceeds shareholder equity – not that unusual for a REIT but something to analyze, for sure. Ajax pays an 8.2% dividend yield.

DR Horton is a home building outfit also traded on the New York Stock Exchange. The Fort Worth, Texas-based firm operates nationwide.

DR Horton Inc weekly price chart, 10 9 19.

stockcharts.com

The price/earnings ratio is 12 and the stock trades at just over 2 times book. Earnings are solidly positive this year and the same goes for the past 5-years earnings record. DR Horton pays a 1.1% dividend.

Ready Capital Corporation is another real estate investment trust listed on the New York Stock Exchange.

Ready Capital Corporation weekly price chart, 10 9 19.

stockcharts.com

The price/earnings ratio is 8. The stock goes for 92% of its book value. As with other similar types of REIT’s, long-term debt exceeds shareholder equity. Earnings have been good last year and over the past 5 years. Ready Capital pays a dividend yield of 10.3%.

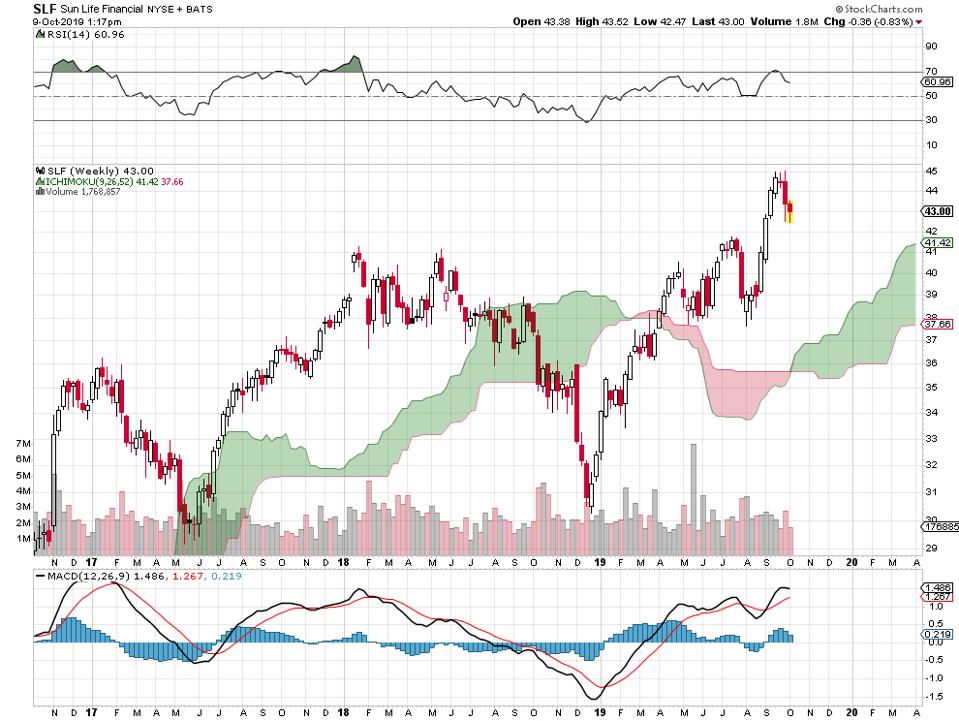

Sun Life Financial is NYSE-listed, a Canadian-based property and casualty insurance company.

Sun Life Financial weekly price chart, 10 9 19.

stockcharts.com

Their price/earnings ratio is 14 and they’re trading at 1.5 times book value. Earnings are positive for last year and for the last 5 years. Shareholder equity exceeds long-term debt. Investors receive a 3.71% dividend.

The upshot: while big name, well known “growth” stocks like Facebook (p/e: 30), Netflix (p/e: 104) and Amazon (p/e: 71) fail to make higher highs since mid-summer, here are 4 what might be described as value stocks, seldom mentioned in business media, doing so.

Stats courtesy of FinViz.com.

I do not hold positions in these investments. No recommendations are made one way or the other. If you’re an investor, you’d want to look much deeper into each of these situations. You can lose money trading or investing in stocks and other instruments. Always do your own independent research, due diligence and seek professional advice from a licensed investment advisor.