The Retirement Income Scorecard

Steve Vernon

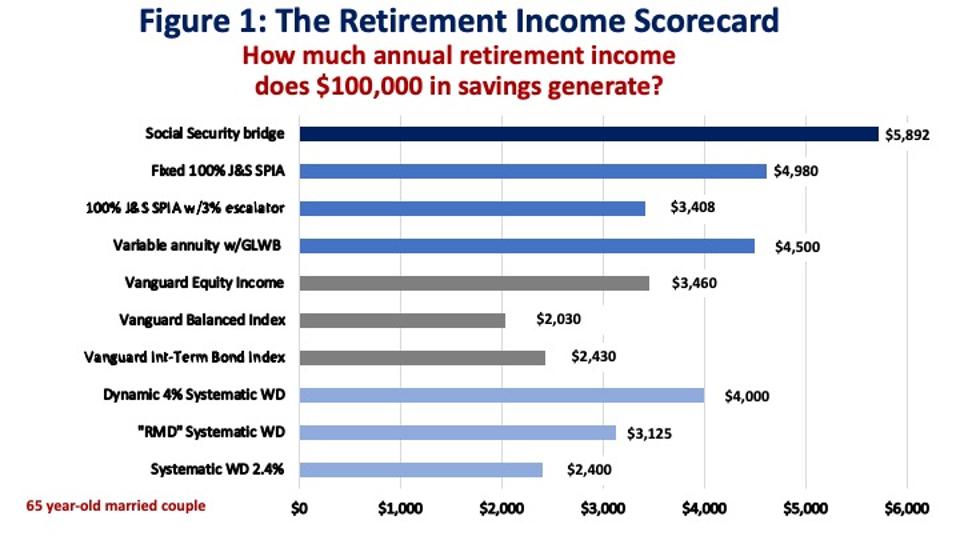

There are many types of retirement income generators (RIGs) that each produce different amounts of retirement income. My Retirement Income Scorecard compares the amounts of retirement income that are possible for 10 different RIGs, which is one consideration for choosing a RIG or combination of RIGs to build your retirement income portfolio.

This post describes details about the different RIGs analyzed in the Retirement Income Scorecard.

Social Security bridge payment

Most people can maximize their Social Security income if they delay starting their Social Security benefits for as long as possible but no later than age 70. If you retire before the date at which you’ve decided to start your Social Security benefits, you can use a portion of your retirement savings as a temporary substitute for the estimated income you’ll get from Social Security once you start getting benefits. This strategy is called a “Social Security bridge payment.”

The $5,892 amount shown in Figure 1 of the Retirement Income Scorecard is an estimate of the additional retirement income a 65-year-old couple can generate if they use $100,000 of their retirement savings to fund a Social Security bridge payment until age 70 (the age at which they plan to start their Social Security benefits), compared to starting Social Security at age 65. (For more details regarding the Social Security bridge strategy, this particular example, and exactly how I estimated the $5,892 amount, see my prior post below.)

It’s important to understand that the amount of additional income that a Social Security bridge payment can generate highly depends on a retiree’s specific circumstances. Nevertheless, the estimate for this hypothetical couple is representative of the potential income that such a strategy can generate.

Guaranteed lifetime annuities

You can invest a portion of your retirement savings with an insurance company that will then guarantee to pay you a monthly retirement income for the rest of your life, no matter how long you live. You can choose to continue the income to your spouse or partner with a joint and survivor annuity.

The Retirement Income Scorecard includes these three annuities:

- A “single premium immediate annuity (SPIA)” with a fixed dollar amount and 100% joint and survivor coverage

- A SPIA that increases the income at an annual rate of 3% per year, with 100% joint and survivor coverage

- A VA/GLWB annuity, which stands for “variable annuity with guaranteed lifetime withdrawal benefit”

One important feature of a SPIA is that once you give your money to an insurance company, you can’t change your mind and withdraw any remaining funds. By contrast, most VA/GLWB products allow you to withdraw your remaining savings, although fees and penalties may apply. A VA/GLWB annuity might also generate future increases in the amount of retirement income you receive, depending on investment performance and the terms of the contract.

There are other types of annuities that will produce different amounts of retirement income. Note also that the income generated by an annuity typically depends on your age and gender, as well as the age and gender of your spouse or partner if you continue the income to them after your death.

If you’re interested in buying a guaranteed annuity to supplement your Social Security benefits, just understand that shopping for an annuity is like shopping for a car: There are many types of features that annuities can include, with different price tags. Shop carefully and pay attention to the details!

Investment income

With this type of RIG, you invest your savings and spend just the investment earnings, which are typically interest and dividends. The principal remains intact.

You can invest in a variety of mutual funds, individual stocks and bonds, and real estate investment trusts.

This RIG generally produces the least amount of retirement income compared to the other three types of RIGs, but it maximizes your flexibility to redeploy the principal at any point in the future.

While there are literally thousands of investments that can generate investment income for you in retirement, the Retirement Income Scorecard included here looked at the following Vanguard mutual funds:

- Vanguard Equity Income Fund, Admiral Shares (VEIRX)

- Vanguard Balanced Index Fund, Admiral Shares (VBIAX)

- Vanguard Intermediate-Term Corporate Bond Index Fund, Admiral Shares (VICSX)

The scorecard used the “30-day SEC yield” shown on Morningstar’s website as of May 30, 2020, and it applied this yield to $100,000 to estimate the annual amount of retirement income. This yield calculates a fund’s hypothetical annualized income as a percentage of its assets, based on the fund’s holdings over a trailing 30-day period.

Systematic withdrawals

With systematic withdrawals, you invest your savings and withdraw investment earnings and a portion of principal each year. There are various methods to calculate the annual amount you withdraw annually. The Retirement Income Scorecard uses these three withdrawal methods:

- A dynamic withdrawal method that calculates your annual income in the first year of retirement by applying 4% to the savings that you devote to this RIG. Each year thereafter, the withdrawal amount is adjusted to reflect investment performance. To determine the annual withdrawal each year, you would apply 4% to your remaining assets that year.

- The IRS method to calculate the “required minimum distribution” (RMD) each year. In this case, you determine the annual amount of your withdrawal by applying a withdrawal percentage to your assets at the beginning of each year. The withdrawal percentage increases for every age. The RMD is currently required at age 70 with a withdrawal percentage of 3.65%. If you use the same methodology, the withdrawal rate at age 65 would be 3.125%. (Note that the IRS recently proposed changes to the RMD methodology that would apply in 2021 and would slightly reduce the required withdrawal percentages, if they’re finalized in their proposed form.)

- A strict application of the “four percent rule,” which, if used today, would adjust the withdrawal rate to 2.4% of assets to calculate the withdrawal amount in the first year of retirement. (See my prior post below for details.) With this method, the withdrawal amounts increase in the future for cost of living adjustments, regardless of your investment earnings. The low withdrawal percentage is designed to insure a high probability that your assets won’t be depleted, even if your investment performance is very poor.

The above methods describe just three systematic withdrawal possibilities; there are other possible methods that could produce different amounts of retirement income.

As you can see, there’s a lot to learn about retirement income strategies. It’s a very good use of your time to find the RIG or combination of RIGs that best suit your goals and circumstances. You’re planning for your financial security for 20 years or more!